Micron Technology Inc. (MU) 38.65 ended up .82 Friday, Mach 8th, making a wide outside range reversal, although down 2.93 or -7.05% for the week. The IV to 56.93 from 51.67 last week and will likely continue higher until March 20. The implied volatility/historical volatility ratio using the range method is 1.57 compared to 1.35 last week, so option prices are more expensive relative to the recent movement of the stock.

Although last week, my long call spread didn't work out, Friday's reversal looks encouraging enough to try once again. This time the plan includes selling an out-the-money put with a long call spread. Friday, March 8th’s, prices:

|

B/S |

Qty |

O/C |

U Sym |

Exp |

Strike |

P/C |

Bid |

Mid |

Ask |

IV |

|

Buy |

1 |

Open |

MU |

Mar 22 |

41 |

Call |

.96 |

1.00 |

1.02 |

64.08 |

|

Sell |

1 |

Open |

MU |

Mar 22 |

43 |

Call |

.46 |

.47 |

.47 |

61.50 |

|

Sell |

1 |

Open |

MU |

Mar 22 |

37 |

Put |

1.28 |

1.30 |

1.31 |

71.25 |

Using the ask price for the buy and mid for the sell and the bid for the put the combination results in a .73 credit [(1.02-.47) -1.28].

After opening the New and Improved Live PnL Calculator and entering the strike prices along with the symbol at:

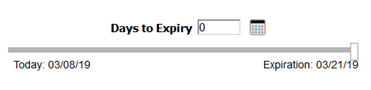

Then advancing the expiration to March 22:

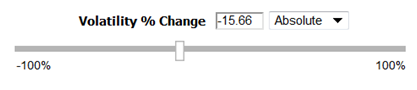

Along with reducing the volatility by 15.66% (based upon the volatility chart showing implied volatility declined to about 45% after reporting in previous quarters):

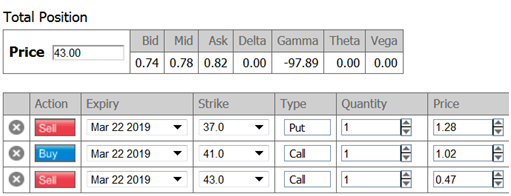

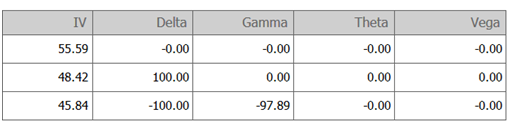

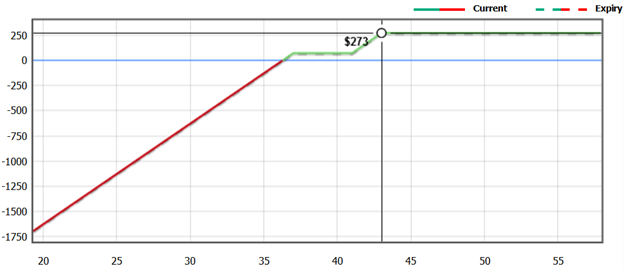

With all this set up, the calculator displays the following with price set at 43, the call short strike,and then the PnL profile with price set at 43:

The  displays all available expiration dates along with strike prices for calls and puts that can be entered by clicking on either the bid or ask price. Then,in the data table,the strikes can be altered: more strikes added/subtracted or quantities changed to produce multiple "what if" scenarios.

displays all available expiration dates along with strike prices for calls and puts that can be entered by clicking on either the bid or ask price. Then,in the data table,the strikes can be altered: more strikes added/subtracted or quantities changed to produce multiple "what if" scenarios.

While the profile above shows the expected result at the target price and at expiration, it can also be set to one week or any other number of days.Or maybe add another out-of-the money short put.

This limited space introduction only briefly mentions the vast capability of the PnL Calculator.

The assumption for the long call with a short put, sometimes called a call spread risk reversal, assumes the stock price reversal that began Friday continues higher and reaches the recent previous high around 43 after reporting earnings on March 20 when the implied volatility abruptly declines.

Use a close back below 38 as the SU (stop/unwind) just in case Friday's reversal fades.

The spread suggestion above is based on the ask price for the buy and middle price for the call sell presuming some price improvement is possible. Then the ask for the put sell. Current option prices will be different due to the time decay over the weekend and any price change.

Summary

The PnL Calculator is a trader’s best friend when it comes to what-if scenarios. Sure, checking profit and loss is an inevitable part of setting any strategy, but every options trader knows that they need to be fluid. Circumstances change, and with them, strategies must be adjusted. You may have a trade in mind, but what happens when the volatility changes? What changes as we get closer to expiry and experience time-decay? What happens when the position price isn’t exactly as you expected? These are the questions every trader faces before locking in their trades, and these are the questions the PnL calculator can help answer. So, next time you’re about to allocate and order, take a moment and check your profit and loss under different circumstances with the PnL Calculator!

Written by Jack Walker. Jack Walker is the author of IVolatility.com’s Volatility Trading Digest. Jack is a former PSE options market maker and hedge fund manager. Jack has contributed to SeekingAlpha, TalkMarkets, amongst other financial news sites.

Related articles:

There are no comments to display.

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.

Note: Your post will require moderator approval before it will be visible.