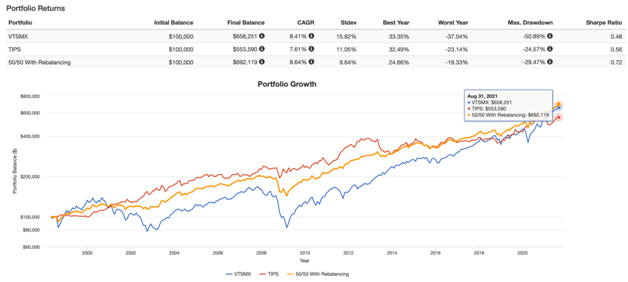

Historical Data, May 1998 – August 2021

Vanguard Total Stock Market Index Fund (VTSMX)

- CAGR: 8.4%

- Standard Deviation: 15.8%

- Sharpe Ratio: 0.48

- Growth of $100,000: $658,251

FTSE US Inflation-Linked Securities Index 20+ Years (TIPS)

- CAGR: 7.6%

- Standard Deviation: 11.1%

- Sharpe Ratio: 0.56

- Growth of $100,000: $553,590

TIPS had a correlation of 0.01 to VTSMX over this period creating diversification and a great opportunity to illustrate the benefits of systematic rebalancing even when considering it had a lower return.

50/50 VTSMX/TIPS allocation with rebalancing

- CAGR: 8.6%

- Standard Deviation: 9.6%

- Sharpe Ratio: 0.72

- Growth of $100,000: $692,119

Systematic rebalancing is bringing the portfolio back to a 50/50 allocation when it drifts by more than 5% in either direction at the end of any month. For example, if VTSMX would outperform TIPS by enough to cause the portfolio to eventually drift to 56/44, it would be rebalanced back to 50/50 by selling VTSMX and buying TIPS. The same would be done during periods where TIPS outperform VTSMX. Human nature often makes us want to do the opposite and buy more VTSMX (TIPS) when it has outperformed and sell TIPS (VTSMX). This is known as recency bias where we extrapolate the recent past into the future. Systematic rebalancing automates good “buy low, sell high” behavior. Since 1998 a total of 19 rebalancing trades were required, which is less than once per year on average.

Summary

Buy and hold investing is often stigmatized as unsophisticated because of its passive nature, but when done right it should instead be described as buy, hold, and rebalance. Many research papers have been written drawing similar conclusions that systematic rebalancing often leads to outcomes where the portfolio return is greater than the sum of its parts. Some describe this effect as “the rebalancing premium”, where 1+1 can sometime equal 3 in investing.

Before evaluating different funds and asset classes on a standalone basis it’s important to consider the impact a particular fund or asset class may have on a total portfolio. Without this insight in mind someone might decide to go all in with VTSMX because it’s had a higher historical return, unaware that a portfolio combining VTSMX and TIPS would have had a higher return and less risk. In my next article, I’ll show how this can impact a retiree taking monthly withdrawals.

Jesse Blom is a licensed investment advisor and Vice President of Lorintine Capital, LP. He provides investment advice to clients all over the United States and around the world. Jesse has been in financial services since 2008 and is a CERTIFIED FINANCIAL PLANNER™ professional. Working with a CFP® professional represents the highest standard of financial planning advice. Jesse has a Bachelor of Science in Finance from Oral Roberts University.

Related articles

There are no comments to display.

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.

Note: Your post will require moderator approval before it will be visible.