SteadyOptions is an options trading forum where you can find solutions from top options traders. Join Us!

We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

-

Posts

473 -

Joined

-

Last visited

-

Days Won

17

Content Type

Profiles

SteadyOptions Trading Blog

Forums

Everything posted by luxmon

-

Tom must either have a very short memory or getting desperate; he brought back Karen to share her "success story" https://www.tastytrade.com/tt/shows/geeks-on-parade/episodes/trading-for-your-future-with-karen-geeks-2019-07-22-2019

-

@TrustyJules ThinkOrSwim's vernacular for buying an iron condor is literal - long the guts and short the wings. @Gen88 to explain what is happening based on your post - you entered a good risk/reward (18:482 on the call side) at the expense of a relatively low probability of profit. But, you got the rip in DIS stock you needed. I see the condor marking over $1.00 now. If it were me, I'd take the money and run (or at least close two call spreads to cover for your original debit).

-

Thanks for the explanation, and I see the conundrum. After thinking about it, I would say it's not a big deal for the Scanner to say None since you have the "W" field indicating if weeklies are available (allowing one to still accurately filter for 1 or 2-week eligible calendar candidates). Thanks, Tim

- 1061 replies

-

- rv chart

- volatilityhq.com

-

(and 1 more)

Tagged with:

-

- 1061 replies

-

- rv chart

- volatilityhq.com

-

(and 1 more)

Tagged with:

-

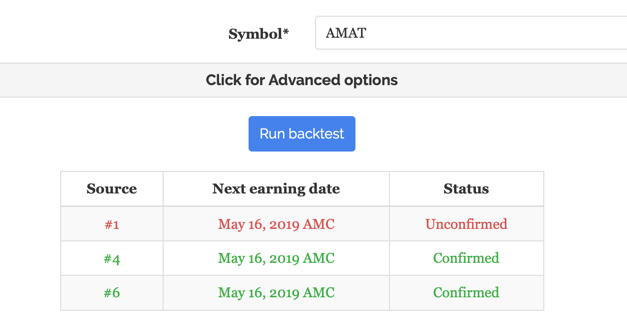

AMAT is being reported as having a confirmed earnings date by two of the sources, but they have not confirmed on their website (and usually don't until the first week in May). Curiously enough, yesterday only source #4 was showing confirmed. I suspect these sources have their wires crossed?

- 1061 replies

-

- rv chart

- volatilityhq.com

-

(and 1 more)

Tagged with:

-

No worries, I've become spoiled as it's almost always there by the time I run the scan in the evening! The new features are great so I'll take the side effects once in a while.

- 1061 replies

-

- rv chart

- volatilityhq.com

-

(and 1 more)

Tagged with:

-

@Djtux I've been checking periodically but it appears today's data is not yet available in the scanner. Do you think it will be up tonight? Thanks

- 1061 replies

-

- rv chart

- volatilityhq.com

-

(and 1 more)

Tagged with:

-

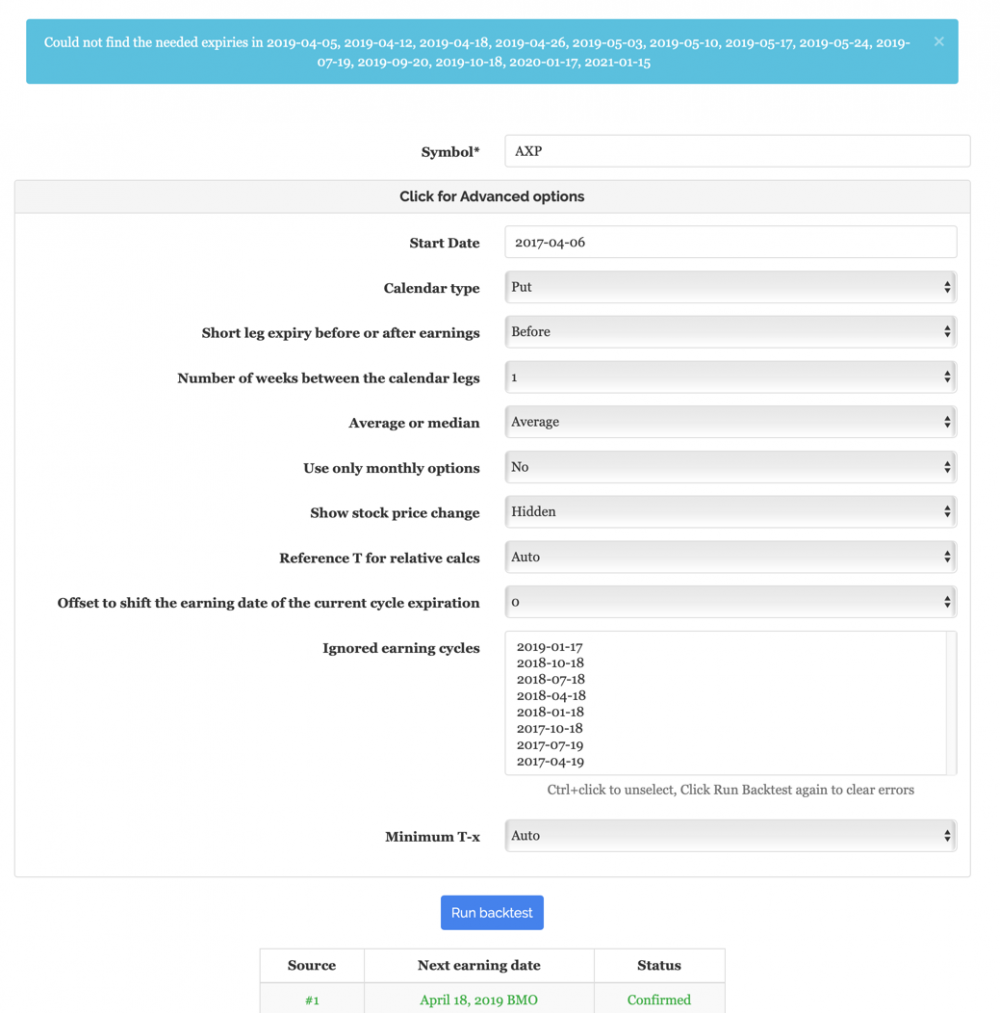

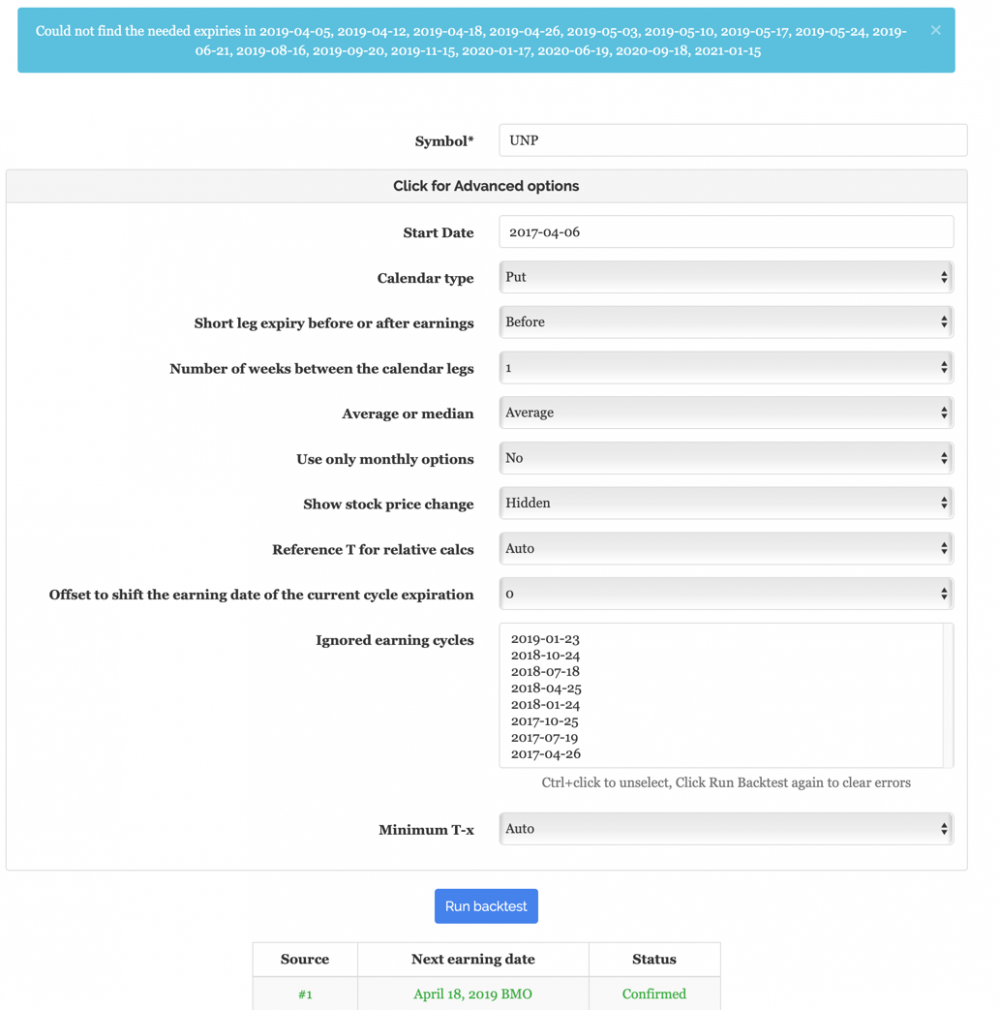

I noticed when backtesting calendars where the short expiration expires before earnings with 1-week spacing and the earnings date is relatively near (I haven't quantified how near), the tool seems to not be able to compute the calendar for the current cycle. I've attached two examples of the error messages where I'm backtesting for the Apr12/18 calendars and the option series that cannot be found. Are there some settings that need to be tweaked in this case? Updated: Maybe it's due to the Good Friday holiday on 4/19, and the options that week expire on Thursday(?) Thanks AXP: UNP:

- 1061 replies

-

- rv chart

- volatilityhq.com

-

(and 1 more)

Tagged with:

-

Most excellent! Having this raw data opens up many more avenues for filtering trade candidates. Many thanks.

- 1061 replies

-

- rv chart

- volatilityhq.com

-

(and 1 more)

Tagged with:

-

Thank you for clarifying! I'm as reluctant as anyone to suggest adding more columns to the scanner (especially after just updating my Excel VB scripts to point to shifted column references), but.. I must say having the earnings expiration IV (projected or confirmed) reported would be icing on the cake to help scan for interesting pre-pre earnings calendars if it could be squeezed into a future update 😉

- 1061 replies

-

- rv chart

- volatilityhq.com

-

(and 1 more)

Tagged with:

-

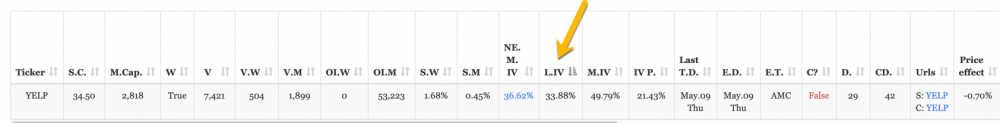

@Djtux Thank you for the recent enhancements to your tool, they are already proving very helpful to me. On another topic, could you discuss a bit on how the "Last implied volatility" data is determined? It seems to not always indicate the IV of the earnings expiration if the earnings is too far out. For example, see the YELP example below where "L. IV" is reported as ~34% but the May10 term is 56%. Is there a window of time it looks in to determine the level? Thanks much, Tim

- 1061 replies

-

- rv chart

- volatilityhq.com

-

(and 1 more)

Tagged with:

-

I've read every one of them. Highly recommended. https://www.artemiscm.com/welcome#research

- 1 reply

-

- 1

-

-

I am honored to be asked to help mentor the CA PV forum. A little about my background: I started self-directed investing in stocks 25 years ago and augmented that with covered call selling and collaring about 10 years ago. I wanted to get more serious about trading options and spreads, so after a lot of research I decided upon SteadyOptions forum in 2013. It was here I really learned the importance of key principles like position size, portfolio balance, risk/reward planning, and often overlooked trade execution skills. I still trade a few pre-earnings names I follow when conditions setup and time allows. In the last few years with the air getting thin in stock market valuations I began to work on long equity portfolio hedging techniques. I focused my learning time (with the help of a mentor) to establish a background in taking advantage of market conditions to create low cost ways to add long gamma and vega positions to offset the risk with long equity exposure. I’m excited about the strategies in the CA forum and continuing to learn amongst the members there. -Tim I use (not intended to endorse any of them, just fyi): Tools: LVX, ONE, TOS, VolatilityHQ, custom Excel/Python tools for scanning, and more recently testing out TradeHawk Brokers: TDA, Tradier, IB Stock research services for fundamental analysis: Stansberry Research

-

Tradier is hot garbage this morning. As much of a pain it is, I've found it's best to diversify across several brokerage houses and use each for their unique advantages.

-

While not exactly the solution you (and I) are looking for, the TradeHawk platform will send you an SMS text message when an order fills so at least you are aware of that. You can then use Rho to work any orders you have placed that haven't filled. But unfortunately (along with lack of notifications in the current version) I've found Rho is really no better than the Tradier web app at creating order tickets of multi-legged spreads.

-

@Djtux I realize you're probably inundated with requests with this tool, but would it be possible in the scanner to report the total open interest in the weekly expiration series?

- 1061 replies

-

- rv chart

- volatilityhq.com

-

(and 1 more)

Tagged with:

-

@Djtux I've wondered about this - Is the data you use the exact end of day prices that one would see after hours in a brokerage platform? Thanks.

- 1061 replies

-

- rv chart

- volatilityhq.com

-

(and 1 more)

Tagged with:

-

Hi @OptionsChurning. You are misinformed about IB/TOS having IRA limitations preventing the spread strategies used here. I have option-spread enabled IRA accounts at IB, TOS and Tradier. You simply need to complete the proper paperwork with the broker before they'll allow spreads. Which one is the best, well, they all have their pros/cons and it's impossible to answer for you. I'd suggest starting with one and then migrate if another better suits your needs, or split your funds between a few like I did.

-

I realize it's in the Calendar backtesting tool, but I was referring to the Scanner tool.

- 1061 replies

-

- rv chart

- volatilityhq.com

-

(and 1 more)

Tagged with:

-

@Djtux The tool you have is fantastic, thank you for offering it. I was just curious if you have given any more thought to adding this feature to the scanner (for being long the option after earnings and short the option before earnings)? I can imagine the complications, but I think this tool could be extremely useful as I've been running across quite a few names (albeit too late to capture much theta) where the earnings IV is similar to the pre-earnings IV. Best regards, Tim

- 1061 replies

-

- rv chart

- volatilityhq.com

-

(and 1 more)

Tagged with:

-

I've been using Trend for Tradier for a couple of years now (got it as a free-add on at some point while conversing with someone at Tradier about their web order entry shortcomings). I would just add that Trend is also worth a look as a cheap simple Tradier platform for stock watchlist, option matrix, and spread order entry/management if you don't think you'll trade 3000 contracts a month. Just fyi. I've been demo'ing TradeHawk for the last few days and it has a lot more bells and whistles for sure, and if I feel the volume will be there might add that as well through this deal. My biggest beef is lack of an option for a light motif (like Trend and other platforms).

-

This has got to be the second dumbest "feature" of ONE next to the inability to view intraday data of the current trading day until the start of the next trading day. No amount of complaining to the them has worked to fix these which would make ONE a near perfect options backtester. Even OptionView can do these two things correctly but I can't stand the lag and clumsiness of the software.

-

I'm not sure I completely understand your question, but the Think or Swim platform has a study called "Comparison" where multiple securities can be plotted together on a single chart. http://tlc.thinkorswim.com/center/reference/Tech-Indicators/studies-library/C-D/Comparison.html Whether it is the best platform or not is a matter of personal choice.

-

The guy at Trader is correct - the FILL will show as one line under orders, but the positions are still listed individually and not easy to close as a spread (need to manually configure expiry, strikes, call/put, etc)

-

They pass though the CBOE regulatory fee for VIX options of 0.41 per contract. Add on the ~0.043 OCC fee that is added to everything and you'll end up paying about 0.45-0.46 in the end. Cheapest I've seen. I can't remember the SPX or RUT fees as I quit trading them there long ago, but I do know SPX was higher than VIX. I don't trade them anymore since they don't allow time spreads on cash settled options (at least in my relatively small account there), and their inability to provide margin relief for broken or unbalanced butterfly/condors. Tim