SteadyOptions is an options trading forum where you can find solutions from top options traders. Join Us!

We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

-

Posts

473 -

Joined

-

Last visited

-

Days Won

17

Content Type

Profiles

SteadyOptions Trading Blog

Forums

Everything posted by luxmon

-

The performance data of this service has not been updated sine Nov 2024. Is it still active?

-

I only hold USFR in the account now and tried to sell some. Also seeing issues with basic equity orders cancel/modify.

-

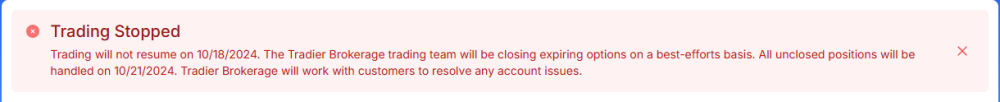

I checked the trade confirmations from yesterday and everything seems complete - including the shares I was assigned from ITM expiring options they failed to close out with their "best-efforts". My little IRA is at 10x leverage now. This should be interesting to iron out.

-

Mine could be pretty disastrous if their "best efforts" didn't get around to closing the shorts of the expiring SPY iron flies that were open. Luckily it's a small account and an IRA so even if it blows I don't think they could come after me for a debit balance, but who knows.

-

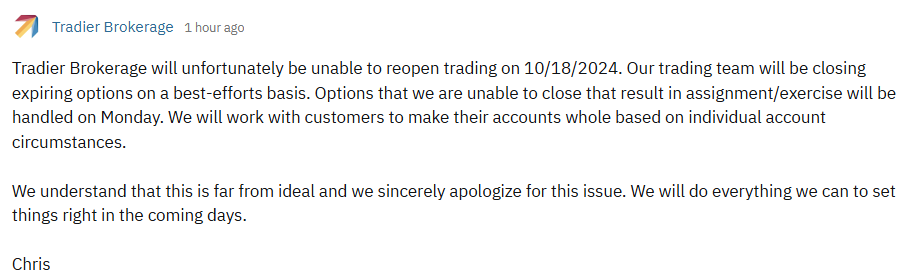

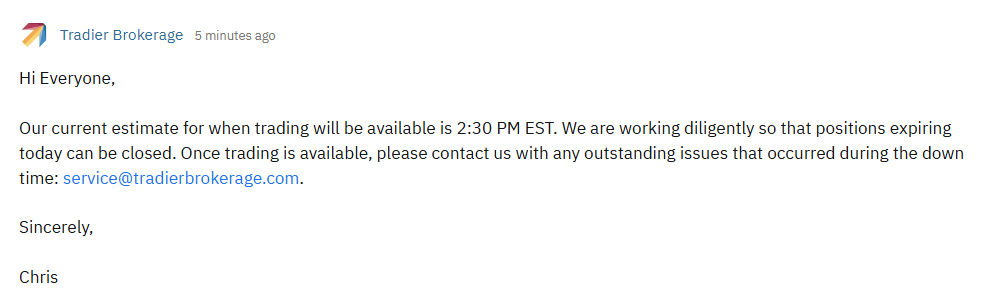

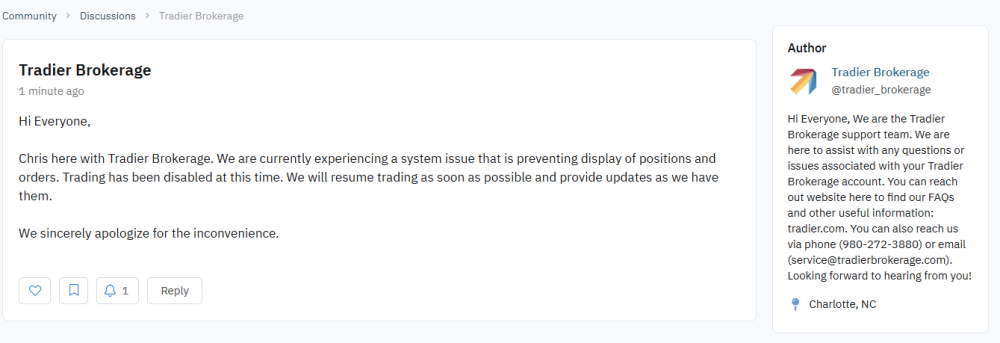

A bit more color from Chris but it sure would be nice to know what's in my portfolio into the weekend.

-

The sad part is I can't even make offsetting positions in another account to neutralize the Tradier position that may or may not be resolved today.

-

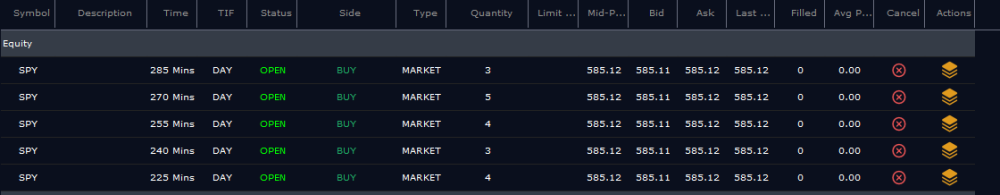

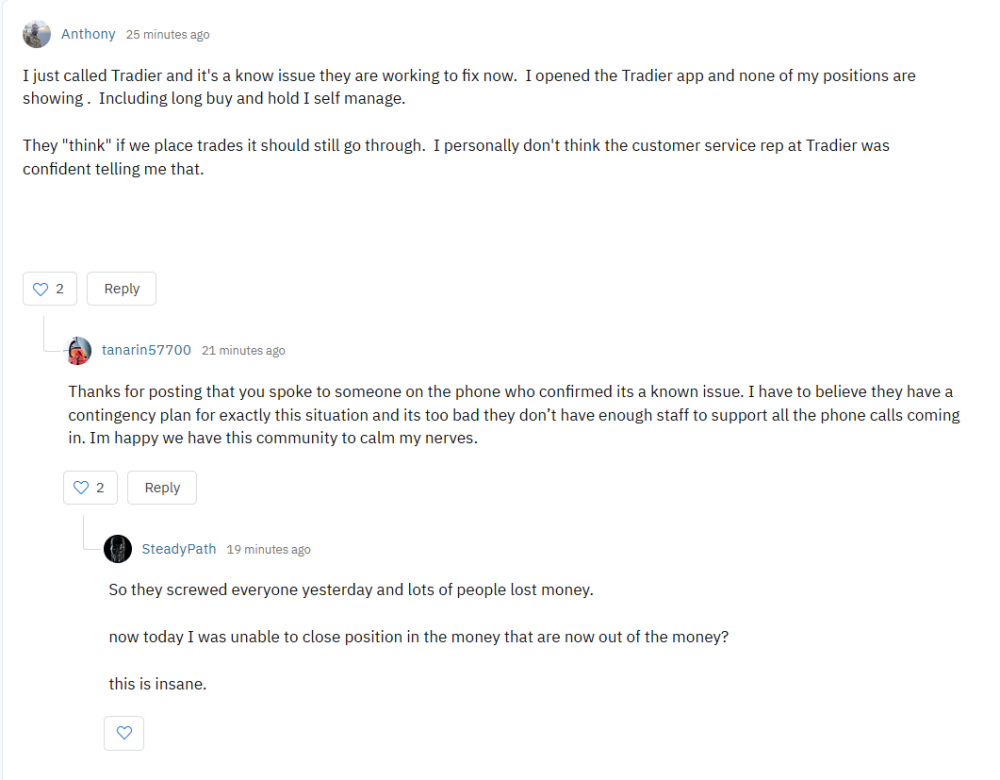

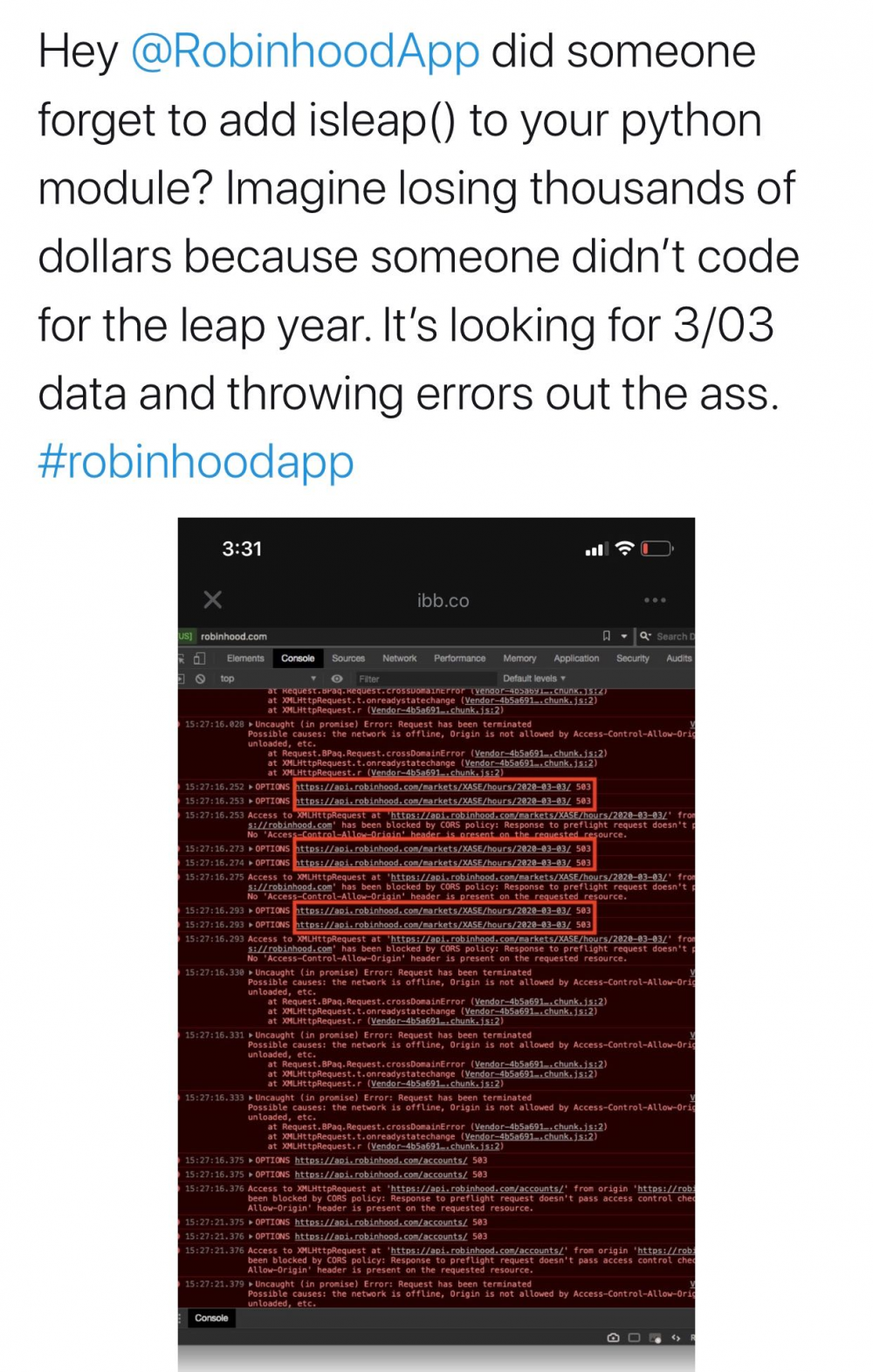

Yeah I think they're still working on things. There's chatter at OA that they're busting 0DTE trades opened today that were still open at the time the outage started. I can see some weird phantom orders for SPY in Tradier Pro that I didn't place, but the quantities were equal to the iron flies I had opened.

-

I can see my positions now EXCEPT ones expiring today.

-

-

That is very disingenuous not to have the other outages posted that prevented people from trading.

-

Tried calling but there's no one home. I have bots running on OptionAlpha that are tracking positons but orders sent are being rejected. The forums are lighting up there too and someone who got through said the rep "thinks" the orders might be getting through. What a joke. Chris from Tradier actually posted over there directly telling us what everyone already knew.

-

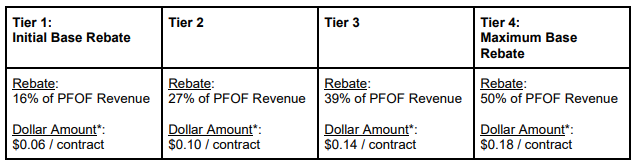

I wasn't aware of that brokerage. In reading their rebate terms, I was surprised to see the PFOF kickbacks these brokers get are quite significant (0.36 per contract). At least this one gives you half of if provided you trade enough volume. There's got to be some hidden price to pay in execution slippage that probably wipes this savings out.

-

Luckily I've been moving my operations to Schwab. This has been happening multiple days this week near the open and is completely unacceptable.

-

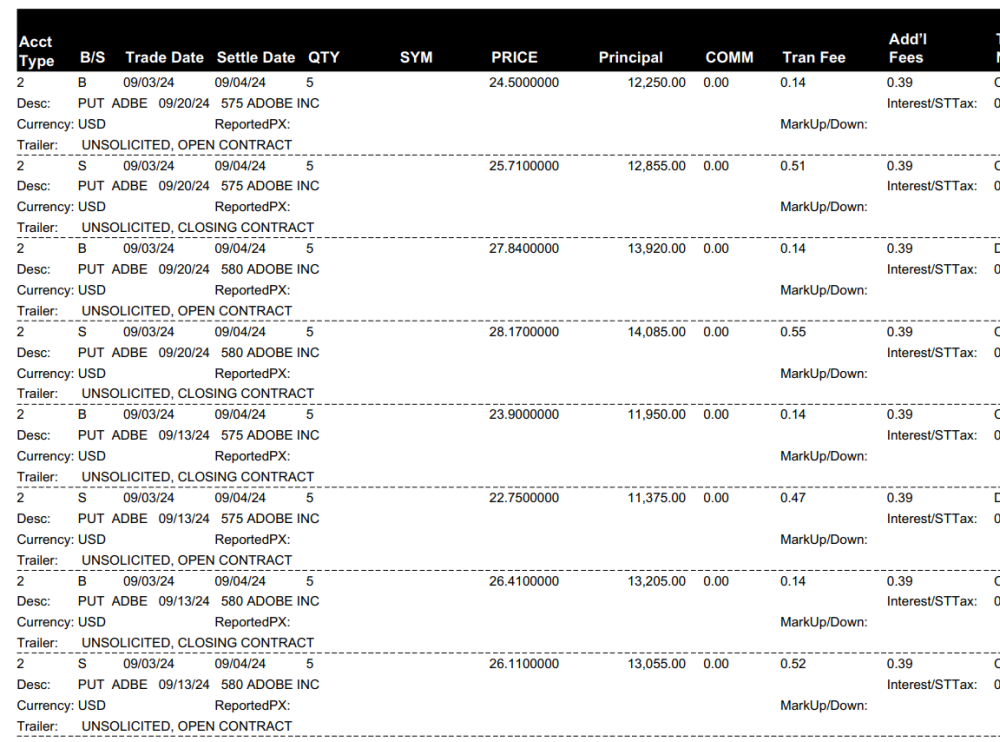

.03 per contract is 5X cheaper on fees than Tradier which averages about 0.14/0.15 per contract on spreads now.

-

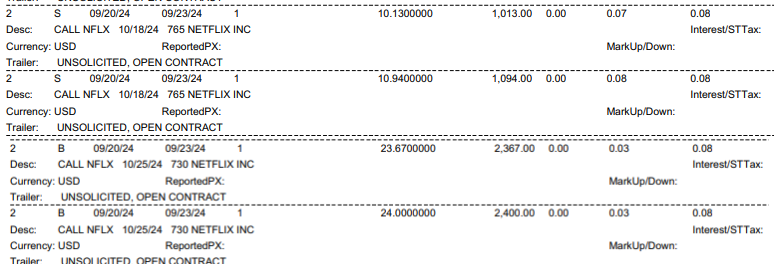

Just to close out my comment on Tradier vs. Schwab - Schwab does also have misc fees but they are quite a bit less (0.01 for buys and 0.04 for sells). Here's the same NFLX contracts as I posted above from Tradier: The key point is it is becoming much more close between free brokers and regular brokers.

-

Yeah I just checked some singles on NFLX from last Friday and it was similar (0.11 for buys to 0.15-0.16 for sells). SPY for me was similar but obviously the index options SPX & VIX tack on their passthrough exchange fees. I used to do a very cheap pre-earnings calendar play on TWTR 6-7 years ago where'd buy a 1-week calendar for 0.04-0.05 and sell it for 0.08-0.09 in the same day (or same hour) in 100-200 lots at a time, multiple times per cycle. (Often multiple times a day until the broker said I ran out of cleared cash ha ha). Back then it was 0.04-0.05 fees per contract and it makes a big difference on returns for these types of trades when considering round trip "misc" fees.

-

I just peaked at a trade confirmation from Tradier as they sent a note a while back about increasing "misc" fees for the no-cost option trades they offer for $10 / month. For equity options it looks like they are now up to around 0.14-0.15 contract between the "Tran Fee" and "Add'l Fees" they tack on. Last time I looked it was around 0.09. For comparison I pay 0.30 / contract at Schwab with much less hassle and a better mobile platform. Time to re-think these free brokers.

-

@cwelsh , I'm not sure I've seen this specific question addressed. Between my wife and I our employer tax deferred retirement accounts (403b/457b) have grown and have become a pain to manage, causing me to lose some sleep at times with the risk I'm carrying there. It dawned on me and I think this is possible to use Anchor here. Could one buy an S&P equivalent index matching fund (like VIIIX or VFIAX) in those employer accounts, beta-weight that combined position against SPY and employ the anchor hedging gadgets in my IRA? I think the ITM call could be synthetically made by buying a beta-weighted number of long puts at the same expiration and strike as the ITM call in the IRA. I realize there would be no leverage but at that point I wouldn't really care as there would at least be protection in the aggregate of tax deferred accounts. Would there be any other limitations, such as if anchor sells shorter duration calls against the long duration ITM call (where then I wouldn't have a long call in the IRA)? If not I think it might work. Let me know what you think or if I'm missing anything. Thanks, Tim

-

MIke, This is a subtle but well known issue (and discussed in previous posts). SPX is cash settled and Tradier doesn't provide margin relief for the time spread (they assume by default you'll forget to close the short option by expiration and thus could have a margin issue if it was ITM and you're short on cash). You can get around this by using SPY instead. Other brokers (like TD or IB) seem not to care about this. Tim

-

-

Chartaffair.com - RV Charts & Backtesting for Steady Options

luxmon replied to Christof+'s topic in Promotions and Tools

@Christof+ Thank you. How frequently does your software scrape the sources for changes to earnings date info? I'm assuming this would affect the timeliness of receiving email alerts from your website for earnings date information. Thanks -

Chartaffair.com - RV Charts & Backtesting for Steady Options

luxmon replied to Christof+'s topic in Promotions and Tools

@Christof+ Can you check your software earnings dates sources? NFLX 2019 Q4 earning date was confirmed Dec 13 AM (I received an email from their investor relations) but your sources still list unconfirmed. Hence, your software is providing the incorrect RV graphs. Thanks -

This is the case for me also. Very early on with the free commission plan they absorbed these fees but started passing them to the customer at some point. I got a more polite response when I asked but there isn't anything you can do. $0.10-0.11/contract still isn't bad.