.thumb.jpg.bee8d0f8364e45d958faea77beea4697.jpg)

There is a bullish momentum pattern in Netflix Inc (NASDAQ:NFLX) stock 7 calendar days before earnings, and we can capture that phenomenon explicitly by looking at returns in the option market.

LOGIC

The logic behind the back-test is easy to understand -- in a bull market there can be a stock rise ahead of earnings on optimism, or upward momentum, that sets in the one-week before an earnings date.

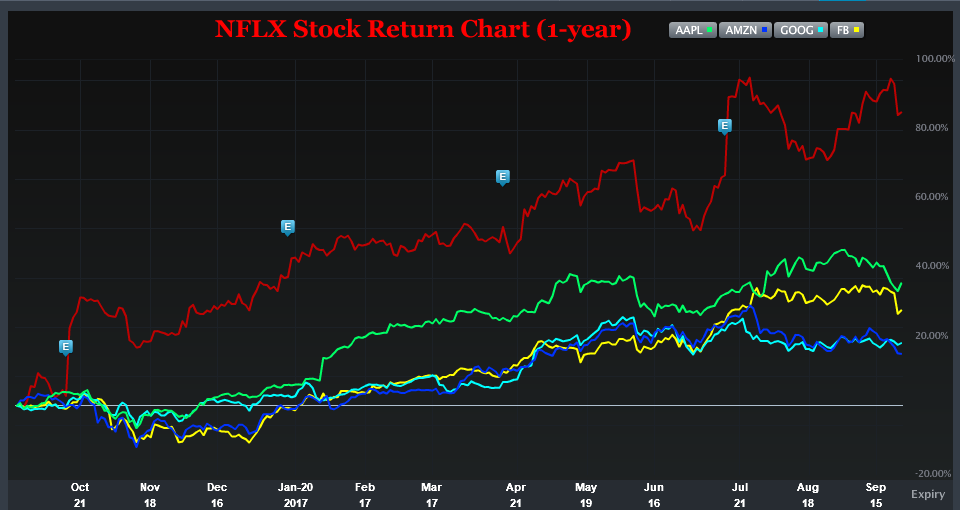

Stock Chart

We can start with a stock return chart over the last year comparing Netflix (in red) to the rest of FAANG.

Netflix has more than doubled the rest of the high momentum crew.

The Bullish Option Trade Before Earnings in Netflix Inc

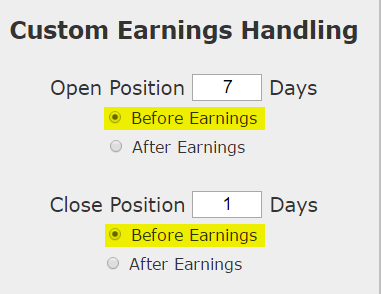

We will examine the outcome of getting long a weekly call option in Netflix Inc 7-days before earnings (using calendar days) and selling the call before the earnings announcement.

Here's the set-up in great clarity; again, note that the trade closes before earnings, so this trade does not make a bet on the earnings result.

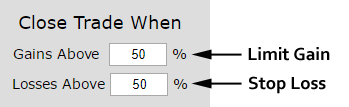

RISK MANAGEMENT

We can add another layer of risk management to the back-test by instituting and 50% stop loss and a 50% limit gain. Note that this is a little different from our normal 40% stop and limit. Here is that setting:

In English, at the close of each trading day we check to see if the long option is either up or down 40% relative to the open price. If it was, the trade was closed.

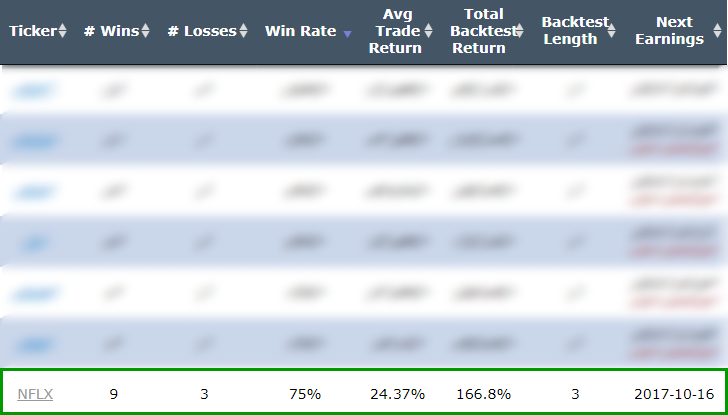

Back-test Discovery

We found this back-test by looking at pre=-earnings strategies in the Nasdaq 100. We focused on 3-year results, and sorted by wins.

Don't worry, we will talk about those six companies with better scan results soon, but Netflix has a nice narrative around it that stands out.

RESULTS

Here are the results over the last three-years in Netflix Inc:

We see a 173% return, testing this over the last 12 earnings dates in Netflix Inc. That's a total of just 84 days (7-days for each earnings date, over 12 earnings dates). This has been the results of following the trend of bullish sentiment into earnings while avoiding the actual earnings result.

We can also see that this strategy hasn't been a winner all the time, rather it has won 9 times and lost 3 times, for a 75% win-rate and again, that 173% return in less than six-full months of trading.

Setting Expectations

While this strategy had an overall return of 173%, the trade details keep us in bounds with expectations:

➡ The average percent return per trade was 26%.

➡ The average percent return per winning trade was 47.7%.

➡ The average percent return per losing trade was -39%.

Back-testing More Time Periods in Netflix Inc

Now we can look at just the last year as well:

We're now looking at 105% returns, on 3 winning trades and 1 losing trades. It's worth noting again that we are only talking about one-week of trading for each earnings release, so this is 105% in just 4-weeks of total trading.

➡ The average percent return over the last year per trade was 26.1%. This is remarkably similar to the three-year result of a 26% average return.

➡ The average percent return per winning trade was 40%.

➡ The average percent return for the one losing trade was -15.7%.

Going Yet Further

While we're at it, we can take a look what really sets this back-test apart from some others that actually have slightly higher win rates. We are also focused on the 9-month back-test:

| NFLX: Long 40 Delta Call | |||

| % Wins: | 100% | ||

| Wins: 3 | Losses: 0 | ||

| % Return: | 131% | ||

Tap Here to See the Back-test

We can see that Netflix has a bit of streak to it right now with three consecutive pre-earnings one-week long call back-tests showing wins, with an average return of 40%.

WHAT HAPPENED

Bull markets tend to create optimism, whether it's deserved or not. With the recent history of outperformance of the other FAANG stocks and nice winning streak, this gets twice the attention and is worth noting well ahead of the next event. To see how to test this for any stock we welcome you to watch this quick demonstration video:

Tap Here to See the Tools at Work

Risk Disclosure

You should read the Characteristics and Risks of Standardized Options.

Past performance is not an indication of future results.

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account. It's easy and free!

Register a new account

Sign in

Already have an account? Sign in here.

Sign In Now