SteadyOptions is an options trading forum where you can find solutions from top options traders. Join Us!

We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

-

Posts

407 -

Joined

-

Last visited

Content Type

Profiles

SteadyOptions Trading Blog

Forums

Everything posted by ex3y7s

-

Thanks for the fast reply, and good to know! I thought perhaps there was a setting to chart the calculated mid like in IBKR.

-

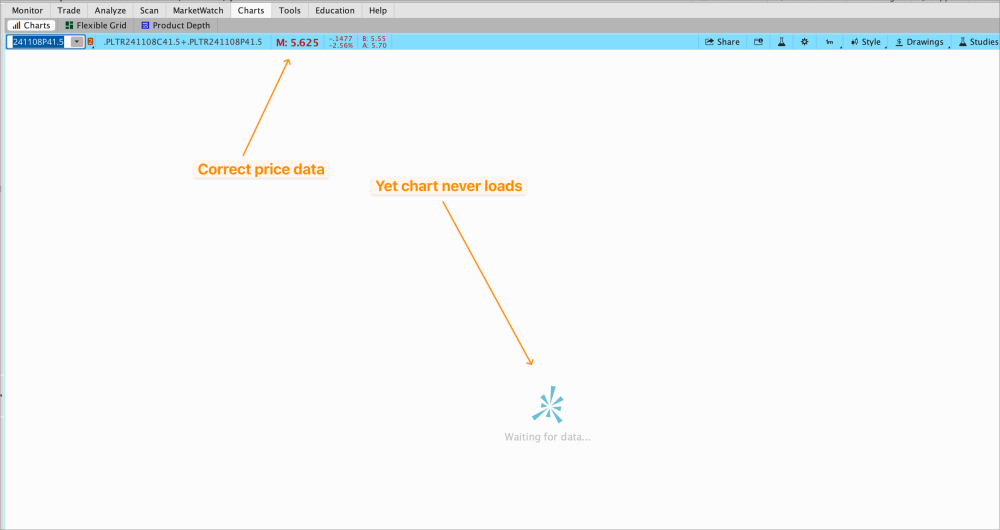

I know this has been covered before but the search and my search-fu leaves a lot to be desired. What's the magic to chart the midpoint of an options spread in TOS? I've added the symbol to a chart with what I believe to be the correct syntax, for example this PLTR straddle: .PLTR241108C41.5+.PLTR241108P41.5 The chart shows the mid and the bid/ask at the top in the data section, but doesn't actually display a chart: it just keeps spinning "Waiting for data...". Do I need to tweak a setting or does this functionality no longer work on TOS, or perhaps only work for certain spreads?

-

Thanks for updating—so it sounds like IB is correctly interpreting the rule, but for some reason their email is telling you about contracts (instead of orders) when that's totally irrelevant? Are you actually placing that many orders? It's strange/troubling that they would say "daily average of 373 contracts" because that's really not that much if you're daytrading options. It would not be the first time IB has (mis-)interpreted regulatory rules in a way that results in more restrictions for customers.

-

I’m confused by their wording—the 390 rule states “orders”, but they appear to be referring to your average daily number of contracts. Do you actually average that many discrete orders (eg algotrading), or is this a case of IB interpreting the rule in an erroneously strict fashion? In other words, if I place one order per day for 1000 contracts that should not trigger the rule; 391 orders for 1 contract each should. It is worth noting if you’re not actually filling that many orders but are constantly moving limit orders around (either using software or constantly dragging them around the price ladder) you may inadvertently be registering many “orders” if they are being cancelled/replaced or rerouted.

-

I use the API to place orders, and to track fills and executions. I would not use it for market data (it's too slow). I haven't investigated their streaming APIs; I've only used the poll-based ones. If you have a strategy that relies on fast market data, I would recommend paying for a real data connection.

-

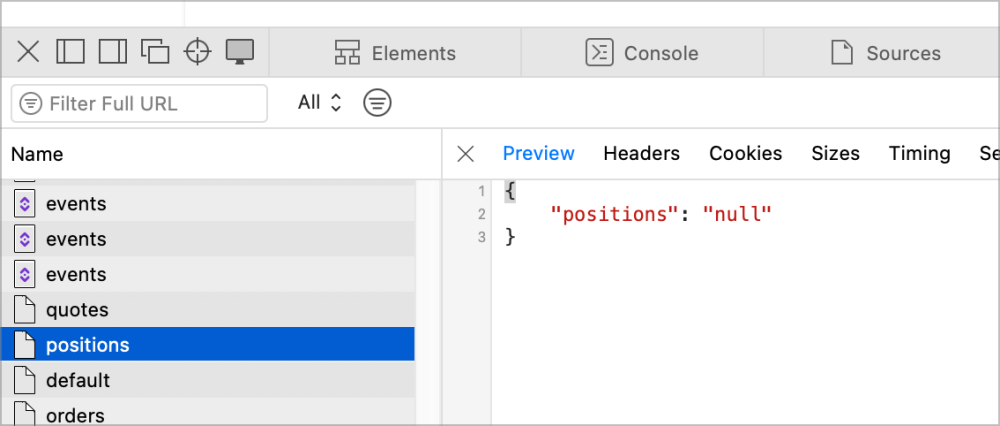

Yes, I've used it extensively. It works pretty well, although it has quirks around the JSON format (probably because they're using XML and some library that does a weird job converting it), so it will do things like return the literal string `"null"` and if you have one open order, return `"orders": {}` but if you have multiple that becomes an array, so just little inconsistencies like that. The documentation is adequate, not great. It is much less cumbersome and finicky than the IBKR TWS API.

-

They've been totally radio silent AFAICT on postmortem, causes, tech remediations, etc.. I'm definitely going to be downsizing my account with them (but will continue to use them for small but commission intensive trades).

-

Looks like they have backfilled the cost basis on current positions (but not the acquired date).

-

The irony if Tradier has to use their own order backend to liquidate clients' assigned positions and all the market orders get stuck in "Pending". 🤔😅

-

Every position has the same acquired date too if you look at the API which means they probably backfilled this from another data source that lacked both cost basis and acquisition date.

-

Depending on their client's positions that are assigned, what happens to them over the weekend, and their operating cash, this could easily bankrupt them. I wonder if brokerages have insurance underwriters for such issues. Yes you absolutely can sue them, but if they go under you are just one of tens of thousands of creditors. Not trying to create a panic as I obviously have no idea what Tradier's operating structure looks like but similar things absolutely have happened to brokerages causing them to go bankrupt and account holders became bag holders. Just another reason to keep your accounts small, distributed, and the largest ones with the most reputable firms. I would guess total catastrophe is unlikely, but I wouldn't expect any benevolence or generosity when it comes to settling assigned/expired positions.

-

IANAL, but the disclaimer on their website isn't super encouraging. Systems response and account access times may vary due to a variety of factors, including trading volumes, market conditions and system performance. Past performance is no guarantee of future returns. Use of these systems is at your own risk. Please visit Tradier Disclosures/Policies for a full list of policies and disclosures.

-

-

The rub with Public is that they don't allow many complex options strategies, so you wouldn't be able to use it for anything diagonal in nature (like DD's), and if you wanted to do an iron condor you'd have to leg in (not sure if they'd require separate margin for each side—I'd imagine so based on their software). I have an account with them but declined to fund it once I discovered their restrictions, so I can't comment on the execution.

-

I find a decent way to think about this is the cutoffs where saving a penny on the execution makes up for the extra commission. For example IBKR is 0.65/contract, so if we assume Tradier is 0.15 per contract, here's how much better of a fill you'd need to get on IB to make that up: Single option: 0.01 (would save you 0.50: 0.01 * 100 - 0.50) Two-leg: 0.01 (same cost) Four-leg: 0.02 (same cost) If you feel the fills are equivalent, you can save a significant amount using a discount broker, however if the fills are even slightly worse, the discount evaporates quickly. Personally, I use both Tradier and IBKR, tending toward IBKR for "weird" orders (like 3:2 ratios) and more expensive contracts like the double diagonals; I've found IBKR tends to make up more than the $0.02 on a $10 spread. On a $0.90 calendar, it does not. I agree with krisbee that Tradier's web interface is fine—their desktop app is hot garbage IMO and I'd rather use the website. Mobile app is also pretty bad and I tend to just use the website on mobile as well.

-

Right but there's no way to get a quick aggregate view right? Like "this cycle was 8 different strikes over the pictured time period".

- 1061 replies

-

- rv chart

- volatilityhq.com

-

(and 1 more)

Tagged with:

-

One thought is the charts could indicate somehow the number of different ATM strikes that each cycle comprises.

- 1061 replies

-

- rv chart

- volatilityhq.com

-

(and 1 more)

Tagged with:

-

I've been noticing issues with Tradier all morning. Orders getting rejected, stuck in "Pending" states, etc.. I did get a few orders filled so it's doing a little better than TOS.

-

Does anyone have experience with IB’s mobile app on iOS? I can’t figure out if there’s a quick way to add existing option positions to an order ticket (eg to roll) without having to view the full chain. It’s IB so I wouldn’t be surprised if it’s just not possible but figured I’d ask.

-

Thanks! It’s not a hard requirement as I have other data sources I can use; I was mostly wondering if folks are using a la carte subscriptions or the bundles. It wasn’t clear to me if the OPRA L1 covered all options exchanges or not.

-

What market data subscriptions are folks using to trade options on IB? I see both combo bundles and a la carte offerings, and it's not immediately clear to me exactly which I need. I would only be trading options; all my stock and futures trades are with different brokers.

-

This is a cool idea. Is the repo publicly available, or would you consider making it so? I'm an experienced software engineer but have only started dabbling in NN stuff lately by going through the amazing Karpathy videos. I'm sure I could learn a lot from seeing the code.

-

That's annoying--do you know how they handle long vertical spreads that are completely in the money at expiration? Will they also just close your shorts before the market closes, or will they do the right thing and exercise both to leave you flat (and with the max profit)?

-

Also a good point. SPY has dividends, so there is an assignment risk not to mention an attendant price gap after that dividend is paid.

-

This is an excellent idea. Do be aware, however, that SPX with a zero-commission broker is still likely to be cheaper than SPY with that same broker. Zero-commission SPY is definitely cheaper than commission + SPX exchange fee, though.