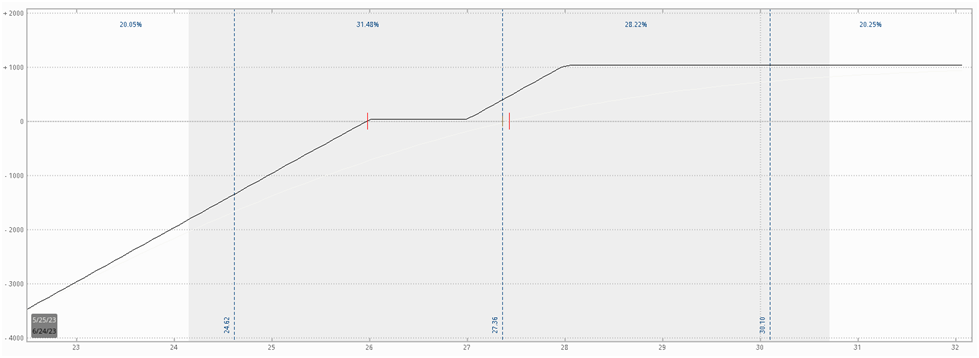

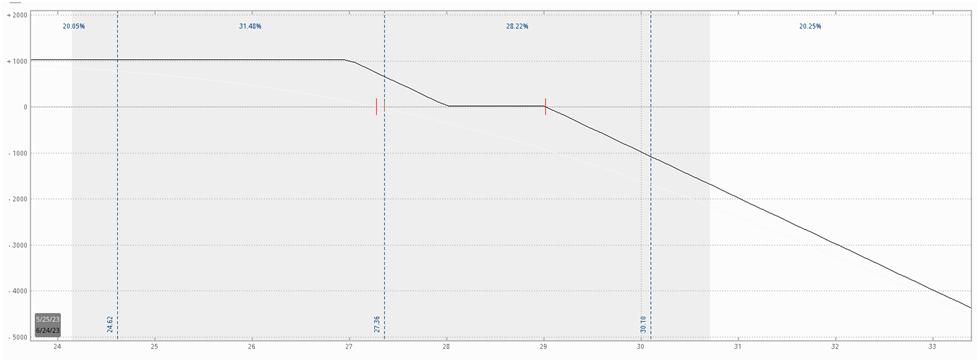

The individual payoff diagram of each seagull spread will vary based on strike selection, however, below are rough ideas of bullish and bearish seagull spreads:

Bullish Seagull Spread:

Bearish Seagull Spread:

The goal of the trade is to reduce the risk of a vertical spread while still allowing the trader to participate in some directional upside potential. The addition of a third leg (the short put/call) provides a level of protection by using the premiums received to offset potential losses.

The strategy tends to be more popular in the Forex world, but it does sometimes come up in the stock and index options world should it fit a trader’s specific market outlook.

Seagull Spread vs. Vertical Spread

A seagull spread is nothing more than adding a short leg to a vertical debit spread. While it does dramatically alter the payoff profile, the directional market view remains the same.

Seagull vs. Vertical Spread Profit Potential

The Seagull option spread strategy is a way of hedging a vertical spread. Like many hedges, it’s really a game of tradeoffs. The short leg of the Seagull spread helps to reduce the cost of the debit spread, and if properly structured, can bring the net debit of the trade to zero.

The premium collected from the short leg offsets some potential losses from the debit spread, making the trade’s probability of profit higher than a vanilla debit spread. However, the short leg acts as a double-edged sword.

While it can improve the likelihood of making a profit from the trade, it creates a scenario of potentially unlimited losses from the short leg.

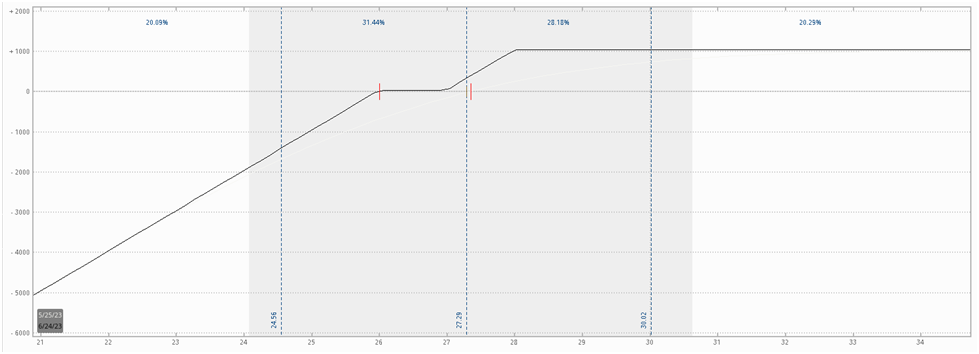

To illustrate this, let’s pretend we’re trading the following Bullish Seagull Spread in Intel (INTC):

● Buy 27 Call

● Sell 28 Call

● Sell 26 Put

The payoff diagram would look like this:

As you can see, the debit spread provides no protection against the potentially unlimited risk of the short put with a strike price of $26.

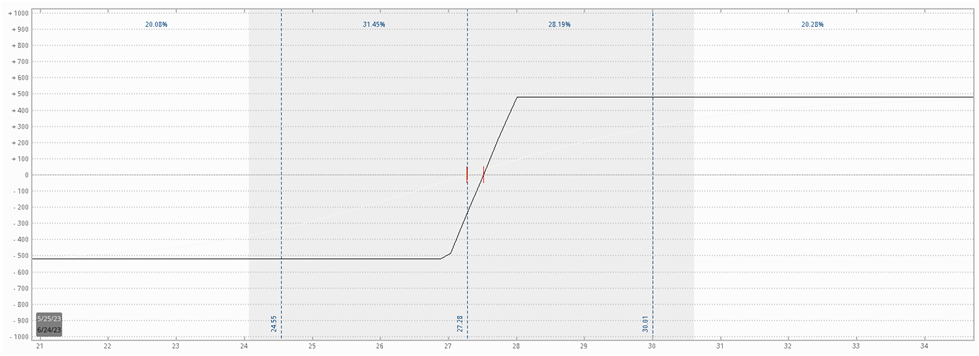

On the other hand, let’s look at the same debit spread without the short put leg. Which would be:

● Buy 27 Call

● Sell 28 Call

The payoff diagram looks like this:

The two options offset each other, leaving the trade to have a defined risk and defined profit potential. However, as you can see, you reach the maximum loss threshold much faster in this vanilla debit spread than you do with the Seagull Spread.

When To Use the Seagull Spread: Market Outlook

The Seagull Spread is a “safer” way to get a vertical spread-like payoff profile. Selling the third option gives the trade much more room to breathe before you reach your max loss level.

In effect, the two spreads are expressing somewhat similar market views, but the Seagull Spread has a short volatility component, so the trade benefits from the passage of time, or is close to being theta-neutral.

So a trader should stick to the vertical debit spread when implied volatility is low and they expect a significant move.

On the other hand, a Seagull Spread makes far more sense if you think implied volatility is high yet you still have a directional view on the stock price.

How to Create a Zero Cost Seagull Option Spread

The addition of the third leg of the Seagull Spread enables a trader to turn a vertical debit spread into a spread with a net credit, or close to zero cost.

This is dependent on strike selection, but if the premium in the short option outweighs the net debit of the vertical debit spread, the trade can be entered for near-zero cost.

Let’s return to the Seagull Spread we created in Intel (INTC), which is:

● Buy 27 Call @ 1.47

● Sell 28 Call @ $0.95

● Sell 26 Put @ $0.61

In this trade, we collect $1.56 in credit for selling the call and put, and we pay out $1.47 in net debit, leaving us with a net credit of $0.09. This means that we will collect $0.09 to enter this trade.

You can alter your strike selection all you’d like to create a spread with a higher net credit or a small net debit.

You should never structure a Seagull Spread solely based on the “net credit” number on your screen. Instead, everything should be driven by your market view. If you don’t have a market view, why are you trading?

Bottom Line

The vertical spread is the backbone of many options trading strategies. Many strategies rely on simply altering and repositioning a series of vertical spreads. The Seagull Spread expands on this very idea.

The addition of a third short leg to a vertical debit spread allows a trader to further shape their options trade structure to fit their market view or risk tolerance. Sometimes you have a market outlook that roughly fits that of a vertical spread, but you want more leeway, which you can give yourself by adding a short option.

Subscribe to SteadyOptions now and experience the full power of options trading at your fingertips. Click the button below to get started!

Join SteadyOptions Now!

There are no comments to display.

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.

Note: Your post will require moderator approval before it will be visible.