That’s fine if you’re super bullish on AAPL and are happy with that exposure, but it’s not great diversification.

Thankfully there is a way to trade this popular income strategy and still maintain some level of diversification.

A poor man’s covered call is like a regular covered call but requires only a fraction. It’s like taking a leveraged position, so the returns in percentage terms will be amplified.

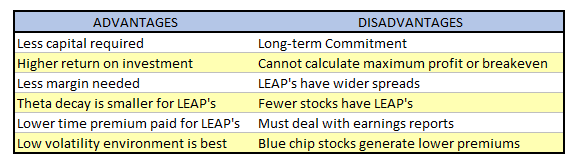

Below are some advantages and disadvantages of a poor man’s covered call over a regular covered call.

I like using this strategy with ETF’s, that way you have built in diversification.

For examples, I could set up a pretty well diversified portfolio by trading poor man’s covered calls on the following ETFS:

Bonds – TLT

Real Estate – IYR

US Stocks – SPY

Emerging Markets - EEM

With 4 underlying ETFs and not a whole lot of capital, I have set up a diversified portfolio that generates income through selling call options.

Let’s look at some examples:

AAPL

Earlier we looked at the amount of capital required for one covered call trade on AAPL stock which would be around $17,300.

Let’s compare a standard covered call with a poor man’s covered call:

AAPL COVERED CALL

Trade Date: Feb 15th, 2018

AAPL Price: $172.99

Trade Details:

Buy 100 AAPL Shares @$172.99

Sell 1 March 16th, 2018 $180 Call @ $1.60

Total Paid: $17,139

Fast forward to March 10th and the AAPL shares are now worth $17,985 and the call has only gone up to $1.71. That means the total position is now worth $17,814 for a gain of $675.

This represents a gain of 3.94%. Not bad!

AAPL POOR MAN’S COVERED CALL

Let’s now take a look at how the poor man’s covered call has performed. Instead of forking out $17,299 for 100 shares, we use an in-the-money LEAP call option.

Trade Date: Feb 15th, 2018

AAPL Price: $172.99

Trade Details:

Buy1 January 17th, 2020 $140 Call @ $43.00

Sell 1 March 16th, 2018 $180 Call @ $1.60

Total Paid: $4,140

Let’s see how this position compares on March 10th. The $140 call has increase in value from $43 to $49.50 and the short call from $1.60 to $1.71.

The total position is now worth $4,779 for a total gain of $639 which represents a percentage gain of 15.43%.

By utilizing the poor man’s covered call, we have managed to generate a similar dollar return, while using only a fraction of the capital.

Let’s now take a look at a time when AAPL stock went down.

AAPL COVERED CALL

Trade Date: Jan 29th, 2018

AAPL Price: $167.28

Trade Details:

Buy 100 AAPL Shares @$167.28

Sell 1 March 16th, 2018 $175 Call @ $4.35

Total Paid: $16,293

On Feb 9th, AAPL reached a low of $150.24 and the March $175 call had dropped to $0.50.

The net position was worth $14,974, a decline of $1,319 or 8.10%.

AAPL POOR MAN’S COVERED CALL

Let’s now take a look at how the poor man’s covered call held up.

Trade Date: Feb 15th, 2018

AAPL Price: $172.99

Trade Details:

Buy 1 January 17th, 2020 $140 Call @ $41.70

Sell 1 March 16th, 2018 $175 Call @ $4.35

Total Paid: $3,735

On Feb 9th, with AAPL trading at $150.24, the LEAP call had dropped to $31.35. With the short call trading at $0.50, the net position was worth $3,085 for a loss of $650.

This loss represents a -17.40% return on capital at risk which is worse in percentage terms than the regular covered call.

BUT, the dollar value loss is only half that of the regular covered call. Part of the reason for this is the rise in volatility, which would have given a small benefit to the long call holder.

It doesn’t always work out like this, but in both of these examples, the poor man’s covered call was the better trade. In the first instance, the poor man’s covered call made a similar return while using much less capital. In the second example, the dollar loss was much less, half in fact, than the regular covered call.

Poor man’s covered calls are one of my favorite trading strategies. Traders can achieve excellent returns, but they need to be aware that percentage losses on the downside are magnified as well.

If you want to check out a detailed example of a poor man’s covered call that played out over the course of a year, you can do so here.

Gavin McMaster has a Masters in Applied Finance and Investment. He specializes in income trading using options, is very conservative in his style and believes patience in waiting for the best setups is the key to successful trading. He likes to focus on short volatility strategies. Gavin has written 5 books on options trading, 3 of which were bestsellers. He launched Options Trading IQ in 2010 to teach people how to trade options and eliminate all the Bullsh*t that’s out there. You can follow Gavin on Twitter.

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.

Note: Your post will require moderator approval before it will be visible.