And in sideways markets you can make money selling straddles, strangles and iron condors.

And there are many more strategies to make money in any market. Below is my Options Trading Matrix which breaks these strategies into Bullish, Bearish, Long Volatility and Short Volatility categories.

For beginner options traders I recommend sticking to three core strategies that can make money in any market condition. These are buying calls in a bull market, buying puts in a bear market and selling volatility via a buy-write/covered call.

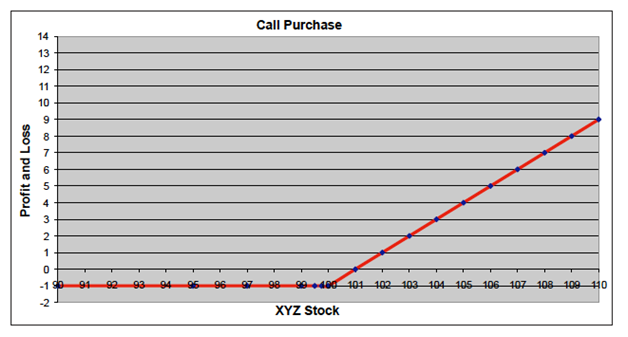

Here is the breakdown on buying Calls:

A call purchase is used when a rise in the price of the underlying asset is expected. This strategy is the purchase of a call at a specific strike price with unlimited potential for profits. The maximum loss on this trade is the amount of premium paid.

For example, the purchase of the XYZ 100 strike call for $1 would only risk the $1 paid. If the stock were to close at $100 or below at expiration, that call purchase would be worthless. If the stock were to go above $101, the holder of this call would make $100 per contract purchased per point above $101.

For the immediate level options trader buying calls, buying puts and buy-write/covered calls should also be used, along with bull call spreads, bull put spreads, bear call spreads, bear put spreads, put-writes and iron condors.

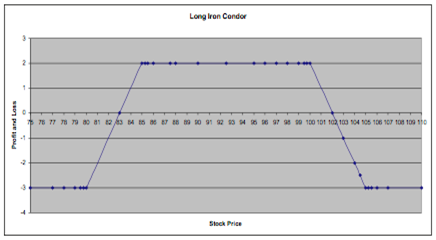

Here is my breakdown of an Iron Condor:

The Iron Condor position is the combination of a bear call spread and a bull put spread in the same underlying.

It’s a strategy that’s a high probability trade, allowing for a modest profit with enough room for error. Also, it’s meant to be a directionally neutral trade, used when volatility is elevated in relation to its forecasted range.

It’s my favorite volatility selling strategy. By selling a call spread and a put spread, you gain extra short volatility and decay, while at the same time limiting your risk.

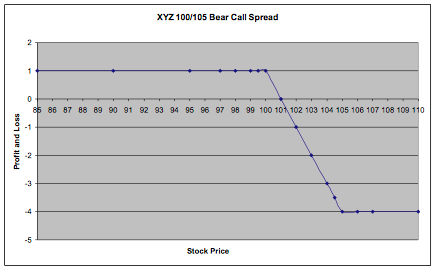

Here’s the hypothetical call spread:

Stock XYZ is trading at 90. You’d theoretically sell the 100/105 bear call spread for $1. To execute this trade, you would:

- Sell the 100 calls

- Buy the 105 calls

For a total credit of $1.

Here is the graph of this trade at expiration.

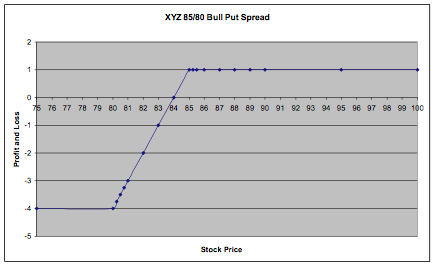

Here’s the hypothetical put spread:

Stock XYZ is trading at 90. You’d sell the 85/80 put spread for $1. To execute this trade you would:

- Sell the 85 Puts

- Buy the 80 Puts

For a total credit of $1.

Here is the graph of this trade at expiration:

Now we will combine these two spreads to make an Iron Condor:

To do this, you simultaneously:

- Sell the 100 calls

- Buy the 105 calls

For a total credit of $1.

And

- Sell the 85 Puts

- Buy the 80 Puts

For a total credit of $1.

This would give you a total credit of $2.

Here is the graph of this trade at expiration:

As you can see in the chart, at expiration, you’d make $2 as long as the stock stays between 85 and 100. Meanwhile, your downside is limited to $3 if the stock goes lower than 80 or higher than 105.

And for the professional trader, every strategy listed in the options strategy matrix above can be used to profit in any market conditions.

To learn more about these strategies and Cabot Options Trader where I use these strategies to create profits in any market visit Jacob Mintz or optionsace.com where I teach and mentor options traders.

Your guide to successful options trading,

Jacob Mintz

There are no comments to display.

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.

Note: Your post will require moderator approval before it will be visible.