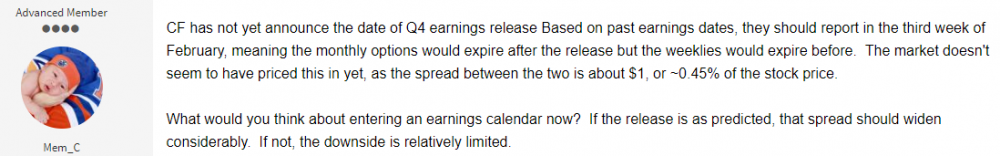

On January 27, one of our long term members posted the following post:

We booked nice gains ranging from 18% to 37% on CF pre-earnings calendars in the previous cycles, but this one was different. We usually don't bet on the earnings date (we did it once and got burned). But the risk/reward of the trade looked very favorable: if the earnings date will be on the second week of February, the spread should keep its value and probably produce 15-20% gain. But based on previous cycles, it was very likely that the earnings will be on the third week of February.

Based on this information, some members started building positions around 0.75-0.85:

I started scaling into the spreads last Thursday around $1.00-1.05 and officially, we had a full position by Friday close at cost base of 1.025 per spread.

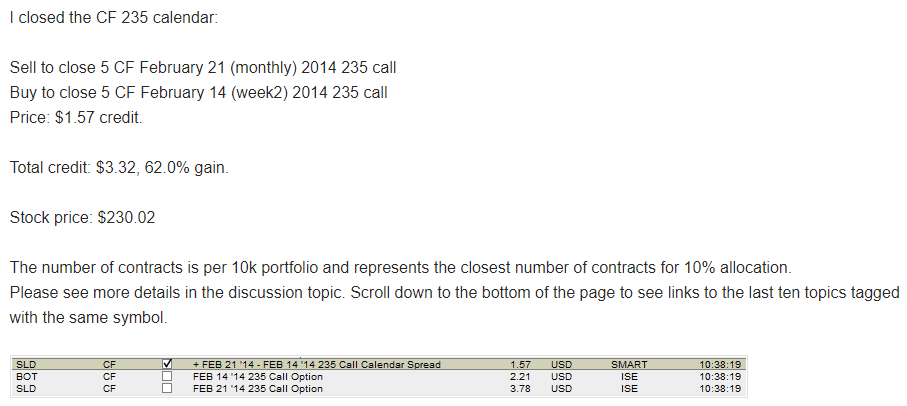

Sure enough, after the Friday close CF announced that they will be reporting earnings on February 18, the third week of February. On Monday, the week2 options IV decreased as expected since those options now expire before earnings, and the monthly options IV increased. We sold the spreads between $1.55-1.75, booking 62% gain in two days of holding, without taking any directional risk.

Some members did even better:

Again, what is especially remarkable about this trade idea is the fact that it came from one of our members, who took the time and the effort to follow and learn our strategies. In SO community, the learning never stops. I am extremely proud of our community that allows us to share ideas and find new opportunities every day.

There are no comments to display.

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.

Note: Your post will require moderator approval before it will be visible.