.thumb.jpg.9188f68d73adb9326c76ce588d0a407b.jpg)

Call Options

Call options are the right to buy a share at a predetermined price sometime on the future.

The have a few key features and terms:

Underlying

All options are derivatives - i.e. they derive from an underlying other security.

In this case the underlying security is likely to be a share - Apple (AAPL) say - or index such as the S&P 500 (see below for more details).

A call option therefore gives the holder the right, but not obligation, to buy the underlying before the option expires.

Strike (Or Exercise) Price

This is the price that the underlying can be purchased.

So, for example, if an AAPL call has a strike price of 200, then the holder can purchase AAPL shares at this price any time before the option expires.

Expiration

The date at which a call option expires - ie the right to purchase the shares only lasts until this date.

Options Premium

The cost to purchase an option.

Thus, for example, a 3 month AAPL 200 call option (ie the holder can buy 100 AAPL shares any time in the next 3 month) might cost $15 a share (ie $1500 in total) in option premium.

Call Option P&L Diagram

Put Options

Puts are the opposite to calls in that they give the holder the right, but not obligation, to sell shares at a predetermined price sometime in the future.

They have similar features to calls:

Underlying

The security over which the put option holder has the right to sell.

Strike Price

The price at which the underlying can be sold in the future.

Expiration

The length of time the holder has to exercise (or use) the option before it expires.

Option Premium

The cost to buy the option.

Put Option P&L Diagram

Note that the put holder doesn't need to own the shares before buying a put.

The owner can simply sell the option in the open market just before expiry if it is in the money (see below).

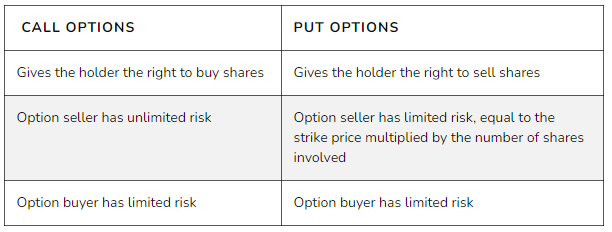

Call And Put Options: The differences

The most important difference between call options and put options is the right they confer to the holder of the contract.

When you buy a call option, you’re buying the right to purchase shares at the strike price described in the contract. You’re hoping that the stock’s price will rise above the strike price of the option. If it does, you can buy shares at the strike price, which is lower than the current market price, and sell them immediately for a profit.

When you buy a put option, you’re buying the right to sell shares at the strike price outlined in the contract. You’re hoping for the underlying stock’s price to decrease. If the stock’s price falls below the strike price, you can sell the shares at a higher price than what those shares are trading for in the market, and earn a profit.

Call And Put Options: Other Terms And Considerations

Options Writing

Thus far we've concentrated on the purchaser of an option.

However one of the attractions (and dangers) of options trading is that you can also be on the other side of the trade, as the so called 'writer' of the options contract.

The writer of an option receives the initial options premium on the creation of the option. Thus, for example, the $1500 in the AAPL example above would be paid to the option writer (or seller as they are sometimes called).

One important concept to understand is that the P&L Diagram of option to its writer is the 'upside down' version of the P&L of the purchaser.

At The/In The/Out Of The Money

An option is said to be:

-

in the money if, at the time, the strike price is lower than the current underlying's price (calls) or higher (calls)

-

out of the money if, at the time, the strike price is higher than the current underlying's price (calls) or lower (calls)

-

at the money if the strike price and current price are the same (for both calls and puts)

Mini Calls And Puts

In general one options contract relates to 100 shares in the underlying.

Thus, for example, one AAPL call option allows the purchase of 100 AAPL shares.

However in 2017 the CBOE launched so called mini options over five highly traded underlying securities: Amazon (AMZN), Apple (AAPL), Google (GOOG), Gold ETF (GLD), and S&P 500 SPRDs (SPY)

These options, designed for smaller retail investors, relate to only 10 shares.

It remains to be seen whether this new product will be as popular these will be: initial take-up has been slow.

Put Call Parity

A key theoretical concept that more advanced options traders need to understand is put call parity.

As this is an introduction to options we won't go into too much detail into this but in summary it is the idea that puts and calls are not as dissimilar as you might think.

In fact you can construct a put or call option by the purchase or sale of a combination of puts, calls and stock. Thus, for example, a sold put option is the same as a bought stock and sold call.

And because they are the same if you know the price of the call, you can deduce the price of the put (and vice versa).

Therefore, call and put pricing is connected - a connection call put call parity. We have a more detailed explanation here: Put Call Parity Explained.

Bottom line

Options do not have to be difficult to understand when you grasp their basic concepts. Options can provide opportunities when used correctly and can be harmful when used incorrectly.

About the Author: Chris Young has a mathematics degree and 18 years finance experience. Chris is British by background but has worked in the US and lately in Australia. His interest in options was first aroused by the ‘Trading Options’ section of the Financial Times (of London). He decided to bring this knowledge to a wider audience and founded Epsilon Options in 2012.

Subscribe to SteadyOptions now and experience the full power of options trading at your fingertips. Click the button below to get started!

Join SteadyOptions Now!

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account. It's easy and free!

Register a new account

Sign in

Already have an account? Sign in here.

Sign In Now