-

Limit Orders

-

Market Orders

-

Stop Orders

- Stop Limit Orders

While the type of order you use might seem like a trivial detail, it can actually make or break a trade’s profitability.

What is a Limit Order?

In a nutshell, a limit order is a way to buy or sell a stock at your limit price or better.

A limit buy order for $2.25 means you're willing to purchase the option contract at any price up to $2.25. If someone will sell it to you for $2.20, your order will execute at $2.20.

It works the same way on the sell side. A limit sell order for $1.50 means that $1.50 is the lowest price you’ll accept for your contract.

Typically, option traders should only use limit orders and different variants of them, as market orders can

Limit orders are the building blocks of financial markets. At their core, exchanges are big databases of limit order books with matching algorithms.

What is a Market Order?

Market orders are orders you send to the market for immediate execution. This means accepting the best available price based on the best bid or offer.

Using market orders is a very aggressive strategy and generally only reserved for those emergencies when you need to exit a market in a panic due to a mistake.

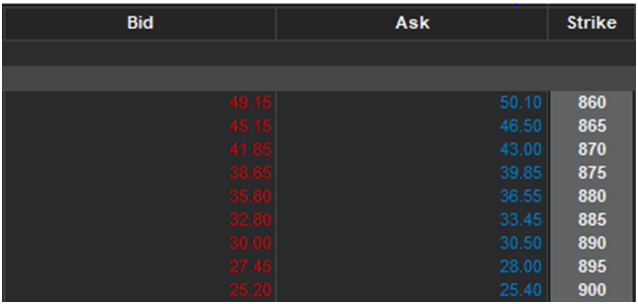

Below are the bid/ask spreads for a series of Tesla (TSLA) options:

Submitting a market order to buy, for example, the 870 call in this series, would most often result in you paying $43.00 per contract.

‘No problem,’ you say, ‘I’m willing to pay $43.00 for those contracts.’

The problem is that market orders are like blank checks to the market. You're telling the market, "I will take any price you give me for this order." It's like going to a real estate agent and saying, "I want to buy this house, even if the seller revises his price upward between now and when you give him the offer."

Not so fast, because there are four problems with using market orders.

Stale Quotes

Market orders have no mechanism to protect you from high-frequency market makers who change their quotes at the speed of light. See this 2011 case where a retail trader submitted a market order to buy an ETF trading at $26, only to see his order executed at $35 due to market illiquidity.

This issue of market illiquidity is only compounded in the options market. Liquidity is fragmented across a series of options contracts. While there are thousands of stocks to trade in the stock market, each stock can have dozens or hundreds of different contracts. Few traders are willing to take the other side of your trades in a specific option contract at any given time.

For this reason, you should never use a market order in options trading. While it's generally advisable not to use them when stock trading, it's far less risky. If you're trading a liquid stock like Apple (AAPL), you might lose a few cents if the quote you rely on goes stale after sending a market order. But order books are very thin in the options market, ensuring significant slippage if the quote goes stale.

Aim For the Midpoint With a Limit Order

The ‘midpoint’ in options trading is the midpoint between the bid and ask prices. If the bid/ask is $4.00/$6.00, the midpoint of that quote is $5.00.

If the option has sufficient liquidity, the midpoint can often act as an approximation of its theoretical or “fair” value. And as a result, market makers or other traders are frequently happy to trade with you at the midpoint, especially if you’re willing to be patient.

The difference between hitting a bid or offer and taking liquidity from the market makes a huge difference in a trader's career. It can be the difference between long-term profitability and breaking even.

While you won’t be able to get the midpoint 100% of the time, you can get it often enough that you should make a habit out of pricing your orders at or near the midpoint unless you have a compelling reason not to.

Wide Bid/Ask Spreads

The bid/ask spread is the difference between the best bid price and the best offer/asking price. In highly liquid stocks like Apple (AAPL) or Microsoft (MSFT), the bid/ask spread can often be as small as a penny when just trading the stock.

This isn't exactly true for the options market. Not all options trade in penny increments. In fact, the minimum pricing increment for many options is $0.05 or $0.10. According to TD Ameritrade, here are the current minimum price increments in the US options market:

|

Contract Price Range |

Price Increment |

|

$0.10 - $3.00 |

$0.01 or $0.05 |

|

$3.00+ |

$0.05 or $0.10 |

Consider that even for an option priced <$3.00 having an $0.01 increment, a penny is still a significantly larger percentage of the price than it is for a share of stock like Apple (AAPL) priced above $100.

Option Bids and Asks Are Bad Prices

The best bid price is generally well below an option’s theoretical value, and the best ask above it’s theoretical value. So sending a market order to the market almost always means that you’ll be overpaying for your options or not getting enough when you sell them.

What To Use Instead of a Market Order: Marketable Limit Order

Perhaps submitting a limit order at the midpoint and patiently waiting to be filled isn’t an option. Maybe you’re making an event-driven trade and you need to get in/out now, or maybe you forgot to close your trades and the market closes in 30 seconds. Sometimes you require instant liquidity.

So if market orders aren’t an option, what do you use when you need instant execution? Marketable limit orders.

A marketable limit order carries all the benefits of a market order without any of the risks of insane slippage.

Marketable limit orders aren't a special option in your trading platform. You can create one with just a simple limit order ticket. You only need to price the order at the bid or ask, and the order becomes eligible for instant execution.

For example, let's say you want to submit a market order to buy an option with a bid/ask of $4.50/$4.55. To submit the equivalent marketable limit order, you would send a limit order to buy the option one tick above the asking price, in this case, $4.60. In this case, if the quote you're relying on goes stale, then the worst that could happen is that you get filled one tick above your expected price.

Summary

Seasoned options traders never use market orders for four reasons:

-

The quote you’re relying on might be ‘stale' when your order makes it to the market, meaning you might end up paying more than you expect.

-

Generally, a market maker will fill you if you submit a limit order at or near the midpoint.

-

Bid/ask spreads are much higher in the options market than in the equity market.

- The asking (bid) price for any option is generally well above (below) the theoretical value of the option contract. It isn't easy to be a profitable trader if you consistently pay too much or receive too little for options.

There are no comments to display.

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.

Note: Your post will require moderator approval before it will be visible.