As a general rule, it's all about risk/reward. Long call has higher risk higher reward. Bull put spread - lower risk, lower reward. If you structure the put spread with both puts OTM, the stock can move slightly down and you can still make money - as long as it doesn't penetrate the short put.

Here are some responses provided by our members:

-

Long call is theta negative whereas the bull put is theta positive (ie. the long call would lose money every day and the put spread would gain every day, ignoring any stock movement).

-

Long call is vega positive whereas the put spread is vega negative. If volatility was to drop, then the long call would lose, but put spread would gain - and vice versa.

-

Long call requires that the stock moves up (and quickly) to make a profit, whereas the bull put can make a profit if the stock stays static, or moves up, or even down a little (depending on the short strike). Essentially, to make money for with a long call, the stock has to move up and quickly, whereas with the bull put spread, the stock just has to stay roughly static or rise.

-

With regards to the "unlimited profit" with a long call - yes, it is true, but in this is theoretical only.

- Long call is Vega positive so IV drop can hurt, and most IVs are elevate right now and IV typically drops when the stock price rises. So a rising stock price and dropping IV can lower profits quite a bit. A bull put spread will benefit from falling IV coupled with a rising stock price. Although a bull put spread has limited profit it can be a safer choice when IV is elevated.

One of the members mentioned that FB ATM calls produced over 100% return after earnings. "Think about this, you knew FB was going to go up and earnings were strong etc etc, and you sold a bull put and got say credit of $300 on spread of $1K. You did the right thing . You sold max IV, collected max theta and your profit was 30% of risk but just $300."

But this is hindsight. FB moved 17%, one of the biggest moves in the recent years. This was an extreme example. Lets take a look at more realistic example.

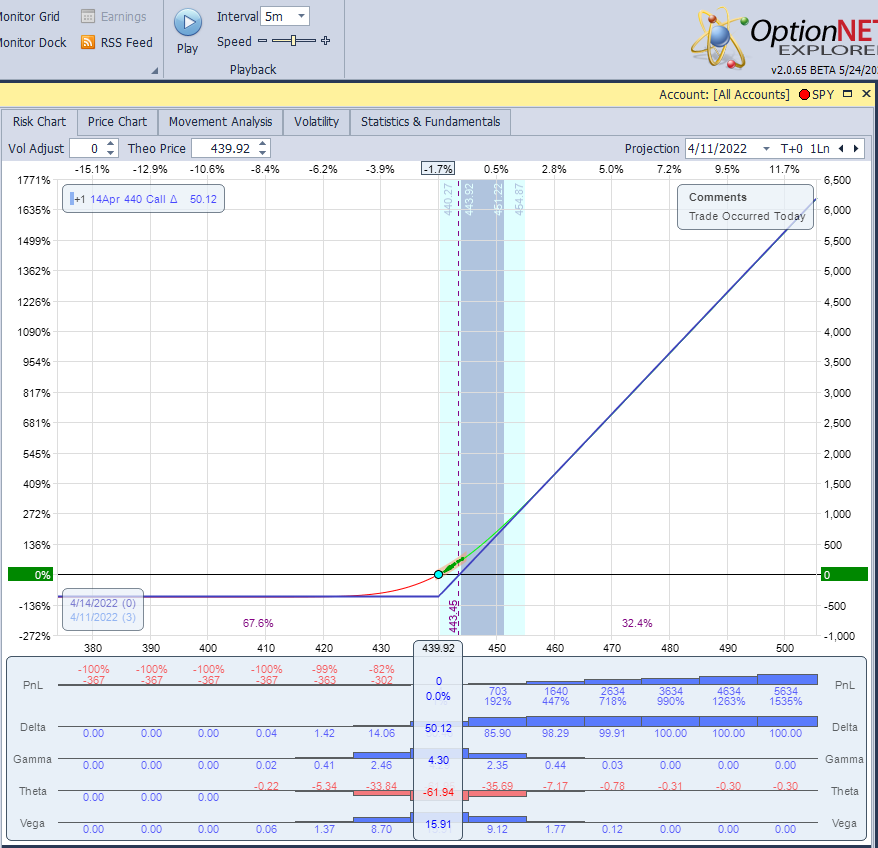

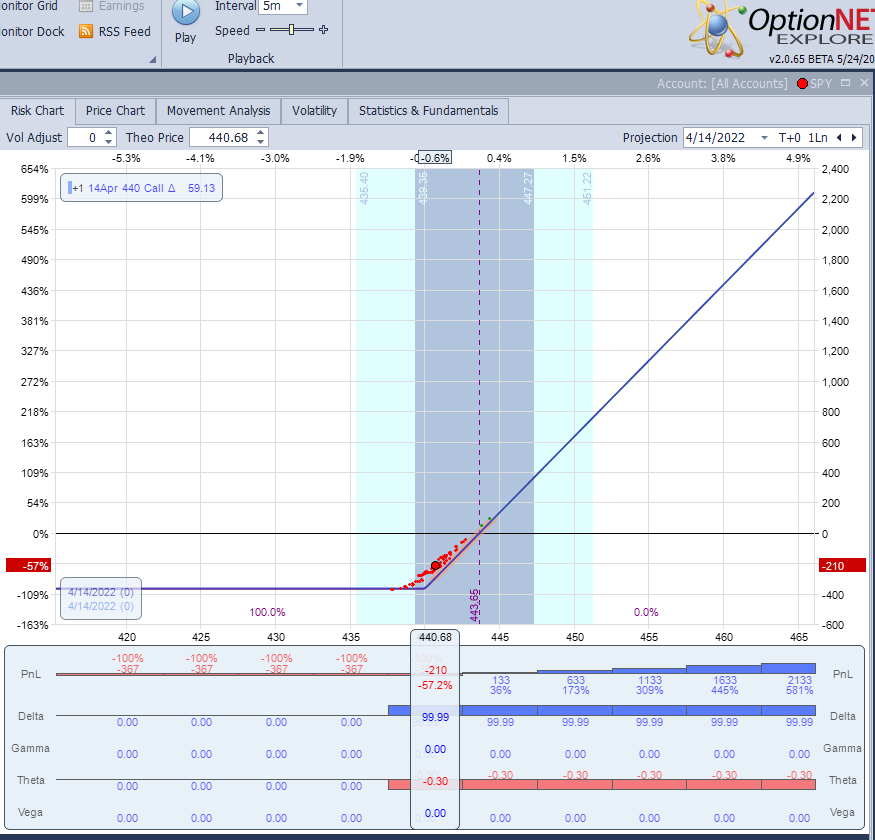

SPY was trading around 440 on April 11.

You could buy ATM call:

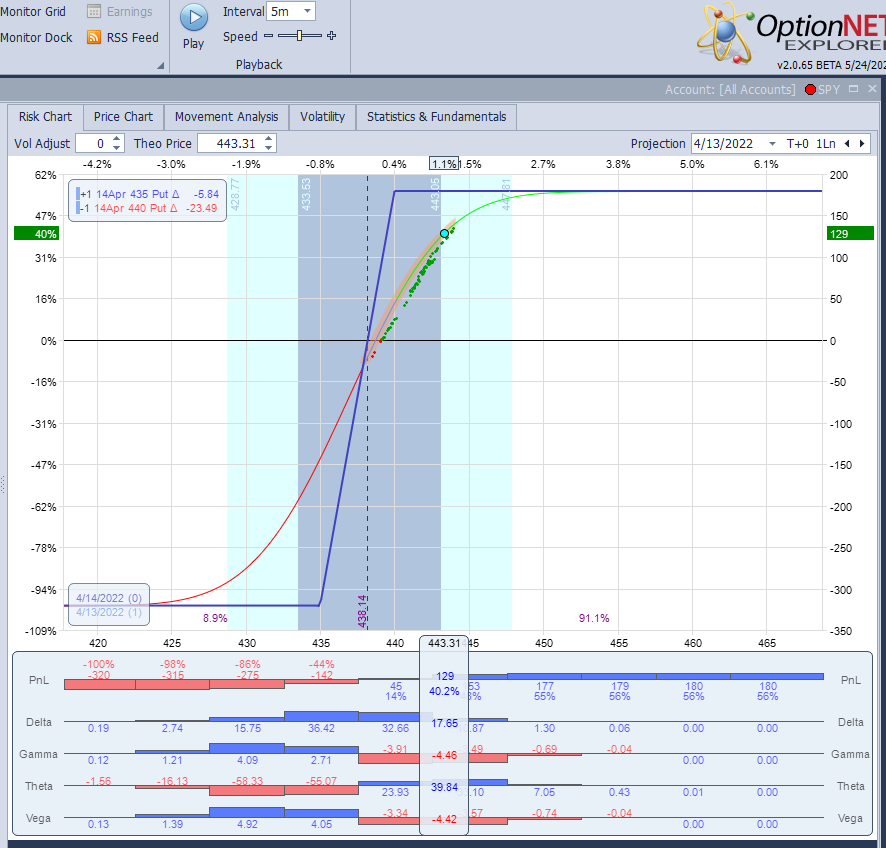

Or sell put credit spread:

What happened next?

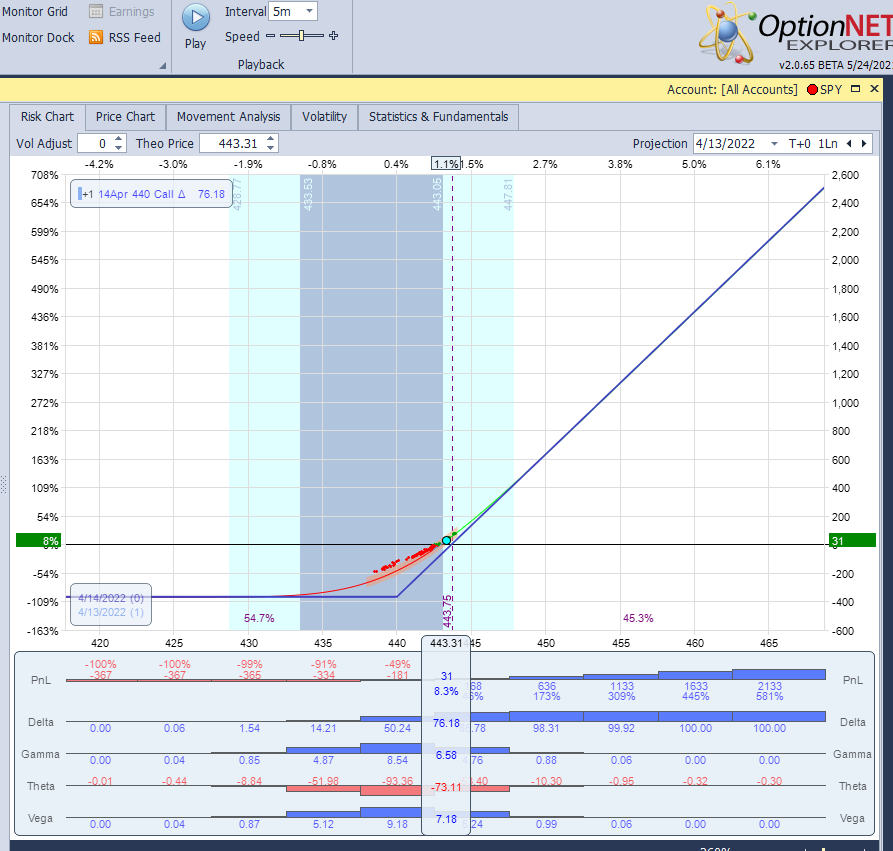

2 days later SPY was around 443.

The call was up only 8%:

But the credit spread was up 40%:

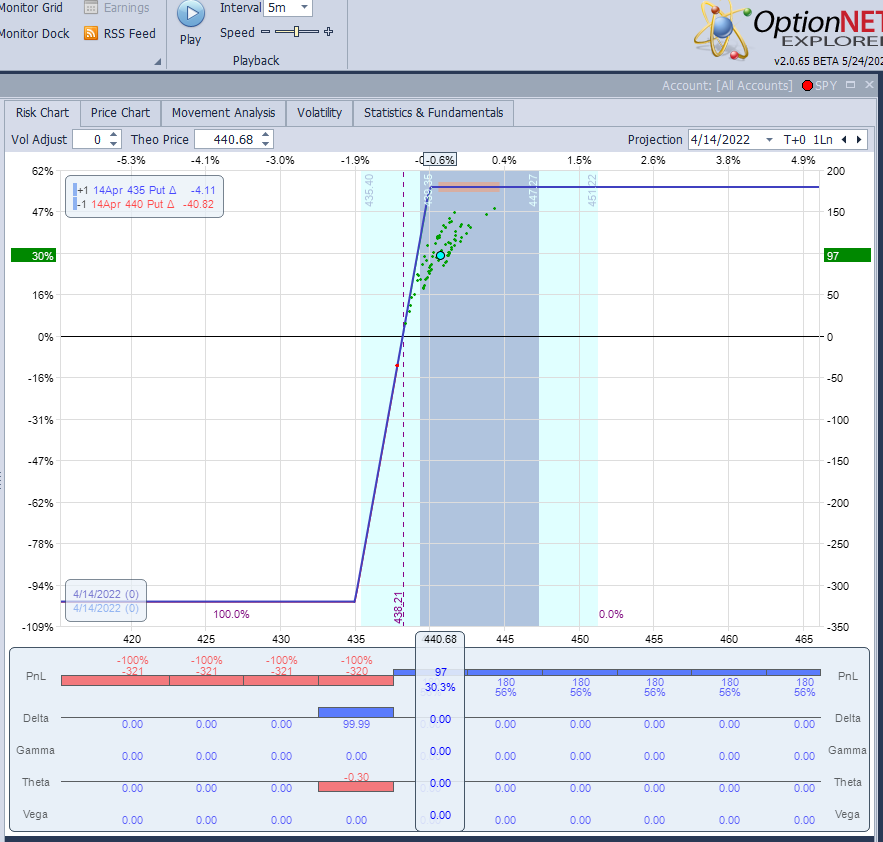

The next day SPY pulled back to where it was when the trades were entered.

The put spread was still up 30%:

But the call was down almost 60%:

The bottom line: you can maximize the gains or reduce the losses. You cannot have it both ways. It's all about risk/reward, and one strategy is not necessarily better or worse than the other.

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account. It's easy and free!

Register a new account

Sign in

Already have an account? Sign in here.

Sign In Now