SteadyOptions is an options trading forum where you can find solutions from top options traders. Join Us!

We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

-

Posts

113 -

Joined

-

Last visited

-

Days Won

4

Content Type

Profiles

SteadyOptions Trading Blog

Forums

Everything posted by SeanM

-

I look forward to this post every year. Thanks, Yowster, and congratulations to Kim and the entire community on another year of remarkable performance.

-

I hear ya. I built a few things from scratch in Excel that have worked just fine for my tracking wants. I probably have to clean it up, and I'd like to add some rudimentary VBA, as well as scan for any sensitive information. I also set it up so that one can compare against the official service picks, as well as factoring in subscription and service fees for both your trades and the services trades. As close as you can get to an apples to apples comparison between your or my performance, and the performance of the service. I'll test all formulas and make sure they're running as they should, then post it here, hopefully by end of day tomorrow.

-

Partially disagree. I did a lousy job of record keeping last year, but in 2015, I had pretty decent executions, despite the crowded nature of what we do. I use IB, so trade costs were about as low as one can get. Commissions reduced my annual return by a little over 40%. Returns for that year are the dream of probably any trader or investor, myself included even including commissions and member dues. I guess my point is that transaction cost is extremely important, and also acknowledge that without execution you obviously miss the trade or possibility over pay, making execution also very important. I don't think execution is everything, though, as that 40% is quite significant. Imagine what kind of impact commissions at a traditional online broker would be.

-

I think all cells in your "Underlying Price" column need to be shifted one line up in the table

-

Yeah, as far as I know each leg will need to be added, as they won't populate automatically. See this rudimentary video I threw together for an example. LNKD Reverse IC example Edit: Just saw your comment edit, so my reply probably is no longer be relevant.

-

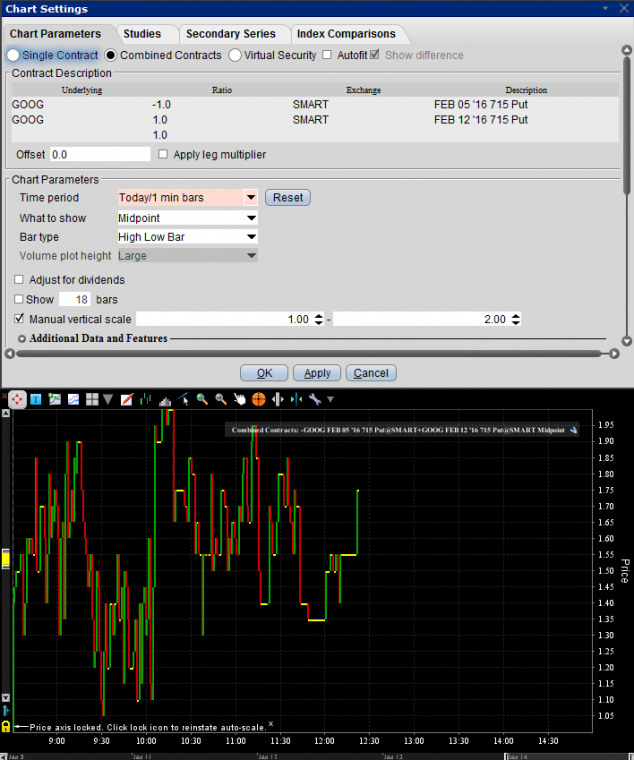

To see the true midpoint, I always create the chart as a "combined chart," rather than charting the spread directly. Go into the chart parameters, then at the very top, change it from "Single Contract" to "Combined Contract" and add your legs individually. I also like to manually set the scale, as auto scale tends to be horrible on these. One thing I have yet to figure out is how to keep the scale from getting f'd up when adding the underling graphed against a secondary axis.

-

One trick that Kim has mentioned is that sometimes if you submit an order and it immediately gets a partial fill, it's worth it to try pausing the order execution (sorry, don't know how this can be done in OptionsExpress), then reactivating it, waiting a few seconds in between each step. I don't know why this works, but it does (obviously not every time). I have success doing this maybe once a month, most recently this week with the GOOG trade. Like you, though, on one of the GOOG legs I only had 1 contract filled. With IBKR, I can submit option combo orders as all or none, but I've never used that option as I think it would significantly reduce fill %. I try not to let partial fills bother too much so long as I get a good price. Annoyingly, they're just a part of life when you're following the methods promoted here.

- 1 reply

-

- 1

-

-

By this time last cycle, we'd already exited our consistently profitable NFLX calendar (a 4 wk version in this instance). Official entry point for the double calendar was ~1.3% of the stock price (or, $8.40 / ~$650). The official exit was for a gain of >20% at 1.55% of the stock price. The DC spread climbed to over 2% leading up to earnings, and many of us booked exceptional profits. So, I'm looking at spreads for the current cycle in this post-split NFLX (as an aside, it took a lot of explaining to my wife why I was in such a bad mood for an entire day upon hearing the news that NFLX would be splitting). It would be a 5 week setup this time (long Nov, short Oct, ER confirmed for Oct 14th). The DCs are around $3.90, or 3.8% of the stock price! If there hadn't been a split, that % would equate to a DC price of $27.30! A few observations (note: all IVs referenced are for the $105 strike, stock is @ $103): IV is much higher for the 1st post-earnings expiry, the Oct monthlies, at 72%, compared to 45%–50% last cycle The IV drop for the Nov monthlies is much less than typically seen, as IV is still at 60% for that expiry date Maybe most perplexing, even the the options expiring before earnings have an astronomical IV, which, at 52% for the Oct wk 2 options, is higher than post earnings options last cycle Unfortunately, these observations lead me not to robotic execution of an assuredly profitable trade, but rather to merely a bunch of head scratching and brow furrowing. So, I thought I'd start a topic for an idea kick-around. My initial instinct is to open a 1 wk calendar that straddles earnings due to the high IV of the Oct wk 2 options, which have traded as low as $2.65 today for the $105 call calendars.

-

Ahhhh! I never even noticed the "Passcode Generator" within the app. Thanks for pointing it out.

-

Interested in hearing the responses. I had the old authentication card, but never received one of the new ones. I did not even know such a card existed until I tried to login to account management a few months back. Since it became available (March 2015?), I've used the iOS authentication app with Touch ID to login to both TWS and Mobile TWS. When I need to get into Account Management, I have to login to TWS first and then open it from within TWS. So, I probably need to inquire about getting one of the new cards . . .

-

Is selling options only way to profit from collapsing IV

SeanM replied to Optrader's topic in General Board

Most straightforward is probably a butterfly with the middle strike at your target price. -

I got 20c today for the 80P. As 4REAL mentioned, wishing I'd closed last Friday, but at least it didn't fall back down today to where it was early last week around 15c.

-

Nice! After a few of our calendars lost value in the final days, I was certainly a bit too quick to cut the rope on this one.

-

Exited both legs today @ $0.86 and $0.90. 19% gain before commissions, 14% after.

-

I entered a 3 week double calendar using the $56 and $56.5 calls (long August monthly, short July wk5) at $0.75 and $0.73, respectively. Earnings are 7/29 AC Previously, we paid: $0.80–$0.85 per spread for a 2 week calendar in October 2014 (exited for 27% gain) $1.15–$1.20 per spread for a 4 week calendar in February 2015 (broke even) In each instance, stock price was nearly identical to what it is at present.

-

Yes, XIV. It's pretty much the greatest long term investment of all time. Also, there is some really good info in this post from a few years back. Volatility Products Strategies & Trades The VXV/VIX ratio strategy mentioned in the post is especially solid. See the following white paper for some great reading. Easy Volatility Investing

-

I entered 605P calendar with the setup used in previous official trades (long August monthly, short July w4 for $3.05). Not a screaming buy, at 0.5% of stock price compared to a similar entry price in October 2014, though in February 2014 we paid ~0.7%. But, I had a gain of 36% entering at 0.5% last time, so I think the time risk is worth it. Note: July has 5 Fridays, so this is a 4 week trade.

-

Thanks for the heads up.

-

Disappointing, but I don't think the trades should be abandoned in the future. Felt like there was a decent margin of safety (assuming all were out before the TWTR leak). For the three trades cumulatively, my after commission loss was 2.2%.

-

Similar outcome here. Entered 52C at $0.33, exited this morning at $0.40. 11.7% gain after commissions. Trying to get out of GPRO even marginally in the black now . . .

-

Good input. Thank you!

-

No, we have not. Just straddles.

-

Yowster, if you read this, are you looking at any of these again? I know you also did a GILD calendar. I'm about to start digging in to the current numbers, but figured I'd check to see if anyone was a step ahead of me. Thanks.

-

Earnings 4/30 AC. I entered a couple of 2 week calendars today. Long May monthly, short May wk1. 98P @ $0.38, 98.5P @ $0.35. Based on my notes from a handful of other cycles, as well as notes from another member (almost certain it was Yowster, but I can't find the thread) these calendars fluctuated wildly in a range of 0.69% – 1.43% of the stock price on a per spread basis, with prices generally highest 2 days before ER. At the current price of $99, that implies a range of $0.68–$1.42 per spread.

-

Yeah, it's driving me crazy. The "view individual legs" button is gone. If needed I'll add each leg to the same Watchlist, but really the last thing I need is extra lines on a 4.7" screen. Quite frustrating.