We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

cwerdna

Mem_C-

Posts

412 -

Joined

-

Last visited

-

Days Won

5

Content Type

Profiles

SteadyOptions Trading Blog

Forums

Everything posted by cwerdna

-

Trading and getting fills with Interactive Brokers

cwerdna replied to cwerdna's topic in General Board

FWIW, on the above (not wanting to take this too far OT), I encountered my 1st case of confusing negative pricing on TOS the other day, but not with IC or RIC (where TOS' behavior makes sense to me). It was involving a 1x2 put spread (buying a Dec 2012 14 put on something and selling two Dec 2012 7 puts). -

No, but unfortunately, I've been so far taking on pretty small positions on Steady Options trades and I've not had much luck in getting fills on many of the plays. I don't think I'll be able to meet even $30/month in commissions on IB for my 1st month. I'm not sure what other plays go on here after "earnings season" is over for the quarter, but I fear I may have trouble meeting that $30 once that happens. Prior to joining this forum, I did (and still do) sell naked way OTM puts (pretty low return, admittedly) on certain stocks that I wouldn't mind owning, using TOS. I do need to modify the orders fairly often. TOS doesn't have cancel/modify fees (unheard to me of until I found out about IB). That's strike 1 against IB. TOS also lets me close out short positions of a nickel or less for no commission. It helps reduce risk once I've taken profits and frees up buying power so I can move on. I don't think IB has that. So, that's strike 2. Most of my trades on TOS are the above, so, it seems like they're not a good idea on IB. This feeds back into not even being able to hit $30/month in commissions. So far, my commissions on IB haven't been outstanding vs. $1.25/contract on TOS. This isn't a weighted average, but this is what I've been paying per contract: RUT: 1.24 (IC that I got a bad fill on because of the IB's goofy negative values and what not) MS: 1.26 (bear put spread) MS: 1.06 (bear put spread) LNKD: 1.06 (bear put spread)

-

No, it's not. It's in the upper right of the screen, above the Setup button. it's the same vertical position as the Monitor, Trade, Analyze, etc. tabs.

- 17 replies

-

- backtesting

- thinkorswim

-

(and 1 more)

Tagged with:

-

Wow! You must either do a a lot of business w/them (more than me?) or have a lot of assets. If mine were $0.85, I'd probably stop trading options at the IB account I opened recently or close it. Some of IB's features like Stock Yield Enhancement (http://www.interactivebrokers.com/en/p.php?f=shortableStocks&p=stockYield-default) sound cool but I at that point wouldn't be doing enough business w/them in stock trading to even meet IB's minimums and thus have to pay for market data feeds.

-

Wow. I wasn't doing 1500 contracts/month and they lowered me from $2.95/contract (TOS rates I was grandfathered into) to $1.25. One of my friends was doing $500+/month in commissions w/TOS and he got it down that low. I was doing $700+/month in commissions. I do have a lot of assets (in the hundreds of thousands of $) w/them across my TOS account, old TD AM account and a TOS IRA account. I think listolyman is right. I think it'd be hard to argue for lower commissions if you haven't even been a customer w/them. I posted a more complete story at http://steadyoptions...tes/#entry5414.

-

You can use OnDemand (orange button in the upper right) in order to do intraday backtesting.

- 17 replies

-

- backtesting

- thinkorswim

-

(and 1 more)

Tagged with:

-

Trading and getting fills with Interactive Brokers

cwerdna replied to cwerdna's topic in General Board

Yeah, I found the Mosiac view to be really confusing and it seemed like many (most?) of the tutorials and documentation assumed you're using Advanced Order Management. I switched to AOM and am planning to stick with it. I don't know of anyone who's negotiated that low and how much activity or assets are needed. I don't know if it's possible. I got mine down to $1.25/contract at TOS. When I was paying $2.95/contract, I was doing $700+/month on average in commissions w/them YTD. I also have a LOT of assets at TD Ameritrade (between my TD AM account, my TOS regular account and my TOS IRA), so I think that helped. FWIW, I had 2 fills on spreads that weren't Steady Options plays on IB. They commissions came out to $1.26/contract and $1.06/contract, respectively. Interesting. Agreed. TOS' way is more natural. -

Trading and getting fills with Interactive Brokers

cwerdna replied to cwerdna's topic in General Board

Yep. :/ I agree completely w/your definitions. That's too bad to hear yet another instance of their customer service being bad. I'll have to re-read your interpretation of how IB works. I was playing around in one part of the IB software and I believe I clicked Reverse Positions (something like that) that should the buy/sell state of each of the legs and I think I saw a negative price and a debit indicator. I agree, it seems like bad software design. I'm not sure if I need to be as careful when closing profitable positions but I think I need to be super careful when placing any credit orders on IB, or not place them at all. Seems like IB needs to dump the minus signs and be more clear about debit vs. credit transactions. Providing a price slider like TOS does would help to avoid confusion. So far, I feel like I haven't been off to to a good start w/IB. Some of the screwy UI or things I miss from TOS might end up not being worth the commission savings vs. TOS. Making costly mistakes doesn't help. edit: While digging around, I think I found a semi-decent explanation of the positive/negative prices at http://www.interacti...ation_order.htm. Ugh! Why?!?! It's unnecessarily confusing. I'm going to need to put a printout of this in front of me. By infamous, I'm guessing many others have hit this and hit it for some time? I stumbled across some Australians at http://www.aussiesto...?t=12598&page=2 who also are confused by the +/- signs, from 2009. I'm guessing it's been this way for a long time (or since the beginning?) and IB has no interest in fixing it. Maybe they profit from erroneously placed trades? -

Trading and getting fills with Interactive Brokers

cwerdna replied to cwerdna's topic in General Board

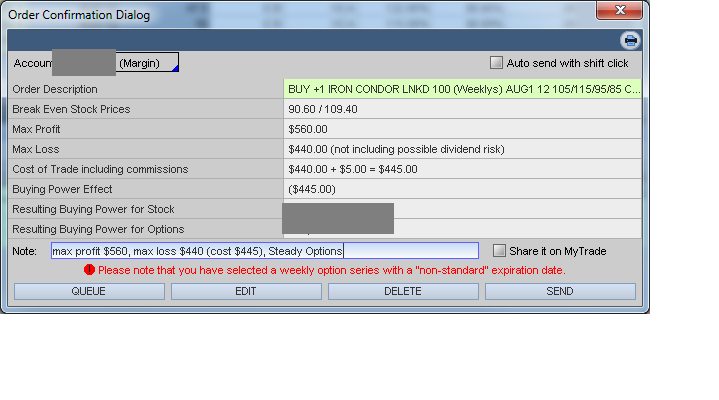

I think your guess as to what happened in my case is right. :/ Yeah, I knew about the hovering/tool tip. It still doesn't make the (+/-) sign and buy/sell terminology much less confusing. Thanks for the tip about about the combo tab. I'll have to play with it more and see if it resolves my sign confusion. It's not convenient as the Options Spreads > Strategy Tab, but it's better than Options Spreads > Pair or Leg-by-Leg. It looks like I can drag and drop the combos created from OptionTrader pages in TWS. Last question (for now), is there something similar to TOS' order confirmation page that shows the max profit, max loss and lets you enter order notes? See attached. Is there any way annotate orders with notes later? -

Trading and getting fills with Interactive Brokers

cwerdna replied to cwerdna's topic in General Board

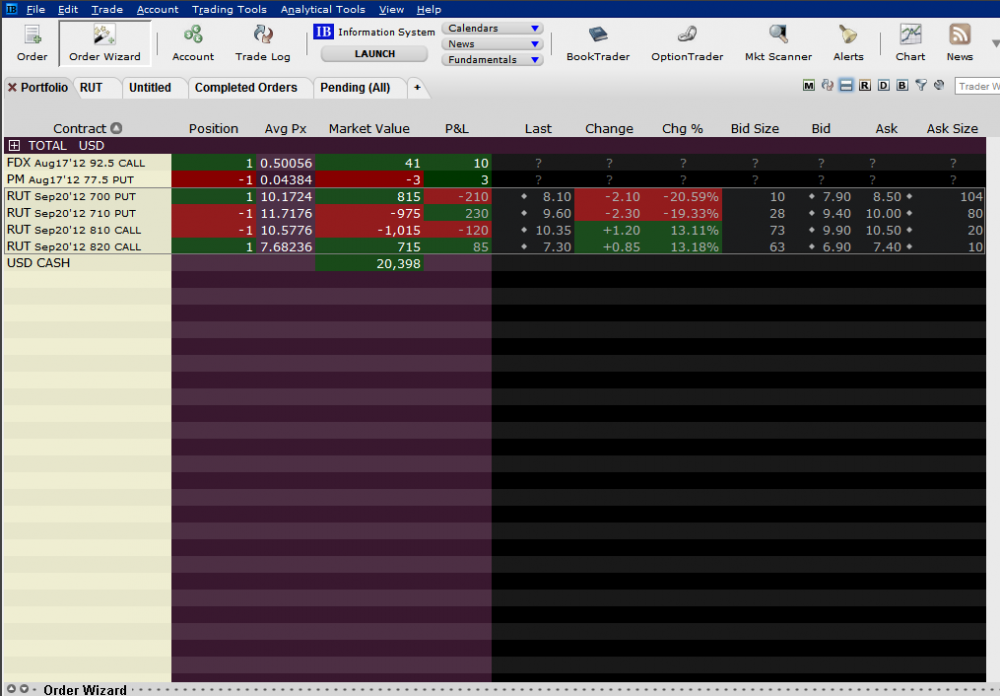

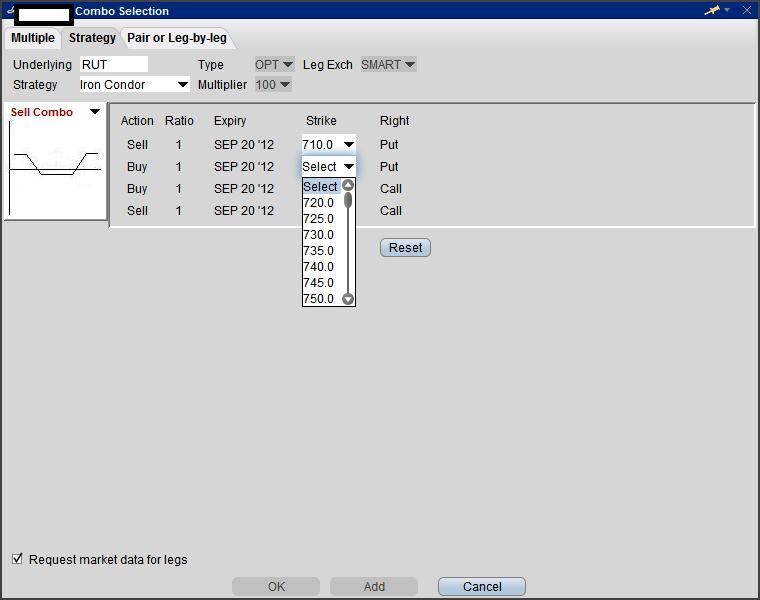

Are you talking about clicking on the + in TWS, then typing in a name, then Order Ref. OptTrader? Then, from there, put in underlying symbol on the left side and select Strategy > Combinations > Options Smart and then build it there? It looks like if I build a spread there, TWS actually remembers the combos instead of forgetting them after you exit the app. Yay! Is there any way to consolidate 4 existing legs on my Portfolio page into an IC that I can buy easily back to close? I created it originally in OptionTrader and transmitted from there. See attached for what I've got now. I tried copying and pasting into a new page but found no menu or context menu (right click) to consolidate or anything. Maybe I should try sending a tech support request to IB? Should I not bother using OptionTrader for spreads? -

Trading and getting fills with Interactive Brokers

cwerdna replied to cwerdna's topic in General Board

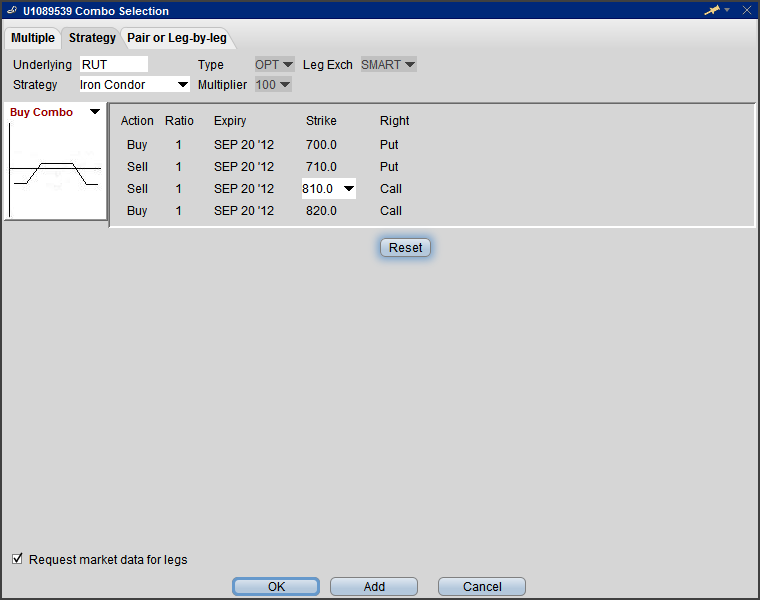

Is this under OptionTrader > Option Spreads button? If I do that, and select Strategy > Iron Condor > Buy Combo/Sell Combo, it seems if I have manually re-select expiry and strikes. I'm looking for something that lets me select what I've got and in one fell swoop lets me create a limit to close the spread. -

Trading and getting fills with Interactive Brokers

cwerdna replied to cwerdna's topic in General Board

Do I have to manually put in the legs one-by-one or should I click Options Spreads, select Iron Condor and reverse the buy/sell (selecting the appropriate expiry and strikes) or something else? I just can't find a way to multi-select the legs of the existing position. I feel like I'm missing something obvious. -

Trading and getting fills with Interactive Brokers

cwerdna replied to cwerdna's topic in General Board

On IB (using TWS), how the heck do you quickly put in a limit order to close a spread, e.g. the the IC on RUT that I have? I can't seem to multi-select legs by holding down the Shift key and clicking the legs on OptionTrader > Portfolio. If I right click Trade > Close All Positions it gives me a warning "Are you sure you want to close all positions? Note: orders will be transmitted instantaneously. Yes/No" It sounds like that will just close them out via a market order. I couldn't find a quick way like I can on TOS. Am I missing something obvious? -

Trading and getting fills with Interactive Brokers

cwerdna replied to cwerdna's topic in General Board

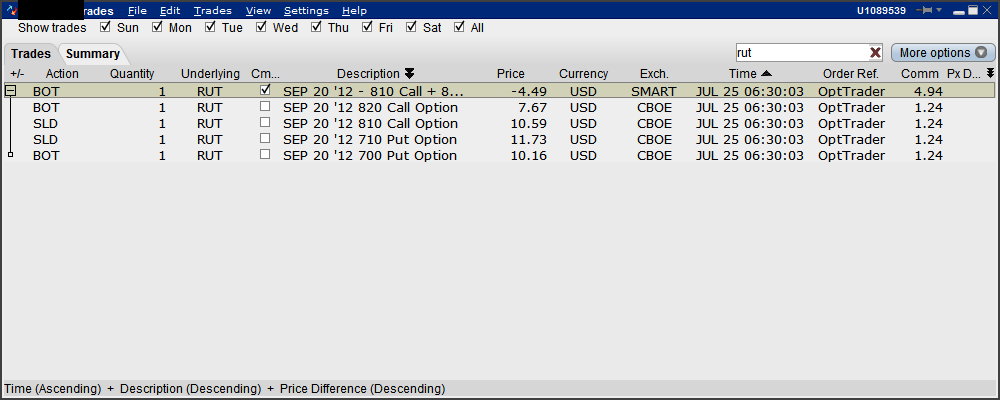

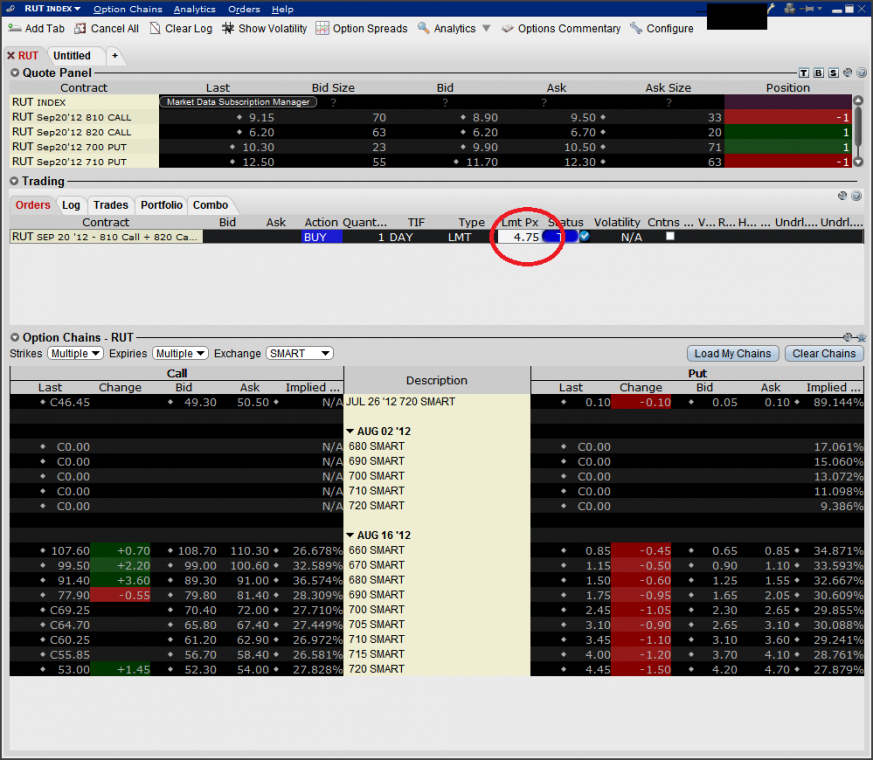

Ok, on Wednesday, on IB I placed an order for the RUT September 2012 IC (http://steadyoptions...12-iron-condor/). I placed it w/a limit "buy" price of $4.75 and it looks like it got filled at $4.49 and thus received a lot less credit than I should have. When I go to Trade Log and I see a price of -4.49 and if I add/subtract the option prices for each leg, it comes out to -4.49. I've attached that as ib-tradelog.png. I looked at Account > Audit Trail (expanded) and can definitely see an Execution report w/a LmtPrice of $4.75 and a LastPx of -4.49. Am I placing my orders wrong? I go into OptionTrader, type RUT, click on Options Spreads, select Iron Condor but the only way I can match the IC structure that Kim has in his post is to select Buy Combo (even though this would be a net credit transaction). I've attached what this looks like as ib1.png If I use Sell Combo (makes sense to me, since it's a net credit transaction), once I select sell 710 put, there's no way I can select the 700 put to buy. I've attached that as ib2-stuck.png. Should I be putting a negative value in the LimitPx (e.g. -4.75) in the trading area (circled in red)? Or, should I be manually entering the spreads and not using their predefined strategies? Or, am I misunderstanding/misreading something and making a dumb mistake? Do you think I should place an opposite order to close out the trade for say ~$4.49 or so and try to enter again w/~$4.75 credit? Side note: My commission here was $1.24/contract, a whopping penny savings over my TOS rate. I'm definitely not used to IB's UI. In TOS, I pretty darn hard to get the (+/-) sign wrong in their entry tool. It specifically says credit or debit and changes color (pink/green). Also, there's that price slider at the bottom which I use a lot. I can properly select all the strikes and when I do a limit order that's a credit transaction, I know it'll do the right thing. -

I figured I'd start a general topic on IB since this isn't about commissions. I found a quirk w/IB that I'd not seen w/TOS. I bought a FDX call (not a trade discussed here) and had an open sell order on it. With the sell order open, I tried to buy another FDX call and IB won't let me. It says "Order Reject: This account cannot have open orders on both sides of the same US Options contract in any related accounts." If I try to override and transmit, it rejects it for the same reason. Known issue? Any workaround or just something I have to live with? I can do the same thing on TOS (and am doing it now). it doesn't care. It lets me do that. I'd rather not cancel the open sell order on FDX as I'd get hit w/a cancel/modify fee on IB, which is something unheard of on TOS (and most brokerages that I'm aware of).

-

Another note re: IB: this was at the bottom of an email I received from IB today. Side question re: IB: Is anyone willing to report whether they receive significant income from their "Stock Yield Enhancement Program" (http://www.interactivebrokers.com/en/p.php?f=shortableStocks&p=stockYield-default) and how often they end up with payments in lieu instead of qualified dividends? I'd never heard of any brokerage doing this before, but it sounds enticing for a bit of extra income on the side...

-

Sorry, I think the UI/portions are accessible change after the account's been funded. I know it wasn't that straightforward for me. I originally started and had to delete my 1st ACH attempt (would've needed me to push an ACH from my bank via a goofy method to IB). I then had to add the bank account info on IB to initiate the microdeposits. There ought to be a way to do ACH before ACAT since I didn't do ACAT at all and have no plans to.

-

^^^ I don't know but http://www.interactivebrokers.com/en/p.php?f=minimumDeposits mentions a $10K min deposit to open an individual account. I think from http://individuals.interactivebrokers.com/en/pagemap/pagemap_login.php, I had to select either Finish an Application or Account Management. II think there were a bunch of funding choice on the left side (e.g. ACH to IB from your bank, IB doing the ACH, wiring, etc.)

-

pgrace0514, I think the point Kim's making is that "commissions are unpredictable and IB cannot provide a good explanation how to avoid or reduce them." That's his motivation for posting examples of what he was charged. They're all over the map. I noticed that at http://individuals.i...parebrokers.php, they're advertising $1 commission for 1 option. Funny enough, there's an "Execution Price Comparison" table which looks like it has 2 columns swapped. I personally find IB's schedule daunting and confusing (http://individuals.i...php?f=otherFees). It seems the unpredictable nature comes from where the order's routed and is further complicated by execution credits. Maybe Kim or some other folks here do enough contracts/month to get a better deal too (http://individuals.i...hp?f=commission).

-

I think you've got your terminology a bit wrong. So, your average was 95.6 cents per contract? From what I'm reading yes, you bought 2 calls, 2 puts and then sold 2 calls and 2 puts = 8. That's still not bad. I've negotiated on TOS down to $1.25/contract. I before was paying $2.95/contract on TOS, which I thought was good, until Kim gave me feedback otherwise. If I you tried the same thing on TD Ameritrade's ripoff schedule (https://www.tdamerit...om/pricing.html), it'd be $9.99 + (4 * 0.75) = $12.99 to open and another $12.99 to close. $6.85 total is a bargain compared to $25.98.

-

I don't know what kind of turnaround you're expecting but I recall ACAT transfers of securities (from TD AM to TOS, when they still used Penson) took a little while (on the order of days, IIRC) and orders had to be cancelled on the sending side. I also transferred an entire account from another brokerage that used Penson to TOS (when they still used Penson). It took a little while too. I don't know about ACAT w/cash only. If you want to fund your account with IB w/ACH (there are other methods), after you go through the application process, you'll need to put in your bank account #, its routing #, etc. and IB (just like other banks and brokerages) need to make small test deposits and withdrawals. Having that show up on the other side takes at least a day or two. Once you confirm the micro-deposit amounts, then you can initiate an ACH xfer from IB. I was approved on Tuesday morning and at some point this week, after confirming the test deposit amounts, I did the ACH $ xfer. The money was supposed to be credited on the coming Monday (7/23/12). It actually got credited today, well after market close. Bottom line: Don't expect things to be that fast. You could possibly do an ACH from the bank side to IB, but the process looks screwy. I didn't want to jump through hoops for that. If you want to speed things up, apply tonight. Initiate the ACH test deposits tonight. It'll be a week or so before you can trade. I don't know if wiring money would be faster, but that's likely going to cost $.

-

I recently joined IB but am waiting for my deposit to post. I think you're misreading it. I doubt there's any requirement to purchase 200 shares of stock. I think what http://individuals.i...hp?f=commission (and from the example) is saying is that the min. commission for stock orders is $1.00. If you buy 1 share, 25 or 100 at time, or anything <=200 shares, you're going to get charged $1 commission. For me, I don't know about OH, but of bigger concern when doing an ACAT transfer is the cost basis info will probably be lost (not carried over). If you use Gainskeeper (I use it w/TD AM and TOS) and have something complex going on w/those stock (e.g. bought some here, sold some here, split, spinoff, etc.), those aren't good candidates (IMHO) to transfer over. When I transferred some stocks from TD AM to TOS (this is after the buyout but before the integration was complete), I was advised that cost basis info wouldn't carry over. They were correct. Thus, I only moved "simple" stocks and those where I could earn some covered call income (had 100+ shares, was optionable, etc.).

-

Hmm, so they're charging you ~$1.50/contract? If so, that's worse than the $1.25/contract I'm now getting at TOS.

-

For me, I'm not switching yet. I'm just trying out IB. IB's platform looks totally alien to me, so I need to learn it. My deposit won't be credited until 7/23, so I have a little time. If they're not worth the inconvenience for the savings over TOS, I'm sticking w/TOS. At least I got my TOS commissions down to $1.25/contract. I also might give MB Trading and Lightspeed Trading a shot, if IB doesn't work out.

-

Which plan are you on? Flat rate or Cost plus? (http://www.interacti...hp?f=commission) edit: Whoops! Scratch that. It looks like that doesn't make a difference for options. I was busy going thru the process last night of selecting various options, going thru the disclosures, etc. Is there some other brokerage you'd recommend that's cheaper than what you're paying that also allows reasonably complex orders (e.g. IC and RIC) to be placed all at once?