This leads me to believe the market may be stuck in no-man’s land.

And third, we are coming up on a double whammy for options prices. Here is what I mean by that:

As I have written in the past, options prices get hit hard as one expiration cycle expires and a new options expiration becomes the front month. And this week, January options will cease to exist, and February options will be the front month.

The reason for this? Let’s say you were long stock in Facebook (FB) and short a January call against it. This is the typical buy-write/covered call position. As the January call you are short expires you would look to sell a new call against your FB stock position.

However, Jacob the market maker knows that this trade is coming from individual traders and from institutions. So, as the market maker, I would start lowering the price of the February options ahead of time so that I will be buying at a cheaper price when others are selling.

Then, on top of that throw in the upcoming long weekend.

The stock market will be closed on Monday, January 21st for Martin Luther King Day—a nice three-day weekend. But it’s not generally good for options prices.

Over the course of the next couple of days, the market makers, or more likely their computer systems, are going to “push the date ahead” in all their products. So in the market makers’ pricing models, tomorrow’s date won’t be January 17th, it’s more likely to be January 21st.

And as we get closer to this weekend, the computer models will move the date to January 22nd, which is the day the market opens after the holiday. The models do this to price in the decay of the day off for the holiday. That means that they will take virtually all of the decay out of the options ahead of time so that they aren’t stuck being the buyer of decaying assets over a long weekend.

So how do we profit from this phenomenon? By selling options via buy-writes or option spreads like an Iron Condor.

Here is the breakdown of a short volatility trade known as an Iron Condor which could work well ahead of a long holiday weekend:

The Iron Condor position is the combination of a bear call spread and a bull put spread in the same underlying.

It’s a strategy that’s a high probability trade, allowing for a modest profit with enough room for error. Also, it’s meant to be a directionally neutral trade, used when volatility is elevated in relation to its forecasted range.

It’s my favorite volatility selling strategy. By selling a call spread and a put spread, you gain extra short volatility and decay, while at the same time limiting your risk.

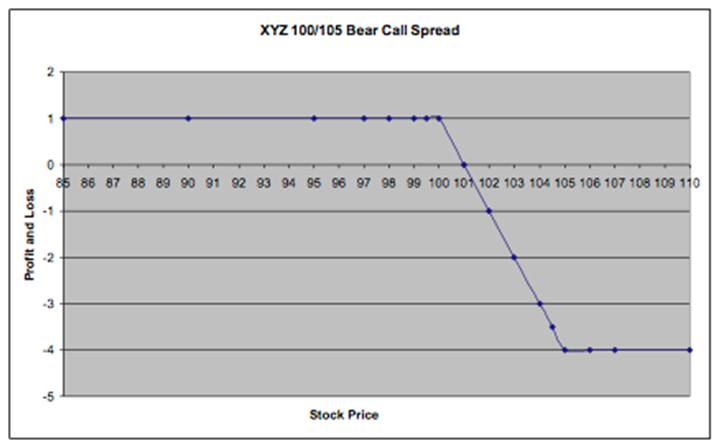

Here’s the hypothetical call spread:

Stock XYZ is trading at 90. You’d theoretically sell the 100/105 bear call spread for $1. To execute this trade, you would:

- Sell the 100 calls

- Buy the 105 calls

For a total credit of $1.

Here is the graph of this trade at expiration.

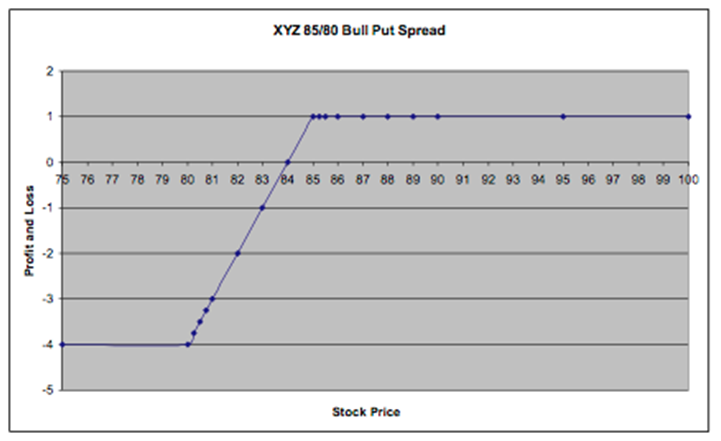

Here’s the hypothetical put spread:

Stock XYZ is trading at 90. You’d sell the 85/80 put spread for $1. To execute this trade you would:

- Sell the 85 Puts

- Buy the 80 Puts

For a total credit of $1.

Here is the graph of this trade at expiration:

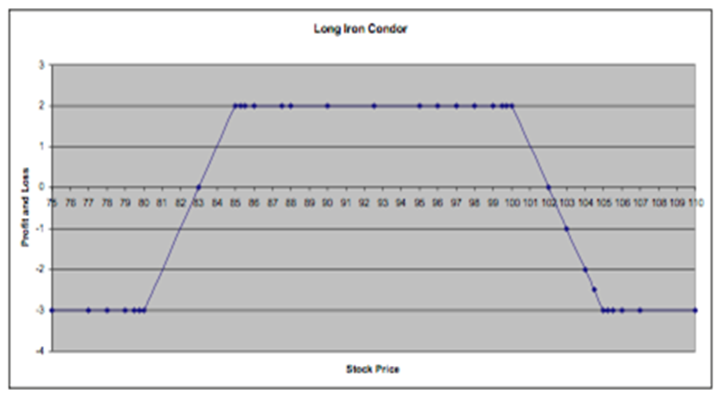

Now we will combine these two spreads to make an Iron Condor:

To do this, you simultaneously:

- Sell the 100 calls

- Buy the 105 calls

For a total credit of $1.

And

- Sell the 85 Puts

- Buy the 80 Puts

For a total credit of $1.

This would give you a total credit of $2.

Here is the graph of this trade at expiration:

As you can see in the chart, at expiration, you’d make $2 as long as the stock stays between 85 and 100. Meanwhile, your downside is limited to $3 if the stock goes lower than 80 or higher than 105.

To learn more about these strategies and Cabot Options Trader where I use these strategies to create profits in any market visit Jacob Mintz or optionsace.com where I teach and mentor options traders.

Your guide to successful options trading,

Jacob Mintz

There are no comments to display.

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.

Note: Your post will require moderator approval before it will be visible.