SteadyOptions is an options trading forum where you can find solutions from top options traders. Join Us!

We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

Leaderboard

Popular Content

Showing content with the highest reputation on 09/22/13 in all areas

-

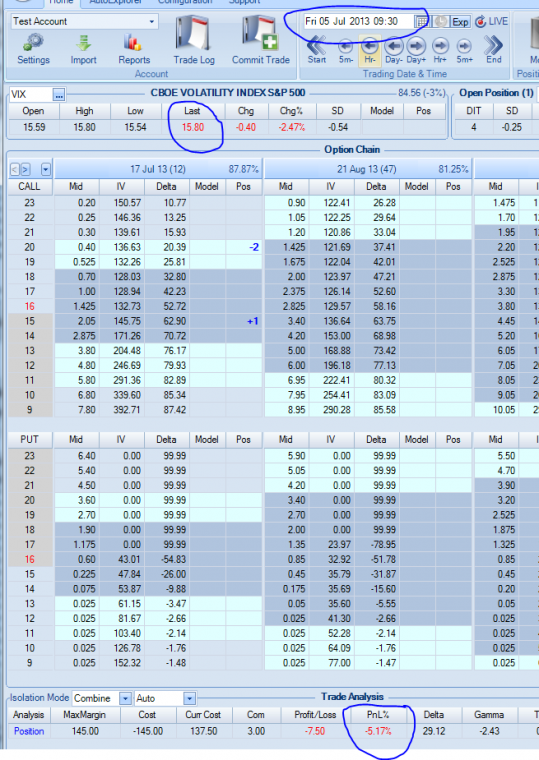

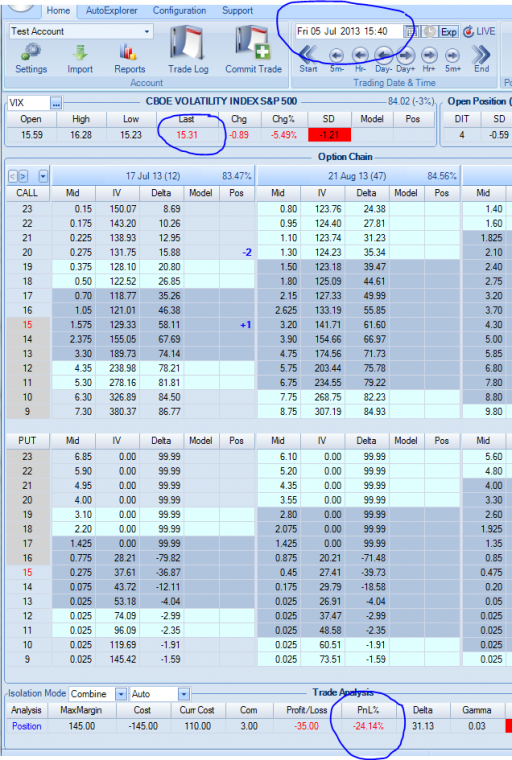

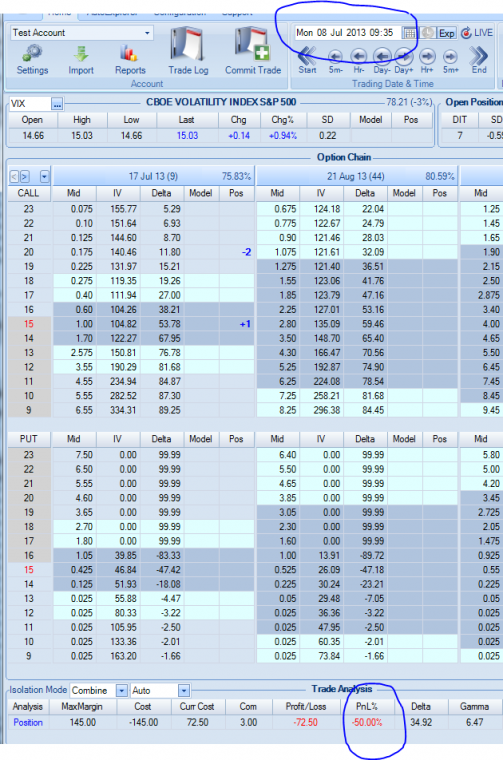

After 500+ trades we recorded today our first 100% loss. SteadyOptions members know that I place full transparency as one of the top priorities of the service. Unlike many other services that publish only the track record at the best, we list ALL our trades on the performance page, good and bad. So it is only natural that our first 100% loss would require a special topic to analyze what went wrong. The Trade Members can see the history of this trade here and all the discussions (over 230 posts!) here. Here is the history of the trade: On July 1st, VIX was trading at 16.20 and we purchased the VIX July butterfly at 1.46 debit: Buy to open 1 VIX July 16 15 call Sell to open 2 VIX July 16 20 call Buy to open 1 VIX July 16 25 call On July 16 we rolled the butterfly to August for 0.80 debit, and on August 19 we rolled to September 16/20/24 fly for 0.40 debit (less 0.30 credit). It expired worthless today. The thesis The idea behind the trade was to take advantage of any IV spike. Take a look at the VIX chart: The entry point is marked in blue. As you can see, VIX went down from 20+ to ~16 and I considered this area low enough. In addition, we also had some VXX puts at that time, and the VIX trade was supposed to partially hedge those puts. Any spike back to 19-20 area would cause the fly to widen to 2.00-2.50 and provide us with very nice gains. What went wrong Well, as we can see from the chart, VIX just kept falling like a rock. It did briefly spike back to the 17 area, but it was not enough. I had a mental stop loss around 30%, but VIX just continues to collapse very quickly and 30% turned to 50-60% loss very quickly and never recovered. The prices moved so quickly that I'm not sure we could get out at 30%. When the loss became 50%+, I didn't see a point to exit. To demonstrate the magnitude of the move, take a look how this trade developed in just one day: Morning July 5 (Friday): End of day July 5: Morning July 8 (Monday): Basically we didn't have a chance to get out at 30% stop loss. So, the first mistake was entering when VIX was around 16. This is just not low enough to give us any margin of safety. Second mistake was obviously not honoring the stop loss. When VIX went down like a rock, the right thing to do was just exiting for whatever we could get for the trade, but the window of opportunity to exit at 30% loss was very short (about last 15 minutes before the close on Friday, so not sure that all members would even get the alert on time). The reasoning for not exiting was experience of some of our previous VIX trades that were down and recovered nicely. However, the difference was that the VIX was much lower in the previous trades. In hindsight, exiting at 55-60% was the only right decision. Rolling was obviously a bad decision as well - but again, we did it few times in the previous trades and they recovered nicely. Lessons learned Obviously the main lesson is not to go long when VIX is above 15. In fact, to get a good margin of safety, I would even lower the minimum value to 13-14 area. Following this rule provided us some nice gains this year. Sticking to what was working in the past is usually the smart thing to do. Adding significant capital to a losing trade is also a bad call most of the time. Another lesson is that opening those trades only 2 weeks before expiration is not a good idea. You need to give the trade some time to work out. My advise to members: if you don't understand the trade or think it is too risky, don't take it. To reduce the risk, you can reduce the size or not add to a losing trade if you feel that you are throwing good money after bad. There is not doubt that this was a brutal trade. I feel your pain as I'm in the same shoes. Unlike other services, I trade EVERY single recommendation I send - in fact, all trades come with screenshots of fills from my broker. I also open a trade discussion before the trade is made and explain the thesis and the rationale behind the trade. Again, if you don't understand the rationale or don't agree with it, don't take the trade. To put things in perspective, we did 8 VIX trades before this trade and booked 8 winners. Average winner was around 30% - that's 240% cumulative gain. Another proof that you should stick with what is working.1 point

-

Good points here. But a 10k account with allocation issues (7% for 1 contract/14% for two...) will not reflect the performance of a 50k or 100k account. With a larger size account you have no problem of allocation above/bellow 10%... I think the actual formula is fair as you can extrapolate for bigger account. For the VIX trade, Kim have made a good post mosterm analysis. This trade is an horrible one. The mistakes are obvious, especially the stop one. Even with a 50% loss you must exit if your stop loss was at 30%. The 20% extra loss are a sort of "slippage"... A stop is in place to protect capital... The only suggestion i could make to Kim: In your trade discussion or in the alert, maybe you could indicate a hard stop level. Above this loss, any member should try to salvage the trade. I know this can be brutal and cause some additional loss because some trades could recover. But i don't see other solution to protect capital from disaster. The stop should be large enough to be triggered only a few time per year but could avoid massive loss... By this way you can be sure that members will not miss the information, as the "catastrophic" stop level is known before entering the trade. And if a trade is stopped, we can make the roll after market condition are going better. Without any pressure because expiration or unrealised loss to recover... SO members should never forget that a roll is nothing more than a new trade and should be treated like an independant trade. I hate the "rolling sensation" as you invest more money to a looser who should have been cut earlier. It can give the sensation that you can alway recover a loss wich is not true. And because the first trade make your judgement biaised you will probably miss the proper exit on the roll as you have a "loss to recover". For the VIX Trade, let's say that prefined stop loss is 30%. The market dropped super fast and members exited with a 50% loss. Let's say 500$ per 10k account for this trade. As we are out of market, we could have done the "roll" with vix at 12/13. Probably something like a 13/18/23 butterfly. The new butterfly would have give us some nice gain with the VIX spike to 17. As we ARE NOT in the same trade, we have nothing to recover, no pressure. And we could probably have recovered our initial loss. Maybe with a final profit, maybe not. But we are not blocked in a bad trade. In this scenario we had two trade. A stopped one (-50%) and a good gain (+30 % ?). My two cents... .1 point

This leaderboard is set to New York/GMT-05:00