Low to Medium Risk Trade?

One of the options trading sites trades a strategy called "The Spy Debit Butterfly". This is how they describe it:

"How much value would you place on a simple strategy that has a near 100% win rate each year, since its start in 2013!? Risk Level - low to medium. This most amazing trade makes use of a debit butterfly, using it to trade the SPY. We set the butterfly up in such a way that whether the SPY goes up or down, the butterfly increases in value. On Fridays, the SPY trades in such a way that at some point during the day it moves to a range that allows us to exit the play at our profit target."

What they "forget" to mention is the fact that if SPY gaps (up or down) on Friday morning, and doesn't reverse, the trade can lose 100%, and there is nothing you can do about it. This is exactly what happened on Friday Sep.9, 2016. After trading in a tight range for weeks, SPY took a volatile dive, and the trade has lost 100%. In my books, a trade that can lose 100% and you cannot implement any stop losses to prevent it, is definitely not low to medium risk.

This is what they had to say after the 100% loss:

"This week's SPY Debit Butterfly trade left us shaking our heads wondering why the market chose Friday, after trading in a thin range for weeks, to take a major dip. Out of nowhere, the market collapsed on Friday, and the timing of this drop in relation to our trade is very uncanny indeed.

The market has been hovering in a pretty narrow range for quite a while and it was only a matter of time before it decided which way to go, and move in that direction as a breakout. Unfortunately for us, it happened on Friday, when we had a play going. After we entered the play on Thursday it closed up nicely, and all we wanted was one more day of only a small change. I didn’t see much news to account for the huge move down, and it just goes back to my negative thoughts about the market being rigged. There is no sense to what has been happening."

All they wanted was one more day of only a small change... The market is rigged... Well, unfortunately for them, the markets don't really care what they wanted. The markets have their own mind. They don't know that you have placed this trade on Thursday and need one more day of only a small change. Blaming the market for your failures is the easiest thing to do, but it won't help you to become a better trader.

If you are not a member yet, you can join our forum discussions for answers to all your options questions.

The victim trader – how to set yourself up for failure

It was just a coincidence that at the same time when this 100% loss happened, Steve Burns from New Trader U shared on Twitter this guest post from Rolf at Tradeciety.com. Rolf explains how some traders blame the markets for their failures:

"Traders who look for excuses and outside circumstances to blame are adopting a dangerous mindset. If you believe that you are engaging in an activity where manipulation takes place and that other participants are taking advantage of you, making the right trading decisions becomes impossible.

If you are constantly expecting to be cheated or that the traders on the other site of your position will win anyways, you can’t perform at your highest level."

Take responsibility for your actions

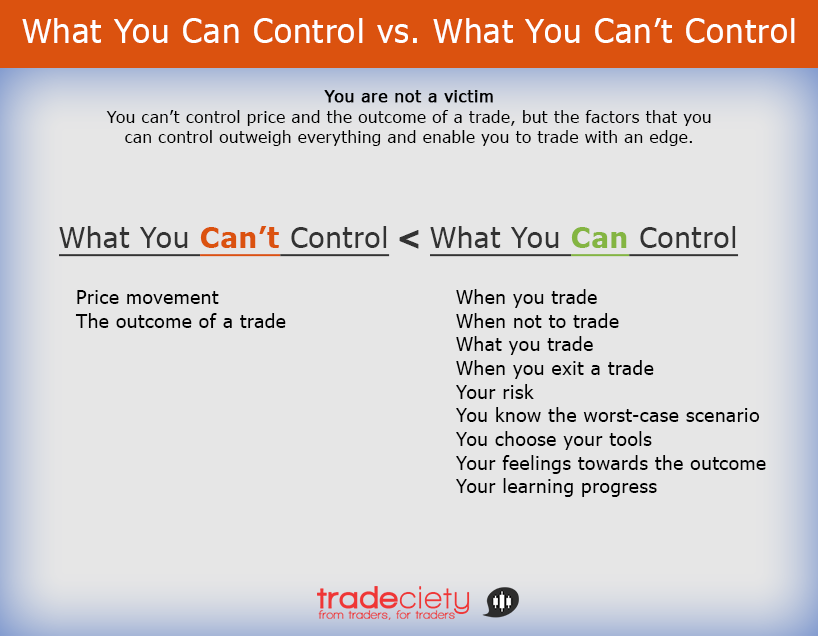

"Only when you can accept responsibility for your actions and decisions, will you become a better and profitable trader. You always have complete control over your trading; you decide when to trade and when not to trade, you control your risk and the worst case scenario, you can exit unprofitable trades and limit losses, and you are the one responsible if you make an impulsive mistake. You are the only one who adds to losses, widens stops, or exits profitable trades too early.

If you operate with a victim-mindset, you are unable to take responsibility for your failures and you won’t see the necessity of looking for ways to improve. The victim trader just changes from one method to the next, hoping to get lucky and find something that works quickly. Only a responsible trader will look for patterns in their trading and find ways to turn failures into successes. A responsible trader doesn’t change systems, but looks for ways to make their current system work."

The following points describe the responsible trader:

- Focus on solutions and not on problems

- Stop blaming others and outside circumstances

- Focus on the things you can control

- Actively work on the things you can change

- Stop using excuses

- Understand that you can’t control the outcome

- Accept that your trading method will not work all the time

This was probably one of the best articles I have read in a while. I highly recommend following both @Tradeciety and @SJosephBurns for great trading insights.

Those points connect to some of Tharp Think rules about the importance of taking responsibility for your results. For example, if you decide to trade based on newsletter recommendations, and lose money, it is your fault, not the newsletter’s fault. You chose the newsletter, and you chose to invest based on its recommendations. You decided to trust the newsletter’s published results, showing they won 75 percent of the time. You decided not to paper-trade the recommendations for six months to confirm the results before starting to trade real money. You didn’t stop to find at least one independent source who had confirmed the newsletter’s track record before trading. You, you, you!

Related Articles:

Are You EMOTIONALLY Ready To Lose?

Why Retail Investors Lose Money In The Stock Market

Are You Ready For The Learning Curve?

Can you double your account every six months?

Are You Following "Tharp Think" Rules?

If you want to become a better trader, I invite you to join our trading community.

There are no comments to display.

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.

Note: Your post will require moderator approval before it will be visible.