BTC/USD has broken above the $8,250 level escaping the long-term bearish channel that had governed its movements since early 2018.

Its teammates on the crypto podium have followed King Bitcoin up, but with worse performances. This characteristic of the rise means that the second condition that I pointed out in a previous article is not fulfilled.

Let us review the requirements. The first was that BTC/USD exceeds $8,250. The second condition is that the ETH/BTC crypto cross goes into bullish mode, and that has not been accomplished yet. However, it may change in the next few days.

ETH/BTC 4 Hours Chart

The ETH/BTC is trading at the 0.03067 level, moving between the EMA50 and the SMA100. Trading between mobile lines generates sudden short travel movements.

Above the current price, the first resistance level is at 0.0312 (upper parallel bullish trend line and EMA50), then the second resistance level awaits at 0.03161 (price congestion resistance). The third resistance level for ETH/BTC is at 0.0332 (upper parallel bullish trend line and price congestion resistance).

Below the current price, the first support level is at 0.0301 (SMA100, price congestion support, and SMA200), then the second support level is 0.0298 (price congestion support). The third support level for ETH/BTC awaits at 0.0275 (price congestion support).

The MACD on the four-hour chart shows a slightly bearish profile, although it can easily turn up and quickly enter the positive zone of the indicator. This is a misleading profile at the time of analysis.

The DMI on the four-hour chart shows bears controlling the asset but with a downward profile. Bulls lose the ADX support, potentially complicating bullish development.

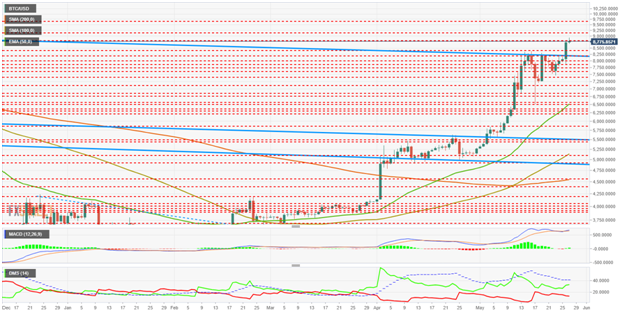

BTC/USD Daily Chart

BTC/USD is currently trading at $8,777 after hitting a relative high of $8.944. The Japanese daily candlestick chart is currently drawing a doji that jeopardizes the technical conquest if it ends the session with this figure.

Above the current price, the first resistance level is at $8,780 (price congestion resistance), then the second resistance level is at $9,160(price congestion resistance). The third resistance level for the BTC/USD pair is at $9,700 (price congestion resistance).

Below the current price, the first support level is at $8,400 (price congestion support), then the second support level is at $8,250 (price congestion support and upper trend line of the long term down channel). The third level of support is back into the bear channel at $8,000 (price congestion support).

The MACD on the daily chart shows how after a bearish cross attempt, it bounced back and now takes advantage of the momentum to break out of the past bearish scenario. The next two days will mark the medium-term scenario.

The DMI in the daily chart shows the bulls increasing the advantage against the bears but still far from surpassing the ADX line that would start a new bullish pattern.

ETH/USD Daily Chart

The ETH/USD is currently trading at $268.16 after yesterday's new high relative to the close. The next resistance level is further away at $290, and reaching it requires accumulating bullish strength.

Above the current price, the first resistance level is at $290 (price congestion resistance), then the second resistance level is at $305(price congestion resistance). The third resistance level for ETH/USD is $318 (price congestion resistance).

Below the current price, the first support level is $260 (price congestion support), then the second support level is $250 (price congestion support). The third level of support for ETH/USD is at $234(price congestion support).

The MACD on the daily chart shows a bullish rebound after the first bearish cross attempt. It is not a very solid structure, so if it continues to rise, it will be in an overbought scenario.

The DMI on the daily chart shows how bulls keep control of the situation and barely celebrate the new relative high. The bears, on the other hand, weaken and remain at the lows.

XRP/USD Daily Chart

XRP/USD is currently trading at the $0.41 price level after sitting a daily high at $0.42. At this hour it loses support for price congestion at$0.412 and hints at a possible downward turning Japanese candle figure.

Above the current price, the first resistance level is $0.412 (price congestion resistance), then the second resistance level is $0.43(price congestion resistance). The third resistance level for the XRP/USD pair is $0.438 (price congestion resistance).

Below the current price, the first support level is $0.39 (price congestion support), then the second support level is $0.37 (price congestion support). The third support level for the XRP/USD pair is $0.35 (EMA50).

The MACD on the daily chart shows a small upward bounce after the first bearish cross attempt. As in the other cases, it may continue to rise, but in an overbought environment.

The DMI on the daily chart shows the bulls reacting up and moving very close to the ADX line. If the D+ were above the ADX, we could easily see a bullish explosion. The bears continue to show weakness.

This is a guest post from FXStreet, a leading provider of data, real time analysis and actionable tools for Forex traders.

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account. It's easy and free!

Register a new account

Sign in

Already have an account? Sign in here.

Sign In Now