That is not to say there is no risk, just less risk.

Market and economic troughs are akin to the aftermath of a forest fire. After a fire has ravaged a forest, the risks for another fire are not zero, but they are below average.Counter-intuitively, it is at these points in time when people are most fearful of fire or, in the case of investing, most worried about losses.With reduced risks,investors during these times should be more focused on the better than average rewards offered by the markets and not as concerned with the risks entailed in reaping those rewards.

Conversely, in the ninth inning of a bull market when valuations are well above the norm, and the economy has expanded for a long period, investors need to shift focus heavily to the potential risks. That is not to say there are no more rewards to come, but the overwhelming risks are substantial, and they can result in a permanent loss of wealth. As human beings are prone to do, we often zig when we should zag.

In January, we wrote Gimme Shelter to highlight that risk can be hard to detect. Sure, high flying companies with massive price gains and repeated net losses like Tesla or Netflix are easy to spot. More difficult, though, are those tried and true value stocks of companies that have flourished for decades. Specifically, we provided readers with an in-depth analysis of Coca-Cola (KO). While KO is a name brand known around the world with a long record of dependable earnings growth, its stock price has greatly exceeded its fair value.

We did not say that KO is a sure-fire short sale or even a sell. Instead,we conveyed that when a significant market drawdown occurs, KO has a lot more risk than is likely perceived by most investors. Simply, it is not the place investors should seek shelter in a market storm as they may have in the past.

We now take the opportunity to discuss another“ value” company that many investors may consider a stock market shelter or safe haven.

We follow in this series with a review of McDonald's (MCD).

You Deserve a Break Today

Please note the models and computations employed in this series use earnings per share and net income. Stock buybacks warp earnings per share (EPS), making earnings appear better than they would have without buybacks. The more positive result is simply due to a declining share count or denominator in the EPS equation. Net income and revenue data are unaffected by share buybacks and therefore deliver a more accurate appraisal of a company’s value.

Over the last ten years, the price of MCD has grown at a 13% annual rate, more than double its EPS, and over five times the rate of growth of its net income. The pace at which the growth of its stock price has surpassed its fundamentals has increased sharply over the last three years. During this period, the stock price has increased 46% annually, which is almost four times its EPS growth and more than six times the growth of its net income.

Of further concern, revenues have declined 5% annually over the last three years, and the most recently reported annual revenues are now less than they were ten years ago when the U.S. and global GDP were only about 60% the size they are today. To pile on,the amount of debt MCD has incurred over the last ten years has increased by 355%.

MCD is a good company and, like KO, is one of the most well-known brands on the globe. Rated at BBB+, default or bankruptcy risk for MCD is remote, and because of its product line, it will probably see earnings hold up well during the next recession. For many, it is cheaper to eat at a McDonald’s restaurant than to cook at home. Although their operating business is valuable and dependable, those are not reasons to acquire or hold the stock. The issue is what price I am willing to pay in order to try to avoid a loss and secure a reasonable return.

Valuations

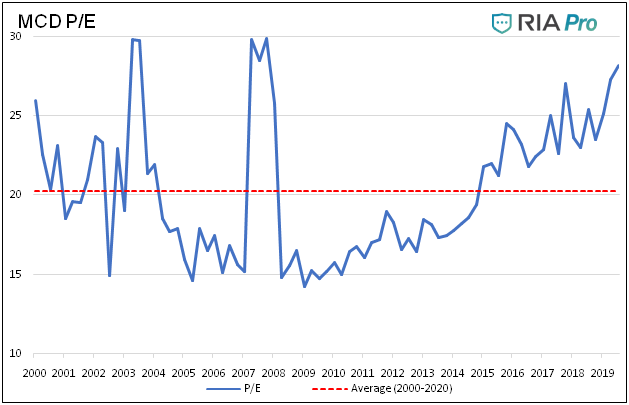

Using a simple price to earnings (P/E) valuation, as shown below, MCD’s current P/E for the trailing twelve months is 28, which is about 40% greater than its average over the last two decades.

The following graphs, tables, and data use the same models and methods we used to evaluate KO. For a further description, please read Gimme Shelter.

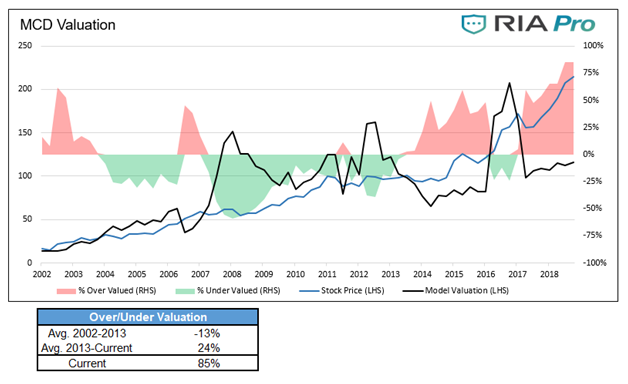

Currently, as shown below, MCD is trading 85% above its fair value using our earnings growth model. It is worth noting that MCD, as shown with green shading, was typically valued as cheap using this model. The table below the graph shows that, on average, from 2002-2013, the stock traded 13% below fair value.

We support the graph and table above with a cash flow analysis. We assumed McDonald's 5.6% long-run income growth rate to forecast earnings for the next 30 years. When these forecasted earnings are then discounted at the appropriate discounting rate of 7%, representing longer-term equity returns, MCD is currently overvalued by 72%.

Lastly, as we did in Gimme Shelter, we asked our friend David Robertson from Arete Asset Managementt o evaluate MCD’s intrinsic value. His cash flow-based model assigns an intrinsic share price value of97.27. Based on his work, MCD is currently overvalued by 124%.

Summary

Like KO, we are not making a recommendation on MCD asa short or a sell candidate, but by our analysis, MCD stock appears to be trading at a very high valuation. Much of what we see in large-cap stocks today, MCD included, is being driven by indiscriminate buying by passive investment funds. Such buying can certainly continue, butat some point, the gross overvaluations will correct as all extremes do.

Even if MCD were to “only” decline back to a normal valuation, the losses could be significant and might even exceed those of the benchmark index, the S&P 500. Now consider that MCD may correct beyond the average and could once again trade below fair value. Even assuming MCD earnings are not hurt during a recession, the correction in its stock price to more reasonable levels could be painful for shareholders.

Michael Lebowitz, CFA is an Investment Analyst and Portfolio Manager for Clarity Financial, LLC specializing in macroeconomic research, valuations, asset allocation, and risk management. Michael has over 25 years of financial markets experience. In this time he has managed $50 billion+ institutional portfolios as well as sub $1 million individual portfolios. Michael is a partner at Real Investment Advice and RIA Pro Contributing Editor and Research Director. Co-founder of 720 Global. You can follow Michael on Twitter.

There are no comments to display.

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.

Note: Your post will require moderator approval before it will be visible.