For AutoZone Inc, irrespective of whether the earnings move was up or down, if we waited two-days after the stock move, and then sold a 3-week at out of the money iron condor (using monthly options), the results were quite strong. This trade opens two calendar after earnings were announced to try to let the stock find equilibrium after the earnings announcement.

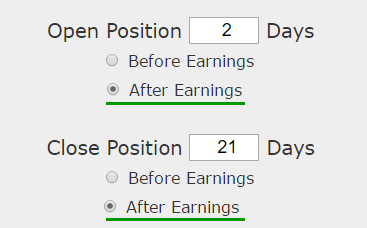

We can test this approach without bias with a custom option back-test. Here is our earnings set-up:

Rules

* Open the short iron condor two calendar days after earnings

* Close the iron condor 21 calendar days after earnings

* Use the options closest to 30 days from expiration (but at least 21-days).

And a note before we see the results: This is a straight down the middle volatility bet -- this trade wins if the stock is not volatile the three weeks following earnings and it will stand to lose if the stock is volatile.

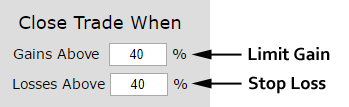

RISK MANAGEMENT

We can add another layer of risk management to the back-test by instituting and 40% stop loss and a 40% limit gain. Here is that setting:

In English, at the close of each trading day we check to see if the entire iron condor is either up or down 40% relative to the open price. If it was, the trade was closed.

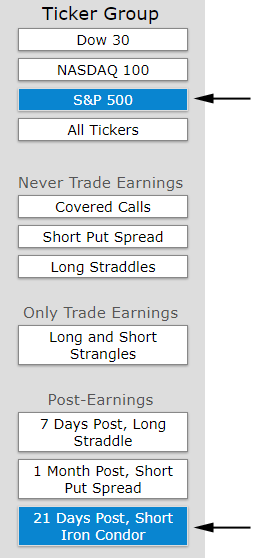

Trade Discovery

We found this trade by using the TradeMachine® Pro scanner, looking at the S&P 500, post-earnings back-tests and specifically the short iron condor. Then we looked at 3-year back-tests and sorted by earnings date.

We can see AZO has the highest win rate and a rather large historical returns.

This can be a nice diversification for those with generally long volatility positions (long options). We do note the rather hectic stock price move after the latest earnings results were announced and a general downward trend. Here is a stock chart:

The back-tester computes all calculations using end of day prices, so two-days after earnings would be 9-21-2017 at (or near) the close.

To adjust an iron condor so that it is symmetric to downside and upside risk, you can read about option skew and the impact on iron condors here:

Option Skew -- What it is and Why It Exists

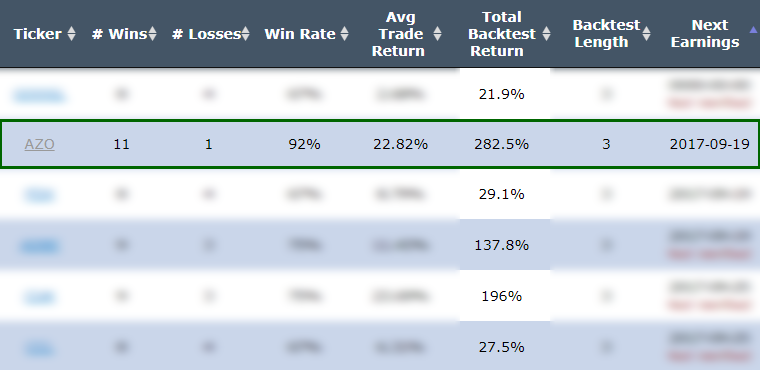

RESULTS

If we sold this 35/15 delta iron condor in AutoZone Inc (NYSE:AZO) over the last three-years but only held it after earnings we get these results:

We see a 282.5% return, testing this over the last 12 earnings dates in AutoZone Inc. That's a total of just 228 days (19 days for each earnings date, over 12 earnings dates).

We can also see that this strategy hasn't been a winner all the time, rather it has won 11 times and lost 1 times, for a 92% win-rate.

Setting Expectations

While this strategy had an overall return of 282.5%, the trade details keep us in bounds with expectations:

➡ The average percent return per trade was 22.82% over 19-days.

➡ The average percent return per winning trade was 24.94% over 19-days.

➡ The average percent return per losing trade was -0.51% over 19-days.

Over the Last Year

We can see similarly strong results over the last year:

We see a 97% return, testing this over the last 4 earnings dates in AutoZone Inc, with 4 wins and 0 losses in that short-time period.

Setting Expectations

While this strategy had an overall return of 97%, the trade details keep us in bounds with expectations:

➡ The average percent return per trade was 29% over 19-days.

WHAT HAPPENED

This is it -- this is how people profit from the option market -- finding trading opportunities that avoid earnings risk and work equally well during a bull or bear market.

To see how to do this for any stock we welcome you to watch this quick demonstration video:

Tap Here to See the Tools at Work

Thanks for reading.

Risk Disclosure

You should read the Characteristics and Risks of Standardized Options.

Past performance is not an indication of future results.

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.

There are no comments to display.

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.

Note: Your post will require moderator approval before it will be visible.