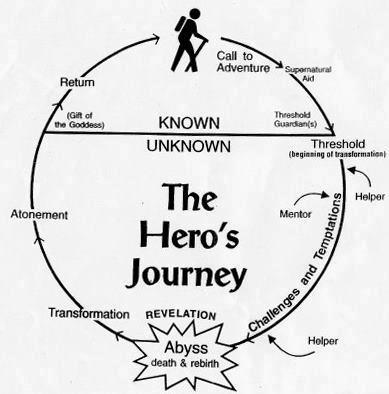

- We accumulate information, we learn- buying trading books, asking questions, maybe going to seminars and researching what really works in trading.

- We begin to trade with our ‘new’ found knowledge.

- We make profits only to give it back very quickly and then realize we may need more knowledge or information.

- We accumulate more information.

- We switch the stocks we are currently following and trading.

- We go back into the market and trade with our improved system. this time it will work.

- We lose even more money and begin to lose confidence that we can even be traders. The reality of losing money sets in.

- We start to listen to other traders and what works for them.

- We go back into the market and continue to lose more money.

- We completely switch our style and method.

- We search for more information.

- We go back into the market and start to see a little progress.

- We get ‘over-confident’ in a single trade and put on a big position believing it is a sure thing and the market quickly takes our money.

- We start to understand that trading successfully is going to take more time and more knowledge than we ever anticipated. MOST PEOPLE WILL GIVE UP AT THIS POINT, AS THEY REALIZE REAL WORK IS INVOLVED AND THAT THIS IS NOT EASY MONEY.

- We get serious and start concentrating on learning a ‘real’ methodology.

- We trade our methodology with some success, but realize that something is missing.

- We begin to understand the need for having rules to apply our methodology.

- We take a sabbatical from trading to develop and research our trading rules.

- We start trading again, this time with rules and find some success, but over all we still hesitate when we execute.

-

We add, subtract and modify rules as we see a need to be more proficient with our rules.

- We feel we are very close to crossing that threshold of successful trading.

- We start to take responsibility for our trading results as we understand that our success is based on our ability to execute our methodology.

- We continue to trade and become more proficient with our methodology and our rules.

- As we trade we still have a tendency to violate our rules and our results are still erratic.

- We know we are close.

- We go back and research our rules.

- We build the confidence in our rules and go back into the market and trade.

- Our trading results are getting better, but we are still hesitating in executing our rules.

- We now see the importance of following our rules as we see the results of our trades when we don’t follow the rules.

- We begin to see that our lack of success is within us (a lack of discipline in following the rules because of some kind of fear) and we begin to work on knowing ourselves better.

- We continue to trade and the market teaches us more and more about ourselves.

- We master our methodology and our trading rules.

- We begin to consistently make money.

- We get a little over-confident and the market humbles us.

- We continue to learn our lessons.

- We learn smaller positions lower the volume of our emotions so we trade smaller and this surprisingly makes us better with our discipline.

- We learn that risk management is one of the biggest keys to winning as a trader, we start to understand that big losses will make us unprofitable so we finally trade a smaller and consistent position size.

- We stop thinking and allow our rules to trade for us (trading becomes boring, but successful) and our trading account continues to grow as we increase our position size only as our account grows.

- We are making more money than we ever dreamed possible.

- We go on with our lives and accomplish many of the goals we had always dreamed of. Money is our new tool to do what we have always wanted.

There are no comments to display.

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.

Note: Your post will require moderator approval before it will be visible.