Is it possible that this member found the holy grail?

After running some backtesting, it turned out that this setup can sill lose money if Implied Volatility drops significantly.

However, since the holding period is 3-10 days, the chances of dramatic Volatility drop are relatively small. In our backtesting the largest loss was around 15%.

Here are some FAQs about this strategy:

Q: Which subscription does this trade strategy fall under?

A: It will be part of our SteadyOptions service and will complement the other strategies we use in our model portfolio (straddles, calendars etc.)

Q: How frequently do they trade?

A: The goal is to have both trades (SPY and QQQ) every week, assuming the setup is good. We aim to open on Friday or Monday and close by the end of the week (holding period of one week or less). We will open the trades based on market conditions.

Q: How did it perform in the backtests when VIX was very low?

A: We back-tested this trade setup using weekly trades for all of 2022 so far. We only saw losses drop below 10% on a handful of occasions (and most of those would end up being winning trades by short expiration) so downside risk of this setup tends to be small. Remember that the main risk of this trade is sharp IV collapse, and with VIX at 15-17, this scenario is much less likely.

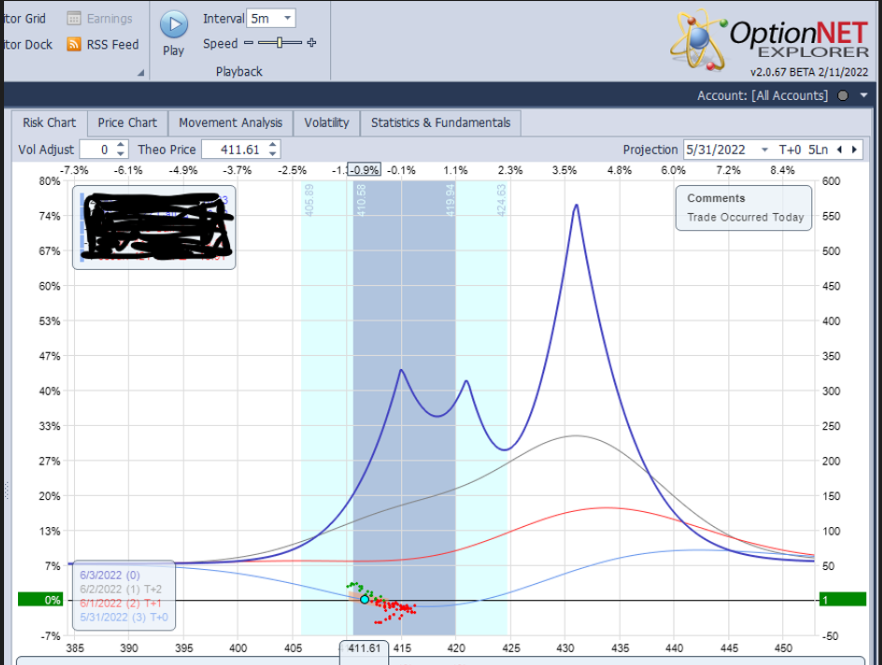

Q: Is the risk graph reliable? It seems like a risk free trade.

A: As mentioned, the trade is risk free only if Volatility does not change during the life of the trade. It can still lose money if Implied Volatility drops significantly. We aim to structure the trade in a way that it can tolerate a 20% volatility drop.

Q: Is the below is a risk free trade after some adjustment have been made? Seems to me the original setup had some (possibly major) risk. In other words, did you sell the below for a credit at the original setup

A: This is the initial setup. We don't adjust this trade. As mentioned, it's not really risk free, there is vega risk.

Q: do you open all the legs at the same time?

A: Yes.

Q: What happens if the markets crash?

A: Since we open the trade for a credit, we will still make 4-7% no matter how much the markets fall. In fact, this is the case where trade really becomes risk free.

So far we closed 10 trades using this strategy, all winners, with an average return of 7.2% and average holding period of 6 days. Only one trade was down 11% at some point, the rest were never down more than 3-4%. For a high probability strategy with an average holding period of less than a week, those are excellent results and excellent risk/reward. If you traded only 2 spreads per trade (~$3,500 total margin), your returns would cover your SteadyOptions subscription for a full year.

If you like to check it out, you are invited to subscribe.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account. It's easy and free!

Register a new account

Sign in

Already have an account? Sign in here.

Sign In Now