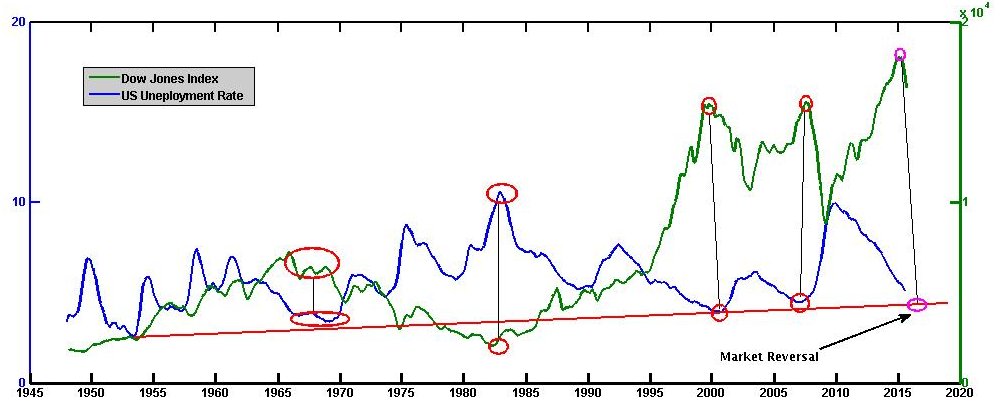

Lets look at the US Unemployment Rate and its correlation with Dow Jones Industrial Average, a leading market indicator. Unemployment rate is a direct representation of the state of economy and hence it’s highly and inversely related with the Market Indices as shown in the graph below.

In 1983-84, market hit the bottom and unemployment rate was at its peak. In 2000 and 2006-07, the market was at its peak and the unemployment rate was at its bottom. As history dictates, unemployment rate has a strong support, as shown by the red line in the graph. Its about to hit its extrapolated bottom while the stock markets is at its peak. Well, it can crash the bottom and set a new historic minimum but the expected chances of happening of such events are very low as dictated by history. Very low unemployment rate can also mean inflated production and hence confirms our belief that the market is now heading for a reversal. It may or may not be immediate but can materialize in coming years.

Another Economic Indicator is US Government Bond 10Y. It’s also inversely related with the market indices because when market goes south investors look for safer bets. The market hit its lows in 1980s and that’s exactly when the US Bond rates peaked. This indicator has averaged 6.3 from 1912 to 2015 (Source: www.tradingeconomics.com) and now nearing its lows of around 2.0, which again indicates that we are facing an impending market reversal.

source: tradingeconomics.com

Will these indicators break through their support levels and set new historic levels or will they bounce off the walls and drag the markets towards correction, only time will tell, but till then we will go with the more likely outcome.

One of our options trading strategy OH-HELIOS is pseudo bullish, it works in bullish or neutral markets. We are going to put a hold on this and will wait until the macro economic indicators return back. Our other strategy OH-APOLLO is market neutral and it works in any market condition. So we will keep investing in it.

By Gagan Gautam, CEO & Founder @ www.optionsherald.com

About Author: Gagan Gautam is a Quant Researcher and Technologist who specializes in developing Quantitative Strategies for Trading Options and bringing world class trading technology to common masses.

There are no comments to display.

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.

Note: Your post will require moderator approval before it will be visible.