1. You Don’t Have A Plan

Failing to plan is planning to fail, yet so many traders start trading options without a trading plan. You need to have an overall trading plan, a plan for each strategy and a plan for every trade. That includes both when things go your way and when they don’t. Remember – “Have a plan, Trade your plan, Review your plan”.

2. Trying To Run Before You Can Walk

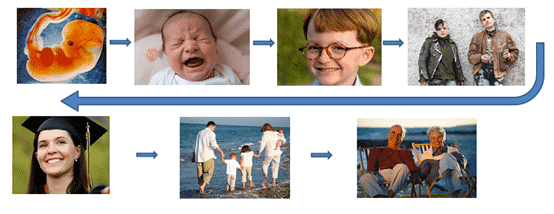

In The Option Traders Lifecycle, I discuss the evolution of an option trader from fetus to retiree.

Where do you sit on the lifecycle? Realistically if you are in your first 2 years of trading, you are not yet able to run. Take it slow and walk, or you will fall on your face.

3. You Don’t See The Big Picture

Each trade is a battle, and it’s disappointing if you lose a battle, but it’s the war that’s at stake. Don’t let one lost battle distract your from the overall goal of winning the war. Sure, we all have bad trades, we all make mistakes, as long as that one mistake doesn’t mean you lose the war (by blowing up your account), you will live to fight another day.

Trading is a business based on probability. And probability means that sometimes we get what we want, sometimes we don't. And that's the nature of the this business. The sooner we accept this, the better we can operate it as business.

4. You’re Living In The Past

Successful people do no live in the past. Winners focus on the present and the future. They look at what they can do to improve their circumstances. Losers focus on the past and the injustices that the market has dealt them. Winners are able to move on quickly from bad trades and accept their shortcomings.

5. You Blame Someone / Something Else

If only the market had done this….. If only the Fed hadn’t decided to extent QE3…. If only the newsletter I was following had cut his losses quicker. You and you alone are in control of your destiny, don’t blame someone else for your failures. Accept full responsibility for where you are, and you’ll have a chance to change it for the better.

Only when you can accept responsibility for your actions and decisions, will you become a better and profitable trader.

For example, if you decide to trade based on someone else's recommendations, and lose money, it is your fault, not their fault. You chose your guru, and you chose to invest based on their recommendations.

You decided to trust the their published results, showing they won 75 percent of the time. You decided not to paper-trade the recommendations for six months to confirm the results before starting to trade real money. You didn’t stop to find at least one independent source who had confirmed the their track record before trading. You, you, you!

6. You Don’t Think You Can Succeed

Henry Ford once said – “Whether you think you can, or think you can’t – you’re right”. Option trading is such a mental game that if you go in thinking your going to fail, you surely will. You’ll cut winners too quickly because you don’t want to see profits evaporate and you’ll take losses when you should hold on. A positive mindset will go a long way to helping you succeed.

7. You Give Up

It takes a long time to succeed in the markets, I would say you have to give it a good 5 years before you give up and possibly 10 before you really feel like you get it. There will be a lot of blunders along the way, but stick at it and you will be better off than 99% of the other would be traders out there. It’s not about how many times you fall down, it’s about how many times you get up.

To become an engineer you have to study 4 years, and probably another 4 years (at least) to become a good one. Why people expect it to be different in trading? What does it really take to become proficient in trading? Can you expect to double your account every 6 months after being an active trader for few months?

Trading, as any other highly competitive sport discipline, takes a lot of hours in front of the screens and practice.

As Winston Churchil said – “Never, never, never give up.”

Van Tharp says successful trading/investing is 60% psychology...only 60%? Humans desperately want to believe there is a way to make money with no or little risk. That’s why Bernie Madoff existed, and it will never change.

Don't give up!

Best luck with your investments!

Related Articles:

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account. It's easy and free!

Register a new account

Sign in

Already have an account? Sign in here.

Sign In Now