Options can be used to make directional bets on a market, to hedge a long or short position in the underlying asset and to make bets on changes in implied volatility. Options can also be used to generate income.

One of the biggest uses of options is to mitigate risk on a long position in a stock or other asset.

Description of the Protective Put Strategy

The protective put is a relatively simple trading or investing strategy designed to try to hedge the risk associated with a long position.

:max_bytes(150000):strip_icc():format(webp)/10OptionsStrategiesToKnow-02_2-8c2ed26c672f48daaea4185edd149332.png)

For example, if a trader or investor is long 100 shares of stock ABC, then he or she may look for ways to protect against a decline in the stock price.

The protective put strategy simply involves the purchase of a long put option that may potentially gain in value if the stock price declines. Here is a simple example:

Protective Put Example

Trader Joe is bullish on stock ABC and owns 100 shares at an average purchase price of $40 per share.

The company has a major earnings announcement coming up in a few weeks, and Joe wants to hedge his downside risk in the stock using protective puts.

With the stock currently trading at $45 per share, Joe decides to purchase the two month $40 put option (ie the strike price is $42) for a premium of $4.

Protective Put Example

If the earnings announcement is considered bullish and the stock price rises, the put option can either be sold back to the market at a loss or can be held until expiration.

If the stock price is above the option strike price of $40 at expiration, then the option simply expires worthless and Joe is out the $4 premium paid for the put.

If the stock price were to plummet, however, Joe's put could potentially gain in value and possibly offset some or even all of the losses on the stock.

If the stock price is below the option strike price of $40 at expiration, then Joe has the right to sell his shares at $40 regardless of how low the stock price goes.

For example, if the stock price declined all the way to $35 per share, Joe's losses would be limited to the $4 option premium paid per share.

When To Put It On

The protective put is used to try to mitigate downside risk on a long position, and can be used under a variety of circumstances. In the example used above, the trader wanted to try to hedge the downside risk that could come from a major earnings announcement.

In another scenario, a long-term investor might continually purchase long puts on a stock position that he believes could see a sharp rise in volatility. Long puts are also long vega.

In yet another case, a trader or investor could purchase a put if implied volatility levels are very low, thus making the options relatively less expensive.

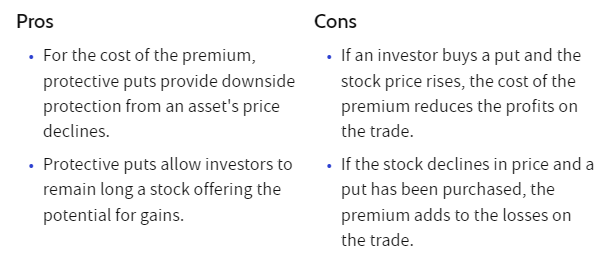

Pros of Strategy

The protective put's primary purpose is to hedge downside risk of a long position in the underlying asset.

Options can provide a degree of protection for a long position as may also potentially produce a profit if the shares drop or if there is a significant increase in implied volatility levels.

Because the put option is purchased, the risk on the put position is limited to the premium paid for the option.

Cons of Strategy

The strategy does come with some cons as well. Because options have an expiration date, the option will lose value as time passes with all other inputs remaining constant.

Options that are close to the current share price may also be prohibitively expensive, forcing the trader or investor to purchase puts that are further away from the money.

Although puts that are further away from the money may provide a hedge against a major sell-off, the trader or investor is still exposed to a degree on the stock.

A put that is a few dollars out of the money may not gain enough value to provide a hedge against a minor to moderate decline in the stock.

Risk Management

Risk management for a protective put can be accomplished in various ways.

If one is hedging a long position, he or she may be willing to simply hold the option until it expires knowing that they will lose the entire premium paid.

Another way to manage risk may be to sell the put back to the market if it loses a certain amount of value. Some traders may decide, for example, to sell a put back to the market if it loses half of its value.

Another method of risk management could include rolling the put out to a later expiration date.

Possible Adjustments

There are several ways to adjust a long put position. The trader or investor could initially buy a put that is further from the money, and roll it closer to the stock price as expiration gets closer and the options become less expensive.

Another method could be to roll the long put out to a later expiration date using the same or even a different strike price. The trader or investor could even decide to spread the long option by selling an out-of-the-money put against it to lower the cost basis.

Using a put to protect a long position in the underlying is a relatively simple position, but it does come with its own set of risks.

Traders and investors must decide how much risk they are willing to assume on the stock price, and must also decide what they are willing to pay for the hedge.

Used under the right circumstances, the long put can provide a degree of protection for a long position, but that potential protection does come at a cost.

Bottom Line

Protective puts limit potential losses from owning stocks and don’t impact maximum gains from owning stocks. However, like other types of insurance, you have to pay a premium to buy protective puts. Over the long term, buying protective puts can drag down your investment returns.

Traders and investors must decide how much risk they are willing to assume on the stock price, and must also decide what they are willing to pay for the hedge.

Used under the right circumstances, the long put can provide a degree of protection for a long position, but that potential protection does come at a cost.

About the Author: Chris Young has a mathematics degree and 18 years finance experience. Chris is British by background but has worked in the US and lately in Australia. His interest in options was first aroused by the ‘Trading Options’ section of the Financial Times (of London). He decided to bring this knowledge to a wider audience and founded Epsilon Options in 2012.

Subscribe to SteadyOptions now and experience the full power of options trading at your fingertips. Click the button below to get started!

Join SteadyOptions Now!

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account. It's easy and free!

Register a new account

Sign in

Already have an account? Sign in here.

Sign In Now