SteadyOptions is an options trading forum where you can find solutions from top options traders. Join Us!

We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

Leaderboard

Popular Content

Showing content with the highest reputation on 08/27/13 in all areas

-

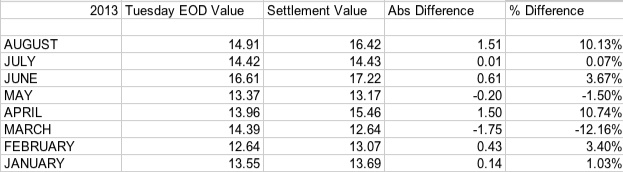

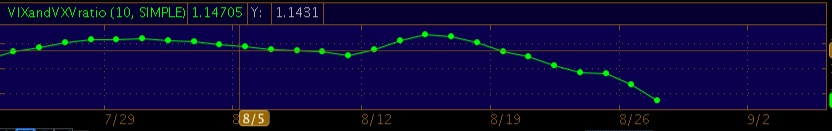

VIX Strategies: Trades below work better if VIX is higher (more value left in them on expiration day) Sell Naked Straddle on expiration Day (extremely high risk) - Sell the ATM straddle (closest strike to EoD price) on expiration Tuesday. - Unlimited loss beyond BE like any short straddle - 100% gain of credit received if VIX settles within Put Strike - credit received / Call Strike + credit received Sell Naked Puts on expiration Day (very high risk) - Sell 1 strike OTM puts on expiration Tuesday. - VIX tends to spike up, not down. Theoretically it's less risky to sell naked puts on the VIX than other underlyings. - You have unlimited loss if VIX settles below your short strike - credit received - 100% gain of credit received if VIX settles above your short strike - credit received Buy Butterfly on expiration Day (high risk) - Buy a butterfly and hold it through expiration - Max profit if settles at short strike point - Some profit if settles within profit zone - 100% loss on debit if settles beyond profit zone http://vixandmore.blogspot.ca/2009/02/vix-butterfly-play.html Long Iron Condor on or close to expiration Day (high risk) - Same thing as butterfly but wider profit zone. can buy it on the Monday or Tuesday. - Hold until expiration - 100% gain on credit if settles within profit zone - Max loss if settles beyond profit zone Here is my own data for settlement risk you might experience this year. These trades are highly speculative in nature and i don't recommend them. They are however quite fun and can be a good replacement for roulette or blackjack. I have data going back all the way to 2008 if anyone's interested i can share it. VIX 16 Put Calendar - Open 16 strike put calendar when VIX is low (for me it's when VIX < 15) - Front month = 16 strike put closest to expiration - Back month = 1 or 2 months out. I prefer 2 months because if VIX rises the back months will be affected less if it's further out. - When the VIX is low, especially at extreme lows < 13, you can often open these for a credit. I have seen it from 0.00 debit to 1.25 credit depending on how long the VIX has been at extreme lows - Wait for a spike that will eventually happen due to the mean reversion tendencies of the VIX, exit for profit. Trade Mechanics - when you short the 16 put when VIX is low, it is statistically likely that VIX will rise. If it does, you profit on your short 16 put. It also benefits from time decay. When the VIX does eventually rise, your back months futures will not rise as much as the front months, so your gain from your short will be higher than your loss from the long. Risk - VIX continues to stay low or drops even lower. Keep in mind VIX cannot go to 0. Why 16? I'm not sure, but Kim and other smart people have figured out 16 is the lucky number to go with. If you dislike 16 you can go with 17,15. Warning: do not do VIX call calendars when the VIX is low and do not do put calendars when the VIX is high, they do not work like normal calendars because the long leg of your calendar is based off the futures pricing, not a single underlying like regular calendars. you are trading off 2 distinct underlyings where the price are related but does not move in unison and you can lose ALOT of money. please be careful. imagine this scenario: vix is at 30. you decide to put on a calender shorting october 30 put, long nov 30 put. 10 days later, VIX drops to 20. your short is based off october futures, which drop more than your nov long (based off nov futures). so your loss on your short position is more than the gains made on your long position since they are not based on a single underlying and the magnitude in price change is different. VXX Strategies: DITM Put - Take advantage of the roll decay when VIX term structure is in contango (which is about 70-75% of the time). What to do? - Buy when a deep in the money put when VXX spikes. How do i know its a spike? - Look at the VXX 6 months chart and compare current levels to higher levels OR watch the VIX when it goes over 20-25 (the mean of VIX historically is around 20, so when it spikes over 20 or goes below 20 it's statistically likely that it will eventually revert to the 20 level, key is eventually because no one knows how long the spike will last). How far do I go out? - Personally i would go out at least 90 days to reduce theta decay, but this is up to you and should depend on potentially how long you want to have your capital tied up. What strike do I pick? - Deep in the money, so pick puts with deltas > -0.9 Risk? - Remember 100% of your risk is undertaken at order entry. Position sizing is your primary way to limit risk. Market crashes, extended market downswings, VIX continue to go up for a long time, you must either take loss or roll further out (which is the same as taking a loss and opening a new position). Broken Wing Butterfly - Take advantage of the roll decay when VIX term structure is in contango (which is about 70-75% of the time). What to do? - Put it on at anytime (DITM put you should wait for the spike) the VIX term structure is in contango. Trade Mechanics - Strike Selection - DTE Selection - Risk - Remember 100% of your risk is undertaken at order entry. Position sizing is your primary way to limit risk. VXV/VIX Ratio Strategy: Marco and some other members discussed this before. It comes from a Tony Cooper paper called "Easy Volatility Investing". You don't need to know everything about all the volatility ETNs and math behind it but if you are interested you can read the full paper here: http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2255327, the trade and concept itself is very easy anyone can do it. But there is a few things you do need to know: 1. What is contango/backwardation for VIX term structure. If you google this there is tons of resources, study it a bit so you understand. (www.vixcentral.com will show you the VIX term structure right now) 2. VXV is the 3 months version of the VIX 2. VXX - Goes down when VIX term structure is contango because it is designed to sell near term futures contracts and buy back month futures contracts. This is called roll decay. 3. VXX - Goes up when VIX term structure is backwardation for the same reason as above 4. XIV - Suppose to mimic the inverse of VXX gains or loss. so 1% decay in VXX = 1% gain in XIV and vice versa. So in summary: When VIX is in contango: VXX down, XIV up. When VIX is in backwardation: VXX up, XIV down. So how do we trade this? Well the logical thing is to figure out what term structure the VIX futures is in right? So just go to vixcentral.com and check it out. it will take you less than 5 seconds everyday. But it's not so simple, ideally you want to be LONG VXX when the backwardation is strong, and long the XIV when the contango is strong. but how strong and at what point do i switch the ETNs? Basically you should ask yourself, how can i be more precise and methodical? Tony Cooper and others have identified some specific ratios to optimise this kind of trade. So through some backtests and calculations various people have come up with a magical ratio that should in theory optimise your P/L. So you want to know the magical ratio? Turns out, the magical ratio to determine when to switch the ETNs is 0.917 with a 10 day SMA The idea is very simple: You take the VXV / VIX ratio. IF VXV/VIX is > 1 this means the term structure is in CONTANGO. Why? It's very simple, VXV is the 3 months version of VIX so if you the 3 months of the VIX over VIX itself and the value is higher than 1 that is telling you VIX spot is lower than 3 months version of itself, so the future is more expensive than spot. so obviously that means the structure is in contango right? IF VXV/VIX is < 1, this means the structure is in BACKWARDATION. Do i really need to explain this again? If you want to optimise your P/L you can use 0.917 instead of 1 (and take the 10 day moving average of the ratio chart). The downside is you have to do more trades. Long XIV shares (no options) if ratio is above 0.917 OR if you have a DITM PUT in VXX keep holding it Long VXX shares (or call options) (or short VXX puts) if ratio is below 0.917 OR if you have a DITM PUT in VXX you need to unwind now Another bonus of this strategy is now you can trade volatility in your retirement accounts. In Canada and US at least... sorry don't know about European stuff. Additional Resources check VIX term structure at a glance: www.vixcentral.com Has a good overview about all VIX based ETN's / ETF's http://etfdb.com/etf...ory/volatility/ good blog about vol products: http://www.volatilityanalytics.com another good blog about vol products: http://sixfigureinvesting.com great website on trading vol products: http://www.tradingvolatility.net/ apparently you can manipulate vix settlement price: http://onlyvix.blogspot.ca/2011/10/how-to-manipulate-vix-settlement-price.html broken wing butterflies: http://www.probabilityofsuccesstrading.com/?page_id=841 what is high IV: http://vixandmore.blogspot.ca/2008/04/what-is-high-implied-volatility.html vix can spike alot without market dropping much in value: http://vixandmore.blogspot.ca/2013/02/all-time-vix-spike-11-and-treasure.html And one of the best volatility sources: www.sixfigureinvesting.com Covering: Volatility—Historical / Backtest Data The VIX index from 1986 XVZ Backtest to 2004 VIX Volatility Futures Data from 2004 Volatility Rolling Indexes from 2004 ZIV Backtest to 2006 VQT Backtest to 2004 When a Hurricane Messes with a Volatility Index How Meaningful are the VIX’s Percentage moves? Volatility—Long Investing in the VIX—CVOL & TVIX are Close How to go long on the VIX / VXX Volatility—Short Going short on VIX Going short on VXX Inverse Volatility—the Winner is XIV Is XIV Behaving Correctly? IVOP and XIV Termination Events Taming Inverse Volatility with VIX/VXV Volatility—Term Structure The Cost of Contango—it’s not the daily roll SPX 1 to 3 month term structure at historic highs VIX Mid-term Futures contango at historic highs Live VIX term structure chart with VIN, VIF, VXV Volatility—Underperforming/ Dead ETNs What’s Wrong with XVIX—A Matter of Contango XXV—The First ETN with Nowhere to go TVIX—Not Recommended Volatility ETNs—Under the Hood C-Tracks’ CVOL Barclays’ VQT Barclays’ XVZ2 points

-

Thanks for all that Mikael! I grabbed the VXX BWB 14/15/15.5 just before close yesterday, commissions are indeed a killer on that one.2 points

-

Hi, Good luck to everyone. I decided not to enter my original trade as I'll be away from keyboard, on vacation for a week. So I can't adjust but should be an interesting time for VXX as it's spiking, Let me know how your BWB goes Saud; with the spike this morning to 16, should have plenty of room to breathe, Best, PC1 point

-

Be careful with calendars on the vix (see first post). The 16 p and 17 c are good ones for sure. Those expiration trades is just gambling. Like I said instead of playing roulette or blackjack you can do one of those trades a month. Technically you have better odds than any game in Vegas since the event is random and you don't have a negative edge the odds of winning are also much greater than any lottery ticket you can purchase as well1 point

This leaderboard is set to New York/GMT-05:00