High volatility such as this provides huge opportunity for option traders. In the article, I detailed out three potential trades for TUR – a Short Straddle, A Poor Man’s Covered Call, a Cash Secured Put and a Bear Call Spread.

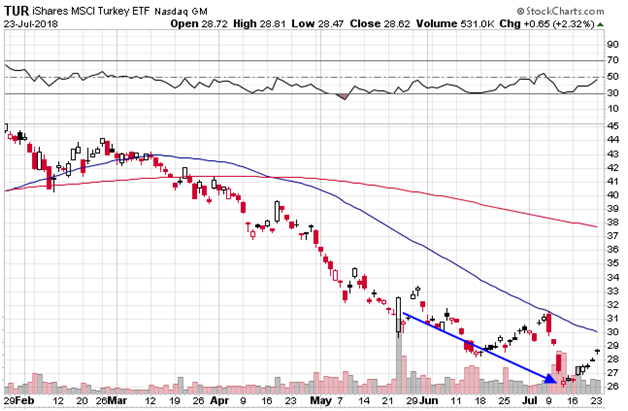

I ended up going with a Short Straddle, a neutral trade, only to see the ETF drop quite quickly from $34 to $27.

As a reminder, a short strangle consists of a short put and a short call placed at-of-the-money. The thesis of the trade is that the stock will remain near the strike price for the duration of the trade and the trader will be able to close the trade for a profit thanks to time decay.

However, sometimes things do not go to plan. If the stock makes a large move in either direction, the short straddle comes under pressure.

In this example, TUR dropped pretty hard, all the way down to $26 at one point.

Here are the details of the trade and the ensuing adjustment.

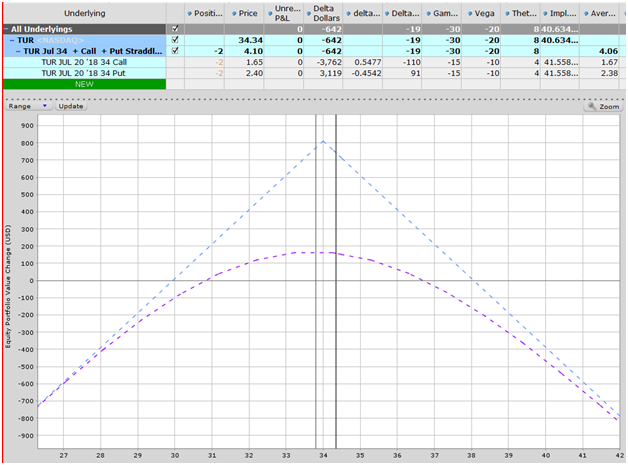

Trade Date: May 30th

Underlying Price: $34.34

Trade Details:

Sell 2 TUR July 20th 34 Calls @ $1.65

Sell 2 TUR July 20th 34 Puts @ $2.40

Premium Received: $820

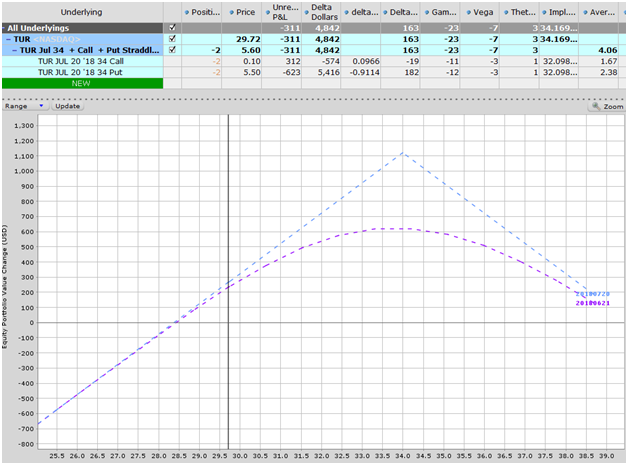

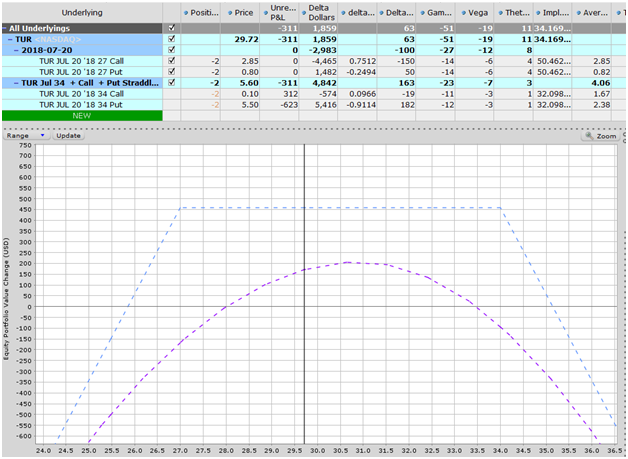

By June 13th, the trade was under a bit of pressure with TUR dropping to $29.72 which was around my initial breakeven point. This was my adjustment point and I adjusted by adding a second straddle at $27.

Trade Date: June 13th

Underlying Price: $29.72

Trade Details:

Sell 2 TUR July 20th 27 Calls @ $2.85

Sell 2 TUR July 20th 27 Puts @ $0.80

Premium Received: $730

At this point the total premium received was $1550 and by adding a second straddle I turned the position into basically a strangle.

A better was to do this perhaps would have been to turn it into a standard strangle with short calls at #4 and short puts at $27. This would have reduced the early assignment risk, but luckily I didn’t suffer any early assignment in any case. Just something to keep in mind for next time.

BEFORE ADJUSTMENT

AFTER ADJUSTMENT

At expiration, TUR closed at $27.97 which resulted in a net profit of $160. Not a huge profit in anyone’s view, but certainly not too bad for a neutral trade on an ETF that dropped 18%.

SUMMARY

In summary, this adjustment strategy for short straddles may not be for everyone, but hopefully I have demonstrated to you that it is possible to still achieve a profit even when the underlying makes a big move. In this example, we achieved a small profit, but we did add more risk to the trade in terms of more contracts.

Finally, I leave you with some words from Dr. Russell Richards regarding this type of adjustment:

“When scrambling to manage a losing trade, especially a losing undefined risk trade, most traders are happy to exit the losing trade at a “wash” or even a small loss. You will have to decide what is appropriate for you, but don’t get greedy when managing losing trades.”

What do you think about this trading strategy, let me know in the comments if you’ve tried short straddles in the past.

Trade safe,

Gav.

Gavin McMaster has a Masters in Applied Finance and Investment. He specializes in income trading using options, is very conservative in his style and believes patience in waiting for the best setups is the key to successful trading. He likes to focus on short volatility strategies. Gavin has written 5 books on options trading, 3 of which were bestsellers. He launched Options Trading IQ in 2010 to teach people how to trade options and eliminate all the Bullsh*t that’s out there. You can follow Gavin on Twitter. The original article can be found here.

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account. It's easy and free!

Register a new account

Sign in

Already have an account? Sign in here.

Sign In Now