As most of our readers know, we trade non directional options strategies. That means that we don't care which direction the stock moves. Our strategies include mostly straddles, strangles and calendars around earnings.

This is how the process works:

- Every week I post a list of trading candidates for the next week in Earnings Trades Discussions forum.

- I post a separate topic for each candidate I think it suitable, with analysis of the suggested prices, average move, previous cycle etc.

- The topic will always include a link to one of the relevant strategy topics above. This allows members to do their homework and to see if they like the potential trade.

- I will try to get the trade at the best possible price.

- When I do, I post it under the Trades forum.

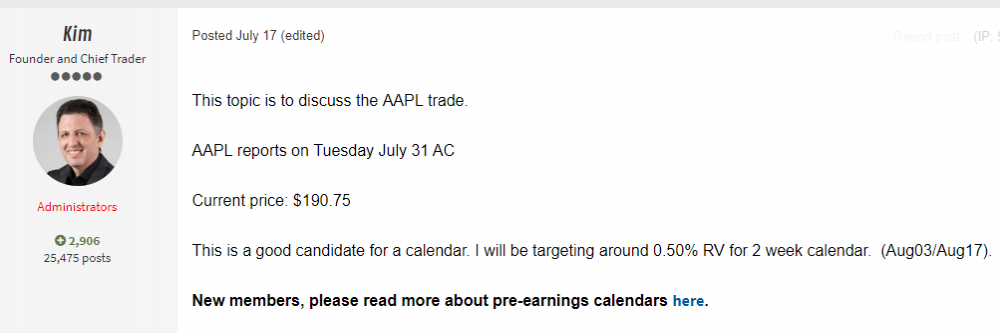

Apple was scheduled to report earnings on July 31. Two weeks before earnings, we noticed that AAPL pre earnings calendar looks cheap. A discussion topic has been opened (please note the discussion topic is always opened before the trade is placed):

This evaluation was based on proprietary software developed by one of our members. The software is designed to show the RV (Relative Value) of the strategies we trade in the last 8 cycles and compared them to the current cycle.

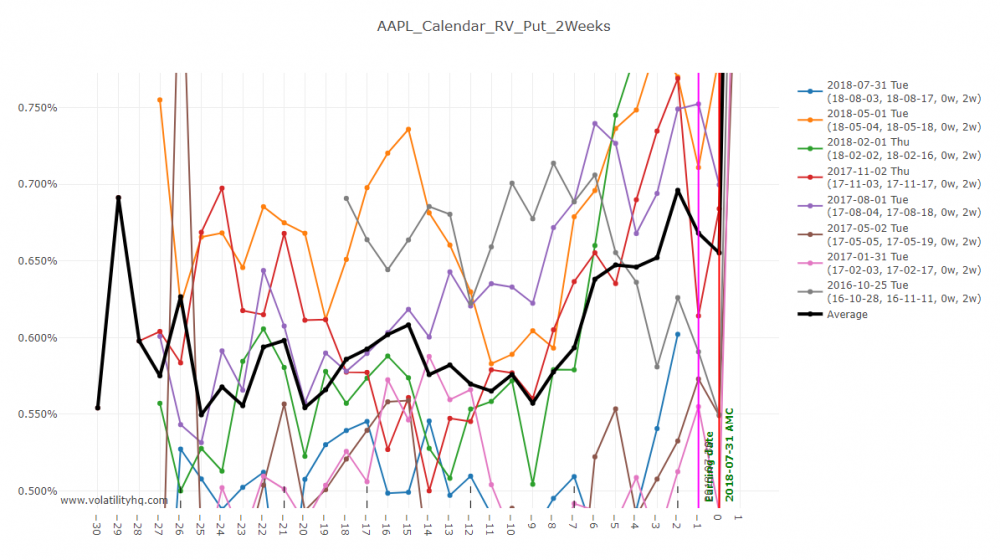

This is how it looked for AAPL:

The blue line is the RV in July 2017 cycle. The black line is the average of the previous 8 cycles. As you can see, the blue line was around 0.5% RV at T-10 (which is when the discussion topic was opened) while the black line had the potential to reach 0.65% RV or higher. That's 30%+ profit potential.

RV means "the price of the calendar as percentage of the stock price." With the stock price around $190, RV of 0.5% translates to $0.95 per spread.

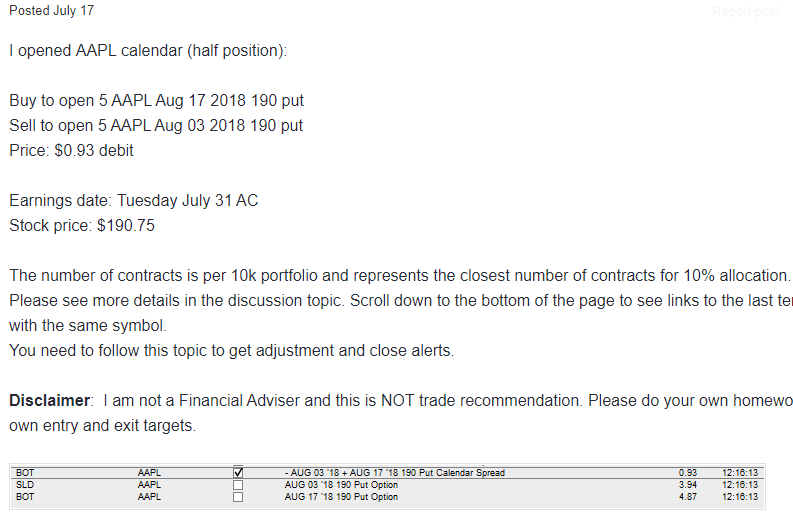

Based on the setup described in the discussion topic, the trade was opened later that day:

Please note that this was a half position (5 contracts, based on $10k model portfolio). We usually start with half position and open another half few days later.

Some members actually got better prices the same day:

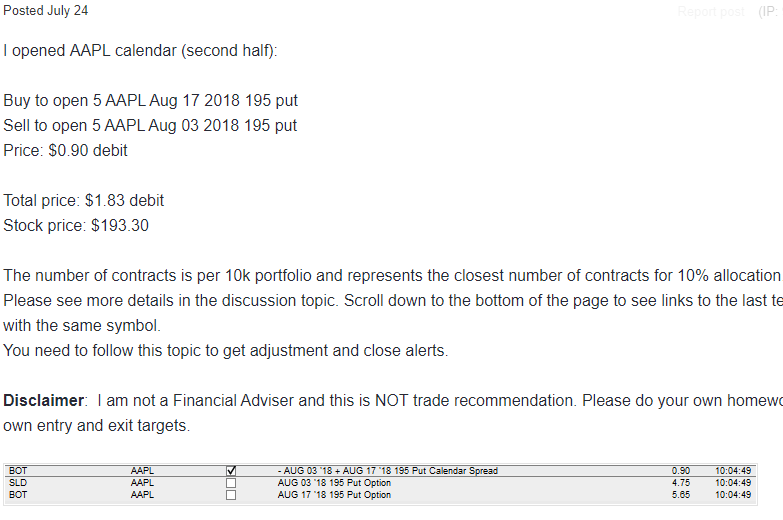

A week later when the stock moved to $193.30, we opened the second half of the trade:

It is interesting that some members opened the second half even before the "official" alert went out, at the same prices:

Those members follow our recommendation of "learn the strategies and make them your own". They are able now to be much more independent and act based on our discussion topics, without waiting for the "official" alerts.

On July 30 (one day before earnings) I closed the first half of the trade:

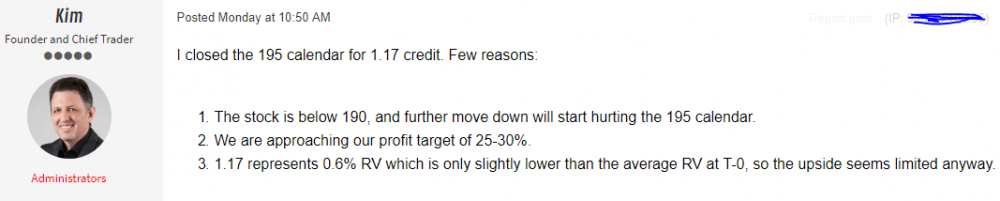

And explained the reasoning on the discussion topic:

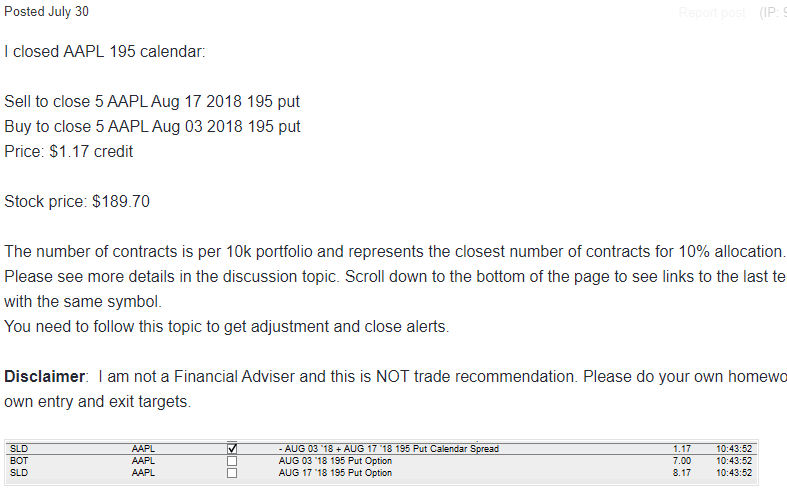

And few hours later closed the second half as well:

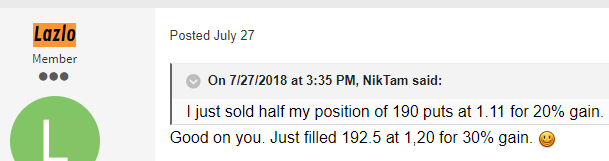

How other members did with this trade?

I hope this trade provided some insights into our trading process, community collaboration etc.

Some people ask us what is our "secret sauce". The answer is: there is no "secret sauce". There are NO secret strategies. It's just hard work, a lot of discipline, risk management and backtesting. This is our "secret sauce".

And of course in our case, it is an incredible value of our trading community.

Want to learn more? Start your Free Trial

Related articles:

There are no comments to display.

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.

Note: Your post will require moderator approval before it will be visible.