We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

All Activity

- Past hour

-

SO can be more than 50% invested during busy earnings periods, so you would need to reduce the position sizing. And your drawdowns might be higher as well, so it would be more risky. But overall, yes, it can be done, although generally speaking, I always recommend not to invest 100% of the account and have at least 20-30% in cash (or less risky assets).

-

SO has all trades listed because it's a lot of trades using different strategies. Services like SY and SV have only 2-3 trades every month, so it's very easy to track the P/L. For example, SY January return of 4% is based on 4 trades closed in January: If you sum the P/L of each trade (291+208+305-326), you will see how we report 4% ($400) return. SV is even simpler - it is typically a single trade per month.

- Today

-

Hi Kim, looks like a fantastic service with a bright future, especially with Yowster managing it, who i know from steady options is incredibly smart and reliable. I think i will likely end up purchasing this too in the future, my question is: given that this is only usually 50% invested, and so is steady options, would it be a silly idea to make that 100% of my portfolio? Could you share some more info on the types of trades and the greeks? Thanks!

-

Kim, New to service, and trying to understand the history of the services, in particular SteadyYields. SteadyOptions has a decent set of details, outlining the trades for (say) 2025. But I cannot find a corresponding set for any of the other services, only aggregates. SY appears to have a "bit of history", but it seems difficult to assemble a complete history of trades, PnL, DrawDown, Risk incurred, Position size in order to have a better understanding of what to expect. Any tables/data appreciated - Phil

- Yesterday

-

Bens joined the community

- Last week

-

Personal MBA Coach changed their profile photo

-

Personal MBA Coach joined the community

-

thetechguy joined the community

-

huynhchinhthuan91069 joined the community

-

philH joined the community

-

BillK joined the community

-

thanks for the information!

-

kennethwes joined the community

- Earlier

-

sensei614 joined the community

-

Bullseye joined the community

-

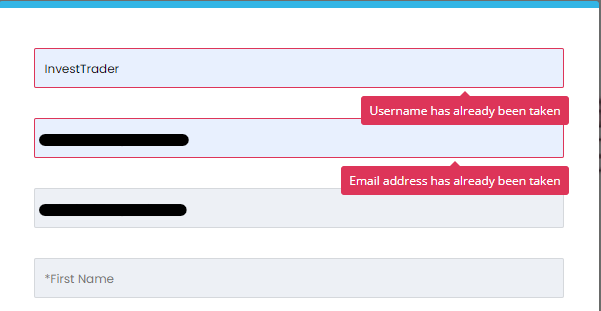

Hi, sorry to hear about that. I cannot find "InvestTrader" in the members. Can you please give me the email address in order for me to find you among all the subscribers? Thanks, Romuald

-

Hi @Romuald A few months ago I registred in your site (the free plan). Now I'm trying to activate a paid subscription. I login, go to the subscriptions page, click on the desired plan and nothing happens. There is no response. If I logout and go to the subscriptions page, then I can access the form to activate the subscription. However, when I start inserting my data, the site rejects it saying that they already exist (which is correct). How can I activate the paid subscription? Thanks In Advance!

-

It’s the friday before the earning. Each earning date is not always on the same day of the week (Monday, Tuesday, etc) so it’s not always the same T-X. Another thing is that the data does until the Thursday because on friday end of day there is no data for that option that is expired.

- 1093 replies

-

- volatilityhq.com

- volatilityhq

-

(and 1 more)

Tagged with:

-

@Djtux Looking at the double calendar RV charts with short leg before earnings, 1 week between calendar legs, weekly options, the black median line ends on different days before earnings date. Sometimes it is on Thursday Friday or Monday. It can be -2 -3 -4 trading days. What is the rule here? I would expect it always to be on a Friday since the calendar's front leg expires

- 1093 replies

-

- volatilityhq.com

- volatilityhq

-

(and 1 more)

Tagged with:

-

Spreadable Mobile Trading App created for Steady Options

mabueh replied to Bull3t007's topic in Promotions and Tools

The app works really well and is quite intuitive - I use it on a daily basis. If I am not mistaken, it is however available only on Apple products and also not accessible in browsers. -

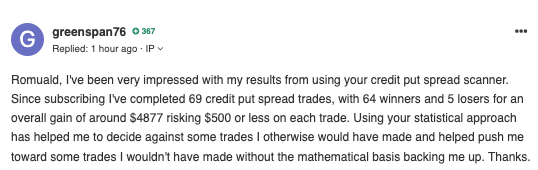

Here's a message I received today that's always a pleasure! I'm delighted that greenspan76 was able to earn this money thanks to my website math-trading.com!

-

Spreadable Mobile Trading App created for Steady Options

Bull3t007 replied to Bull3t007's topic in Promotions and Tools

I have built it and have been using it for three years now. It’s great;) -

Spreadable Mobile Trading App created for Steady Options

MikeMike replied to Bull3t007's topic in Promotions and Tools

I anyone using this app? I have been looking to switch to Tradier, but need to trade via mobile much of the time. If this app works well it would solve that issue for me. Thanks. -

Chartaffair.com - RV Charts & Backtesting for Steady Options

ocr008 replied to Christof+'s topic in Promotions and Tools

I want to cancel my subscription chartaffair please help -

Spreadable Mobile Trading App created for Steady Options

lisamontgom replied to Bull3t007's topic in Promotions and Tools

thanks for the information! -

Hi @Djtux, I came across an article by Newfound Research. In the article, they argue that using a volatility based timing strategy can reduce the hedging cost substantially. https://blog.thinknewfound.com/2020/07/heads-i-win-tails-i-hedge/ Since the timing strategy is about some "simple" manipulations of SPY IV and RV, I wonder if you are willing to included in volatilityhq? Thank you.

- 1093 replies

-

- volatilityhq.com

- volatilityhq

-

(and 1 more)

Tagged with:

-

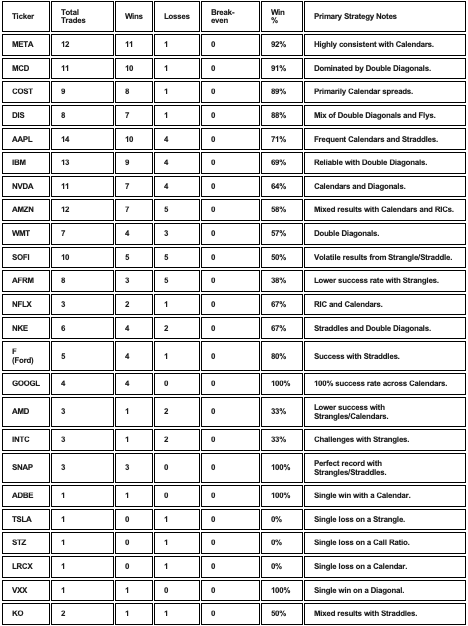

Aggregated Win Analysis by Stock (2022–2025) for SO Trades

Optrader replied to SlayTrader's topic in General Board

SOFI straddle has 50% chance. But RV is very low. So hopefully we will be in positive 50% side. -

Aggregated Win Analysis by Stock (2022–2025) for SO Trades

Optrader replied to SlayTrader's topic in General Board

This is nice and spot ON. The top of list is meta. The day meta calendar was bought. It has kept going up and turned out to be best trade of this year. All others look correct too. So Good Analysis. Thanks -

Yes, there is a coupon in the first post of this thread.

- 1093 replies

-

- volatilityhq.com

- volatilityhq

-

(and 1 more)

Tagged with:

-

Hi, do SO members still get a 50% for the volatilityhq subscription? Thanks.

- 1093 replies

-

- volatilityhq.com

- volatilityhq

-

(and 1 more)

Tagged with:

-

Performance Dissected Check out the Performance page to see the full results. Please note that those results are based on real fills, not hypothetical performance, and exclude commissions. Our contributor @Yowster did an excellent analysis in his 2025 Year End Performance By Trade Type post. Most SO trades are Vega positive trades leading up to earnings events, so volatility plays a key role in the outcome of our trades. 2025 saw 4 VIX spikes that occurred rather quickly (not a gradual rise), most spikes were relatively short in duration with declines starting shortly after the spikes. Trades that were in place prior to the spike performed well, but other trades that did not encompass a spike commonly dealt with falling volatility and RV declines bigger than prior earnings cycles. This meant that trade that would have been small to moderate gains in prior years turned into small to moderate losses this year. Losses above 10% were also more common. As usually, we are very transparent about our performance even when things don't work as expected. No strategy can outperform all the time, and SteadyOptions is no exception. There were some things that worked very well this year, although they were in some of the portfolios outside of SO. Steady Yields (SY) and Simple Spreads (SS) performed very well as many of their trades were helped by the same things that hurt the SO trades. Most trades in SY and SS tended to be Vega negative, meaning that they were helped by declining IV – so both time decay and declining IV helped these trades. Members who subscribed to our all services bundle did very well in 2025: If you allocated an equal amount of capital to each one of our services, your portfolio would be up 36.2% in 2025. In terms of average return of all our services, this was in fact one of our best years. Congratulations to our bundle members, and huge thank you to our contributors: @Yowster @krisbee @cwelsh @TrustyJules and @Romuald for their commitment and dedication! As I mentioned in one of the discussion topics, our performance reporting is very conservative. We rarely have more than 5 trades open at the same time, but with 5 trades open, you are basically only 50% invested. If you made 10% on the invested capital, we would report as 5% return on the total account. No service is doing it, but this is the only correct way to do it. But it also means that members can invest more than 10% per trade on trades that are more conservative and more liquid. Also there are tons of unofficial trades that don't make it to the official portfolio due to their size.being too large for 10k portfolio. If we reported performance like most other services do (return on investment and not on the whole portfolio), our reported performance would be 300%+. More details: How We Calculate Returns? After 14 years in business, SteadyOptions maintains its position as the most stable and consistent options trading service, with 114.5% Compounded Annual Growth Rate. Our strategies SteadyOptions uses a mix of non-directional strategies: earnings plays, Long Straddle, Long Strangle, Calendar Spread, Butterfly, Iron Condor, etc. We constantly adding new strategies to our arsenal, based on different market conditions. SO model portfolio is not designed for speculative trades although we might do some in the speculative forum. SO is not a get-rich-quick-without-efforts kind of newsletter. I'm a big fan of the "slow and steady" approach. We aim for many singles instead of a few homeruns. My first goal is capital preservation instead of doubling your account. Think about the risk first. If you take care of the risk, the profits will come. What makes SO different? We use a total portfolio approach for performance reporting. This approach reflects the growth of the entire account, not just what was at risk. We balance the portfolio in terms of options Greeks. SteadyOptions provides a complete portfolio solution. We trade a variety of non-directional strategies balancing each other. You can allocate 60-70% of your options account to our strategies and still sleep well at night. Our performance is based on real fills. Each trade alert comes with a screenshot of our broker fills. We put our money where our mouth is. Our performance reporting is completely transparent. All trades are listed on the performance page, with the exact entry/exit dates and P/L percentage. It is not a coincidence that SteadyOptions is ranked #1 out of 723 Newsletters on Investimonials, a financial product review site. We also get a very high 4.6 score on trustpilot, the most trusted reviews site. The reviewers especially mention our honesty and transparency, and also tremendous value of our trading community. We place a lot of emphasis on options education. There is a dedicated forum where every trade is discussed before the trade is placed. We discuss different strategies and potential trades. Unlike most other services that just send the trade alerts, our members understand the rationale behind the trades and not just blindly follow the alerts. SO actually helps members to become better traders. Other services In addition to SteadyOptions, we offer the following services: Anchor Trades - Stocks/ETFs hedged with options for conservative long term investors. Simple Spreads - simple spread strategies like diagonal spreads and vertical spreads. SteadyVIX - Volatility based trades. SteadyYields - Treasures trading We offer all services bundle at $3,000 per year. This represents up to 68% discount compared to individual services rates and you will be grandfathered at this rate as long as you keep your subscription active. Details on the subscription page. More bundles are available - click here for details. You can also get the yearly bundle with one month trial at $100 (one trial per member). Subscribing to all services provides excellent diversification since those services have low correlation. We also offer Managed Accounts for Anchor Trades. Summary 2025 was a challenging year for SO, but a very solid year for the rest of our services. SteadyOptions is now 14 years old. We’ve come a long way since we started. We are now recognized as: #1 Ranked Newsletter on Investimonials Top rated service on trustpilot Top Rated Newsletter on Stockgumshoe Steady Options Review: In-Depth Analysis Top 10 Option Trading Blogs by Options Trading IQ Top 6 Options Newsletters by Benzinga Top 40 Options Trading Blogs by Feedspot Top 15 Trading Forums by Feedspot Top 20 Trading Forums by Robust Trader Top Twitter Accounts to Follow by Options Trading IQ I see the community as the best part of our service. We have the best and most engaged options trading community in the world. We now have over 10,000 registered members from over 50 counties. Our members posted over 190,000 posts in the last 13 years. Those facts show you the tremendous added value of our trading community. I want to thank each of you who’ve joined us and supported us. We continue to strive to be the best community of options traders and continuously improve and enhance our services. Let me finish with my favorite quote from Michael Covel: "Profits come in bunches. The trick when going sideways between home runs is not to lose too much in between." If you are not a member and interested to join, you can click here to join our winning team. When you join SteadyOptions, we will share with you all we know about options. We will never try to sell you any additional "proprietary systems", training, webinars etc. All our "secrets" are included in your monthly fee.

-

Although there is no such thing as a 100 percent safe bet in the world of trading, there are 10 things that you can do to minimize your risks and ensure that you're the best trader you can possibly be. Whether you trade stocks, futures, forex, or crypto, these core principles can significantly raise your performance over time, so let’s take a look at them, shall we? 1. A clear, written trading plan If you want to start off on a solid foundation, then you really do need to start out with a clear trading plan that you have written down and can refer back to as often as you need to. Without one, every decision becomes reactive and emotional. A solid plan defines what you trade, when you trade, how much you risk, and when you exit, both for profits and losses. Your plan should answer questions such as: What markets do I trade? What setups qualify as valid trades? How much do I risk per trade? When do I stop trading for the day or week? Writing this down removes ambiguity and helps you stay consistent, even during volatile periods. 2. Strong risk management habits Risk management is what keeps traders in the game long enough to succeed. You can be wrong many times and still be profitable if losses are controlled. Limiting risk to a small percentage of your account per trade protects you from emotional decision-making and catastrophic drawdowns. Stops should be placed logically, not emotionally, and position sizes should always be calculated before entering a trade. Professional traders focus less on how much they can make and more on how much they can lose, because survival always comes first, right? 3. Emotional discipline and self-awareness Trading psychology is often the biggest obstacle to consistent results. Fear, greed, impatience, and overconfidence can sabotage even the best strategies. Becoming a better trader means learning to recognize your emotional triggers. Do you revenge trade after a loss? Do you overtrade when bored? Do you hesitate to take valid setups after a losing streak? Awareness allows you to build rules that protect you from yourself, such as mandatory breaks after losses or limits on daily trades. 4. A focus on probabilities, not certainty Markets are probabilistic, not predictable. Even the best setups fail sometimes. Accepting uncertainty is essential to long-term success. Good traders think in terms of expectancy: over a large number of trades, does the strategy produce a positive outcome? Once you understand this, individual wins or losses become less emotionally charged, making it easier to stick to your plan. 5. Using indicators as tools, not crutches Indicators can be useful, but only when used correctly. Too many traders overload their charts, creating confusion and conflicting signals. The goal of indicators is to support decision-making, not replace it. Price action, market structure, and context should come first. Indicators work best when they complement a clear trading thesis rather than drive it entirely. Some traders look for resources such as the 3 ‘Better’ trading indicators at emini-watch. to improve clarity and reduce noise. The key is not the indicator itself, but how consistently and intelligently it’s applied within a broader strategy. 6. Understanding market context Markets behave differently depending on time of day, volatility levels, and broader economic conditions. A setup that works well in a trending market may fail in a choppy, range-bound environment. Better traders learn to identify context: Is the market trending or consolidating? Is volatility expanding or contracting? Are major economic events approaching? Trading in alignment with current conditions significantly improves odds and reduces frustration, so it is a really important part of the equation if you are looking to be a successful trader. 7. Keeping a detailed trading journal A trading journal is one of the most powerful tools for improvement. Recording trades, screenshots, emotions, and outcomes allows you to identify patterns in both your strategy and behavior. Over time, you may notice that certain setups perform better than others, or that specific mistakes repeat under stress. Journaling turns experience into actionable data and accelerates learning. Even a simple journal can reveal insights that charts alone cannot, so even if it seems like a silly thing for you to do, it really isn’t and it is really worth it. 8. Continuous development Markets evolve, and traders must evolve with them. Ongoing education helps you refine your edge and adapt to changing conditions. This doesn’t mean chasing every new strategy. Instead, focus on deepening your understanding of market mechanics, price behavior, and risk management. Reviewing past trades, studying charts, and learning from experienced traders all contribute to long-term growth. The best traders remain students of the market throughout their careers. 9. Patience and selectivity One of the most underrated trading skills is patience. You don’t need to trade every day or every setup. In fact, overtrading is one of the fastest ways to erode capital. Waiting for high-quality setups that align with your plan improves consistency and reduces emotional fatigue. Many professional traders make the bulk of their profits from a small number of well-executed trades. Sometimes, not trading is the most profitable decision you can make. 10. Reviewing performance honestly Improvement requires honest self-assessment. Regularly reviewing your performance helps you spot strengths, weaknesses, and areas for adjustment. Ask yourself: Did I follow my plan? Did I manage risk correctly? Were losses due to execution errors or normal variance? Avoid blaming the market. Focus on what you can control like your preparation, execution, and discipline. Becoming better is a process, not a destination Trading mastery is not achieved overnight. It’s built through repetition, reflection, and refinement. Every losing trade contains information, and every winning trade reinforces discipline when executed correctly. By doing the 10 things mentioned above, you can better your knowledge, better your decisions and better your bank balance, so what’s stopping you? This is a contributed post

-

Is it still the case? I think some day i have missing info from my data provider.

- 1093 replies

-

- volatilityhq.com

- volatilityhq

-

(and 1 more)

Tagged with:

-

There is a new coupon in the first post of this thread.

- 1093 replies

-

- 1

-

-

- volatilityhq.com

- volatilityhq

-

(and 1 more)

Tagged with:

.thumb.jpg.3ed143eeb45acb89ba43287757ccbd6b.jpg)