Definition of Delta Hedging

Delta hedging is a strategy in which an investor hedges the risk of a price fluctuation in an option by taking an offsetting position in the underlying security. That means that if the price of the option changes, the underlying asset will move in the opposite direction. The loss on the price of the option will be offset by the increase in the price of the underlying asset.

If the position is perfectly hedged, the price fluctuations will be perfectly matched so that the same total dollar amount of loss on the option will be gained on the asset.

In general, hedging is a strategy used to reduce risk. An investor hedges a position in a particular security to minimize the chance of a loss. The nature of a hedge, though, also means the investor will give up potential gains as well. For example, an investor with an options contract for Company ABC that benefits from the stock price falling would purchase shares of that company just in case the stock price rose.

Understanding Delta

Options Delta is the measure of an option’s price sensitivity to the underlying stock or security’s market price. It is the expected change in options price with a 1c change in security price (positive if it rises/falls with a rise/fall in market price; negative otherwise).

For call options, the delta ranges between 0 and 1, while on put options, it ranges between -1 and 0. For example, for put options, a delta of -0.75 implies that the price of the option is expected to increase by 0.75, assuming the underlying asset falls by a dollar. The vice-versa is the same as well.

Reaching Delta-Neutral

An options position could be hedged with options exhibiting a delta that is opposite to that of the current options holding to maintain a delta-neutral position. A delta-neutral position is one in which the overall delta is zero, which minimizes the options' price movements in relation to the underlying asset.

For example, assume an investor holds one call option with a delta of 0.50, which indicates the option is at-the-money and wishes to maintain a delta neutral position. The investor could purchase an at-the-money put option with a delta of -0.50 to offset the positive delta, which would make the position have a delta of zero.

Trade Example: Hedging Long Stock With Long Puts

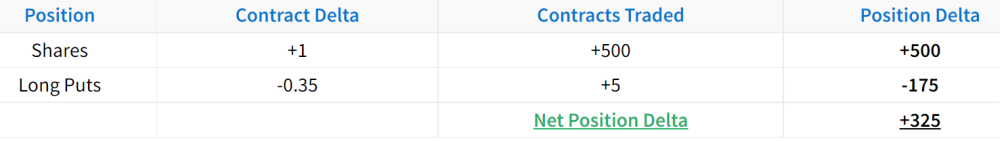

In this example, we’ll look at a scenario where a trader owns 500 shares of stock. Being long 500 shares of stock results in a position delta of +500. If the trader wanted to reduce this directional exposure, they would have to add a strategy with negative delta. In this example, the negative delta strategy we’ll use is buying puts.

Since the trader is long 500 shares of stock, we’ll purchase five -0.35 delta put options against the position. Here is how the position looks at the start of the period:

As we can see here, buying five -0.35 delta puts against 500 shares of stock reduces the delta exposure by 35%. Let’s take a look at the P/L of each of these positions when the stock price falls:

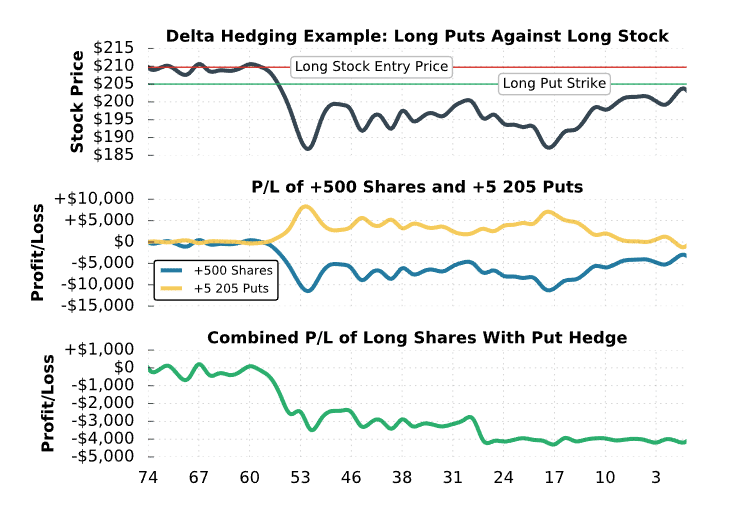

In the middle portion of this graph, the P/L of the long shares and the long puts are plotted separately. As you can see, when the stock price collapses, the long stock position loses money, but the long puts make money. In the lower portion of the graph, the combined P/L of the long stock and long puts is plotted.

The key takeaway from this chart is that the stock position by itself experiences a drawdown greater than $10,000. However, with the long puts implemented as a delta hedge, the combined position only experiences a $4,000 drawdown at the lowest point. By adding the negative delta strategy of buying puts to the positive delta strategy of buying stock, the directional exposure is less significant.

Pros of Delta Hedging

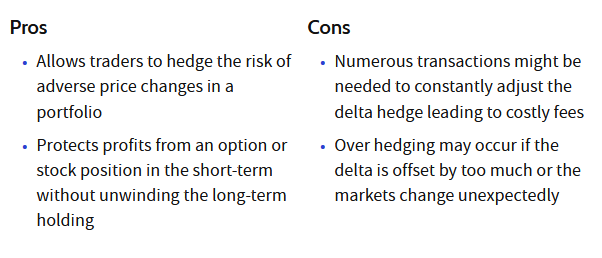

Delta hedging provides the following benefits:

- It allows traders to hedge the risk of constant price fluctuations in a portfolio.

- It protects profits from an option or stock position in the short term while protecting long-term holdings.

Cons of Delta Hedging

Delta hedging provides the following disadvantages:

- Traders must continuously monitor and adjust the positions they enter. Depending on the volatility of the equity, the investor would need to respectively buy and sell securities to avoid being under- or over-hedged.

-

Considering that there are transaction fees for each trade conducted, delta hedging can incur large expenses.

What Is Delta-Gamma Hedging?

Delta-gamma hedging is an options strategy. It is closely related to delta hedging. In delta-gamma hedging, delta and gamma hedges are combined to cut down on the risk associated with changes in the underlying asset. It also aims to reduce the risk in the delta itself. Remember that delta estimates the change in the price of a derivative while gamma describes the rate of change in an option's delta per one-point move in the price of the underlying asset.

Conclusion

Delta hedging is an options trading strategy that aims to hedge the directional risk associated with price movements in the underlying. It uses options to offset the risk of a single holding or an entire portfolio. The goal is to reach a delta neutral state and not have a directional bias.

Delta hedging is a great way to manage the delta (price exposure) of both a position and your overall portfolio. For premium traders, it is a particularly powerful tool to keep your delta neutral positions and portfolio… delta neutral.

There is more to cover on this topic. It is important to note, that before using options to delta hedge, you need to fully grasp the dynamic delta behaviors of your hedges. New traders should consider risk-defined (pre-delta hedged) positions at trade entry. It is important to match your strategy not only to your strategy’s criteria and objectives but also to your options trading ability and knowledge.

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account. It's easy and free!

Register a new account

Sign in

Already have an account? Sign in here.

Sign In Now