This is exactly what's happening to Bitcoin's prices. Investors are expecting that Bitcoin's prices will shoot up, and the only reason why the cryptocurrency costs thousands of dollars today is because people think it's valuable.

However, despite the many controversies and naysayers that are against Bitcoin, one thing that's undeniably happening is that investors are getting more options for exposure to it. The cryptocurrency is helping the market evolve by changing the way people can speculate and hold cryptocurrencies.

Options

For one, it’s now possible to trade Bitcoin options. Although, trading Bitcoin options are not for the faint-hearted as they are expensive and as volatile as Bitcoin.

Bitcoin options are just like any other options where investors pay a mark up for the right to buy or sell a fixed amount of Bitcoins on an agreed timeline. Currently, they are pricey because of "implied volatility". As the sentiment towards implied volatility goes up, so will the prices of the options.

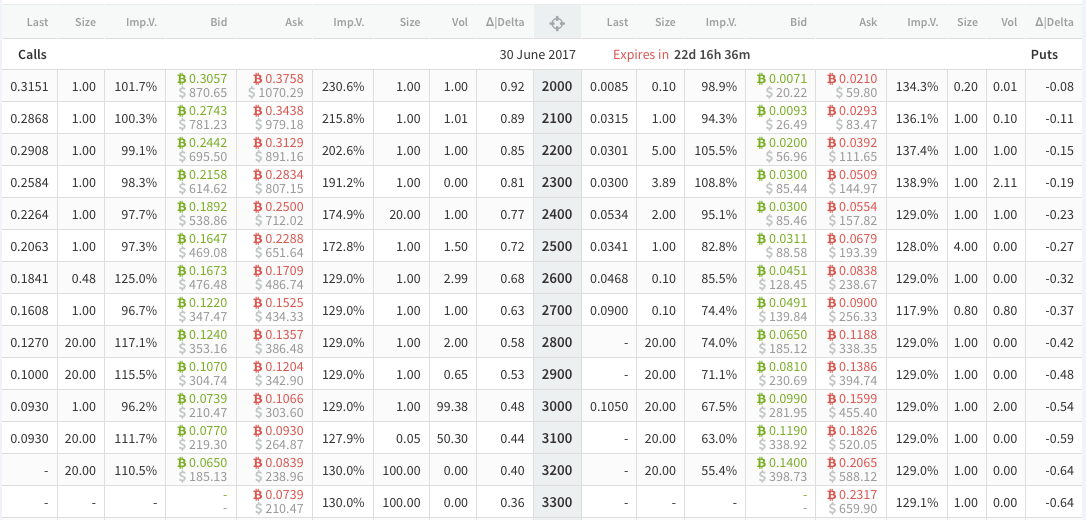

Investopedia provided a good example of Bitcoin options with high implied volatility. Based on the graph, a June 30 expiry shows a high implied volatility that varies from 90% to 200%.

The demand for options has allowed Bitcoin to help the financial markets evolve, especially when the Chicago Mercantile Exchange (CME) announced its plan to launch Bitcoin futures in the last quarter of 2017. The increase in client interest in the evolving cryptocurrency industry led CME to introduce Bitcoin futures contracts.

The number of investment vehicles that tap into the potential of Bitcoin is predicted to expand as the popularity of the cryptocurrency industry rises. Although being new to the investment world, Bitcoin options trading is now available in multiple countries.

Bitcoin ATMs

Bitcoin ATMs can now be accessed throughout the world. Bitcoin ATMs are being introduced in low-income areas, as well as places where banks are limited. Coinwire states that in the state of Detroit, there are about 30 ATMs, with more being strategically placed on the outskirts of Metro Detroit. Highland Park, Hamtramck, Pontiac, and Taylor are some of the low-income areas in Michigan where Bitcoin ATMs are being installed.

There are no clear connections whether or not Bitcoin ATMs affected the cryptocurrency's spot prices, although it gave operators the opportunity to use a different financial model. CBS News specified that Bitcoin ATMs charge a percentage fee, as opposed to a flat fee in regular ATMs. Currently, Bitcoin ATMs collect a fee of about 9%, and if these machines become popular and widely accepted, its effect on the future of the cryptocurrency market is predicted to be massive. As more people feel comfortable with the conveniences that the machines offer, the more popular Bitcoin will become in terms of everyday use and merchant adoption.

Blockchain Technology

Despite Bitcoin's naysayers, blockchain – the framework that powers Bitcoin transactions – is one of the driving factors fueling the cryptocurrency industry's success. Some major organizations including IBM, Walmart, and Starbucks, all of which have no Bitcoin holdings, believe in blockchain's potential to improve payment systems and operations for merchants. With backing from globally recognized brands, the blockchain framework will continuously play a key part in Bitcoin's future success.

In fact, the mere mention of the word blockchain opens doors to both fledgling and existing companies. Riot Blockchain Inc. saw a 20% increase in stock prices when it changed its name and dedicated its operations to blockchain research. Initial Coin Offerings (ICOs) that also dedicate their operations to blockchain's improvement are finding it easy to get funding from companies that believe in blockchain's potential to change the landscape of online financial payment systems.

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.

Note: Your post will require moderator approval before it will be visible.