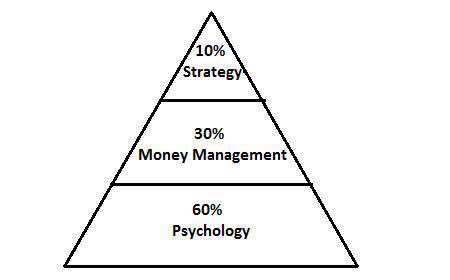

- 10% Trading System

- 30% Money Management

- 60% Psychology

Many years later, Tharp admitted that they were wrong. Now he thinks that Psychology accounts for 100% in trading success.

We can argue about the exact percentage, but there is no doubt that options trading psychology plays HUGE role in trading success.

If you still have doubts about the role of Psychology in trading, consider this:

Recent study by DALBAR shows that investors consistently underperform the broad markets by significant margins. For the 30 years ending 12/31/2013 the S&P 500 Index averaged 11.11% a year. A pretty attractive historical return. The average equity fund investor earned a market return of only 3.69%. What other explanation can you give to this huge difference if not Human Psychology?

I just finished reading Van Tharp latest book Trading Beyond the Matrix. This was fourth Tharp's book that I have read (after Super Trader, Safe Strategies for Financial Freedom and Trade Your Way to Financial Freedom. Honestly, I have a hard time to decide which one is the best - they are all excellent and worth reading.

Here are some extracts from Trading Beyond the Matrix. Every word is gold.

"Trading is not easy to do, but becoming a trader is easy. There are no obstacles whatsoever to anyone opening a trading account. I’ve said for a long time that if trading were easy, Big Money would monopolize it. They’d do so by making the entry requirements so steep that it would be impossible for an average person to trade, perhaps through an education and exam system that would weed out most people. If you want to know Big Money’s rule, just watch the financial media for a week or so. They’ll imply that:

- Selecting the right investment (i.e., picking the right stock) is everything.

- When you find the right investment, buy it and hold it for the long term.

- You must spend a lot of time analyzing the market to find the right investment.

- You should listen to experts for advice, including newsletter writers, brokers, and investment gurus on television.

My experience indicates that those old rules are what cause most people to be net losers in the markets. Through my modeling work with top traders and investors, looking at what they do and how they think, I’ve come up with a new set of rules."

We call these rules Tharp Think. Let’s look at these rules. First, you must understand that trading profitably and consistently is not easy. Sure, you can go into a brokerage company and open an account; that part is certainly pretty easy. As the e-trade baby says, “See, I just bought stock.” And the industry wants you to think it really is that easy—that even a baby can do it with the right trading platform. Can you imagine being allowed to perform open-heart surgery simply by strolling into an operating room and declaring that you want to do so? Of course not. It doesn’t work that way. Similarly, can you imagine building a bridge just by reading a book and then being put in charge of a construction team? Or, worse yet, giving a few orders to the construction team and then going along on your merry way? Again, it doesn’t work that way. Big Money wants you to think otherwise. They want you to believe that you need only turn on some financial program and listen to the stock picks."

So what are Tharp Think rules?

The first new rule is that trading is as much a profession as any other. It takes significant time (several years) and a deep commitment to become a successful trader.

The second new rule is that trading reflects human performance just as much as any top athletic endeavor. You must understand that you are responsible for the results you get. Thus, you should devote significant time to working on yourself in order to be successful.

The third new rule is that objectives are important. Furthermore, you achieve your objectives through position sizing strategies. The quality of your system just tells you how easy it will be to use position sizing strategies to achieve your objectives. Most people don’t even think about objectives, except that they’d like to make a lot of money and avoid losing, and they don’t have a clue about position sizing strategies. They learn that asset allocation is important, but they never understand that what makes it so important is the “how much” factor, which is what position sizing strategies are all about.

Dr. Tharp is also talking about the importance of taking responsibility for your results. In other words, if you decide to trade based on newsletter recommendations, and lose money, it is your fault, not the newsletter’s fault. You chose the newsletter, and you chose to invest based on its recommendations. You decided to trust the newsletter’s published results, showing they won 75 percent of the time. You decided not to paper-trade the recommendations for six months to confirm the results before starting to trade real money. You didn’t stop to find at least one independent source who had confirmed the newsletter’s track record before trading. You, you, you!

If you want to become a better trader, I would highly recommend reading Van Tharp's books.

Related Articles:

Are You EMOTIONALLY Ready To Lose?

Why Retail Investors Lose Money In The Stock Market

Are You Ready For The Learning Curve?

Can you double your account every six months?

There are no comments to display.

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.

Note: Your post will require moderator approval before it will be visible.