.thumb.jpg.aea380fa457d7f57c38952373429dc45.jpg)

EMH is more complex than the efficiency of the overall market, in spite of its title. Anyone who has traded stock after an earnings surprise, an unexpected merge announcement, or a major scandal, knows that efficiency does not always imply. In fact, in the short term, the market is exceptionally inefficient.

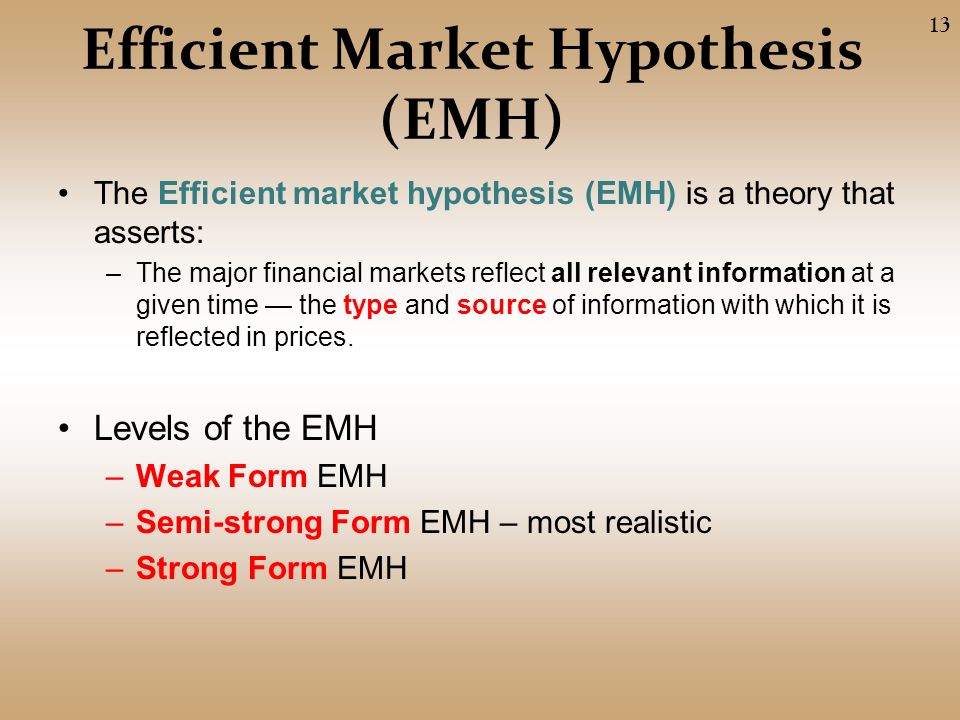

So exactly what does EMH mean?

The hypothesis states that you cannot beat the market because efficiency causes share prices to immediately take into account all known information about the company and its stock.

That definition is pretty straightforward and seems to settle the question. If current stock prices are efficient and do reflect all known information, this means that all pricing is fair and inclusive, and there is no such thing as a bargain-priced stock or an overpriced stock.

Once again, anyone who has traded in the market knows that, indeed, bargain pricing and overpricing do exist. So where is the disconnect?

The advanced understanding of EMH reveals the truth. Assuming the theory is correct, all known information is reflected in the current price of stock. But is that “efficient?”

What is efficient (again, assuming you accept the theory as correct) is the immediate reflection of all known information. This includes all known information, whether true or false. So in the efficiency of the market, rumors, gossip, and false information is all rolled into the same “efficiency” as the accurate information.

So as a first observation, the market is not efficient, although the inclusion of all information is efficient. This is not comforting considering how much questionable and downright false information is floating around in the market.

The second observation is in how the market reacts to all known information. Here you find exceptional inefficiency. For example, a stock’s price reacts immediately when earnings surprises occur, whether positive or negative. The price might move many points when even a small surprise occurs. So the knowledge about the warnings surprise is taken into the price immediately, but the market does not always react efficiently.

Everyone will agree that for a $40 stock, missing earnings by two cents per share is not a big deal; but how often have you seen a stock’s price drop 10% on the day of the surprise? You probably have seen this often. The price tends to retrace back into a more reasonable level within a day or two, so everyone knows the overreaction to an earnings surprises usually is short-term in nature.

This means that the short-term market is efficient in the speed of folding known information into price, but inefficient in how price moves in reaction. Recognizing this more important inefficiency does not destroy the EMH at all, it just defines it more accurately.

In fact, recognizing the short-term inefficiency of the market points to the timing for smart contrarian trading. Knowing that markets are highly inefficient in the short term enables you to time trades expertly.

The efficient market hypothesis is significant when talking about how information immediately affects the price per share; but it pays to also recognize an overreaction to all news (true and false) and to understand that even accurate news is subject to overreaction.

That is hardly efficient.

Michael C. Thomsett is a widely published author with over 80 business and investing books, including the best-selling Getting Started in Options, coming out in its 10th edition later this year. He also wrote the recently released The Mathematics of Options. Thomsett is a frequent speaker at trade shows and blogs on his website at Thomsett Guide as well as on Seeking Alpha, LinkedIn, Twitter and Facebook.

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account. It's easy and free!

Register a new account

Sign in

Already have an account? Sign in here.

Sign In Now