.thumb.jpg.b791bbd10700f03b6b00451fc850f7ad.jpg)

Unfortunately, there is a serious lack of understanding of these products by the general public.

SVXY is one such ETF, so today I’ll look at what it is, how it works and how it is priced.

WHAT IS SVXY?

SVXY is an ETF called ProShares Short VIX Short-Term Futures ETF.

As traders can’t directly buy or sell the VIX index, numerous exchange traded products have been developed since the financial crisis as a way to hedge market volatility.

Some, such as VXX have been “on a hell ride to zero”.

SVXY has not had the same issue, but is has suffered dramatic falls during time of market volatility.

As the name suggests (Short VIX), this ETF is short volatility, so will generally gain in value when volatility falls and drop when volatility rises.

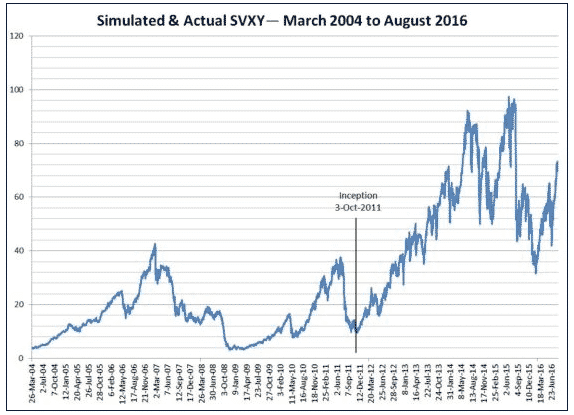

In the below chart, you can see that SVXY has generally been grinding higher during the bull market, but has experienced some precipitous falls at times.

SVXY started trading on October 3rd, 2011 at a price around $10. With the ETF currently at $97.88, the ETF has had an 879% gain since inception.

Even though the ETF is up big, it has experienced some big drops, such as -42% in 3 days in August 2015.

HOW DOES SVXY TRADE?

SVXY trades just like a stock, it can be bought, sold and even short sold whenever the market is open including pre-market and after-market trading periods.

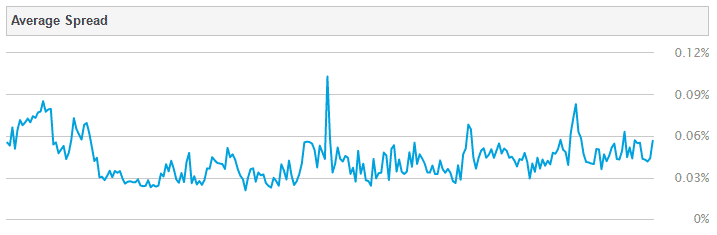

Average daily volume is currently 4.5 million and the average bid / ask spread is around 0.05%, so it is very liquid.

Image Credit: ETF.com

SVXY has options available to be traded with a wide array of strikes.

Option spreads are similar to what you would find in RUT, maybe a little wider.

HOW DOES SVXY WORK? (PRICING), WHAT DOES IT TRACK

The value of SVXY is designed to return the inverse of the daily return of the most popular volatility ETF – VXX.

VXX started trading on January 30th, 2009. On a split adjusted basis, it has fallen from 26,763 to 23.82 for a return of -99.91%.

Taking the most recent trading day as an example (December 26th, 2016), VXX was -1.57% and SVXY was -1.35%.

So, the relationship isn’t perfect due to the nature of the products and also the expense ratios. VXX has an expense ratio of 0.89% and SVXY’s is 0.95%.

To understand how the price of SVXY will move, it is essential to understand how VXX is priced. I wrote a little about that here.

This article on Seeking Alpha also explains it well:

Quote

VXX invests in a combination of the two front month VIX futures.

VXX keeps exposure of one month in the two front month futures on the VIX. It will invest in the combination of the two forward month futures such that its weighted average exposure is a month. This is how it works.

Today was the expiration of the July VIX futures, so as of end of day today the VXX ETF is fully invested in the August futures. Over the next 5 weeks it will sell a portion of its August futures every day and buy September futures on VIX, to maintain the one month average exposure.

Since September futures are currently trading at around 7% higher than the August futures, each time it does this it will lose a little bit of money, known as the roll yield (loss).

In addition, the August futures is currently about 12% higher than the spot VIX, so that will erode as well, as it must match spot VIX on expiration.

Therefore, as a general rule, VXX is going to decay over time and SVXY is going to rise.

However, traders should not automatically assume going long SVXY and / or short VXX is a guaranteed way to make money. Sure, that trade has worked for the last few years, during a bull market, but it has experience sharp declines. The trade would also get hammered in a bear market.

The reality is, if a trader was long SVXY and it dropped 75%, would they be able to continue to hold it assuming that it would to go over the long run? Maybe if you had $500 invested in it. But, what if you had $50,000 invested in it?

SVXY HISTORICAL DATA AND PRICING MODEL

When researching for this article I found a great spreadsheet that contains historical data for the maybe volatility products (VXX, VIXY, XIV, SVXY, UVXY, TVIX).

The following chart also shows the performance of SVXY since inception, but also the backdated performance based on model data.

Image Credit: Six Figure Investing

You can see that during the financial crisis, SVXY dropped 92.5%. So simply going long SVXY is not a valid investment strategy.

LONG SVXY OR SHORT VXX?

Trading long SVXY or short VXX has the same underlying thesis. The trader is betting on a fall in volatility.

SVXY can only go to $0.

VXX can theoretically go to infinity.

Profits can be made more quickly in VXX which is perhaps why some traders prefer it.

In terms of risk, it is more prudent to go long SVXY rather than short VXX, but both trades can suffer potentially devastating drawdowns.

Here is a great quote from Vance Harwood – “It’s interesting that an investment structurally a winner albeit with occasional setbacks is not as popular as a fund like VXX that’s structurally a loser, but holds out the promise of an occasional big win. It seems that people would rather bet on a correction, rather than the slow grind of contango.”

Seems like the casino mentality is alive and well in the stock market where traders are aiming for that big win, but are generally disappointed.

Gavin McMaster has a Masters in Applied Finance and Investment. He specializes in income trading using options, is very conservative in his style and believes patience in waiting for the best setups is the key to successful trading. He likes to focus on short volatility strategies. Gavin has written 5 books on options trading, 3 of which were bestsellers. He launched Options Trading IQ in 2010 to teach people how to trade options and eliminate all the Bullsh*t that’s out there. You can follow Gavin on Twitter. The original article can be found here.

There are no comments to display.

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.

Note: Your post will require moderator approval before it will be visible.