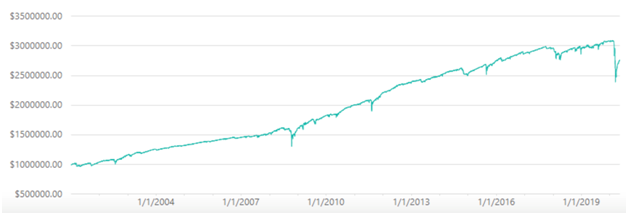

Thanks to the help of a Steady Options member who deserves the credit for co-creating a web based backtesting tool with me, I can quickly test varying short strangle techniques on SPX options from 2001 to May 2020.

Management at 50% credit

My first test will use the aforementioned parameters. Specifically:

- Symbol: SPX

- Time Period: 2001-May 2020

- Strategy: 16 Delta Short Strangle, excess returns only

- Entries: Expiration closest to 45 DTE

- Exits: At least 50% of the credit received or a 21 DTE time stop, whichever occurs first

- Slippage and Commissions: None

- Position Sizing Rule: 1x notional compounded growth of $1 million

- Trade reentry: Next trade entered immediately after closing current trade

- Data frequency: End of day

Results…

- CAGR: 4.44%

- Annualized Volatility: 8.62%

- Sharpe Ratio: 0.52

No management

My second test will use more conventional parameters. I’ll list only variables that differ:

- Entries: Expiration closest to 30 DTE

- Exits: 5 DTE time stop

Results…

- CAGR: 5.46%

- Annualized Volatility: 8.19%

- Sharpe Ratio: 0.67

The results favor the second approach in this sample period, which is passively managed with just an entry and DTE exit. Note that holding until expiration produces similar relative performance results from additional tests I’ve completed using ORATS. So why do many option educators confidently promote active management as a source of additional expected return? The devil seems to be in the data, as the results from my backtesting differs from that which I’ve seen in the articles and videos from others. Do your own homework and form your own opinions, as option backtesting is time consuming, expensive, and difficult to replicate the results of others due to the number of variables involved.

Slightly Bullish

I do find that setting up a short strangle with a modest long bias improves results, which is also counter to what many suggest by recommending either a delta neutral or slightly short delta trade launch. Although a short delta setup “leans into the pain” of a short vega trade, it ignores the equity risk premium (upward drift of equity market prices over time). A slight long bias adjusts for this well documented factor. We can see this in my final test where all variables are held constant as in test number two with the exception of increasing the short put delta from 16 to 25.

Strategy:

- 25/16 Delta Short Strangle

Results…

- CAGR: 6.30%

- Annualized Volatility: 9.93%

- Sharpe Ratio: 0.63

Conclusion

Short strangles on the S&P 500 appear to have been a winning trade for decades. They experience occasional large drawdowns, which would be expected from a strategy that resembles an insurance like risk profile. To continue your own strangle trading research, CBOE has a direct link to an excellent paper from Parametric that I recommend for further reading, “Volatility Risk Premium and Financial Distress”. The author of the paper concludes “The conclusion of the study is unambiguous. Investors may benefit significantly by taking advantage of the Volatility Risk Premium at all times.”

A key consideration to any trade strategy is the fundamental rationale for why a strategy naturally has a positive expected return. If it requires skillful active management of when to get in and out, I’d advise caution as it’s difficult to differentiate luck from skill in financial markets. Like passively owning index funds, market participants efficiently set option prices in a manner that creates positive expected returns for strangle sellers, and it’s unclear whether active management adds or subtracts from expected returns.

Jesse Blom is a licensed investment advisor and Vice President of Lorintine Capital, LP. He provides investment advice to clients all over the United States and around the world. Jesse has been in financial services since 2008 and is a CERTIFIED FINANCIAL PLANNER™ professional. Working with a CFP® professional represents the highest standard of financial planning advice. Jesse has a Bachelor of Science in Finance from Oral Roberts University.

Related articles

- Selling Naked Strangles: The Math

- Selling Short Strangles And Straddles - Does It Work?

- Building a Short Strangles Portfolio

- Bullish Short Strangles

- Iron Condors or Short Strangles?

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.

Note: Your post will require moderator approval before it will be visible.