We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

What Is SteadyOptions?

12 Years CAGR of 114.5%

Full Trading Plan

Complete Portfolio Approach

Real-time trade sharing: entry, exit, and adjustments

Diversified Options Strategies

Exclusive Community Forum

Steady And Consistent Gains

High Quality Education

Risk Management, Portfolio Size

Performance based on real fills

Non-directional Options Strategies

10-15 trade Ideas Per Month

Targets 5-7% Monthly Net Return

Visit our Education Center

Featured Articles

Long Straddle Options StrategyLong Strangle Option Strategy

Calendar Spread Option Strategy

Reverse Iron Condor Strategy

Options Greeks: Theta, Gamma, Delta, Vega And Rho

Comparing Iron Condor And Iron Butterfly

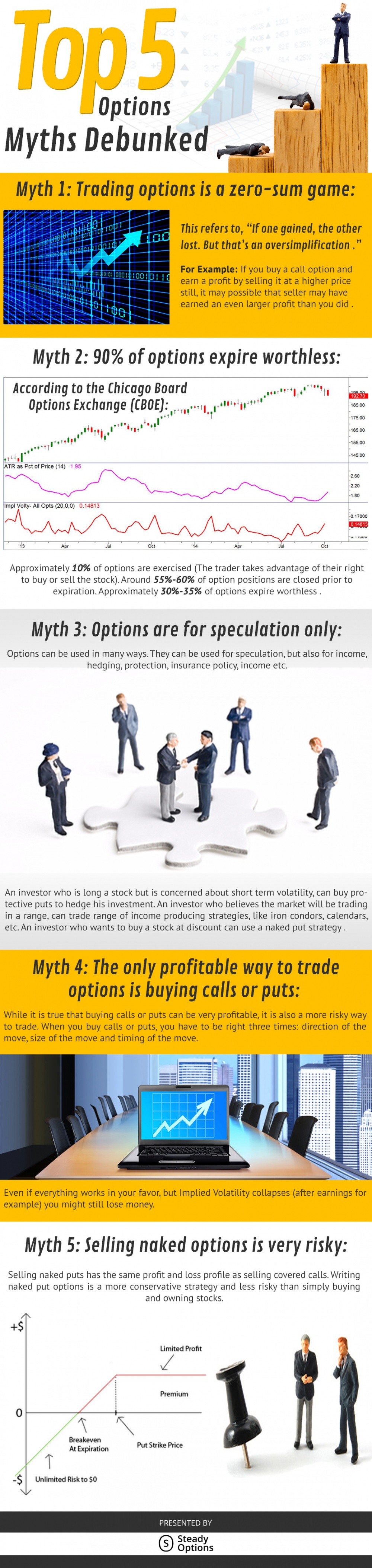

10 Options Trading Myths Debunked

Buying Premium Prior To Earnings - Does It Work?

What Is IV Crush - Implied Volatility Crush Explained

Put/Call Parity: Definition, Formula, How It Works

Useful Resources

CBOEOptions Industry Council

CML TradeMachine

OptionNet Explorer

VIX and More

Options Trading IQ

Market Chameleon

Orats

VIX Central

eDeltaPro

Recent Articles

Articles

-

SteadyOptions 2025 Year in Review

2025 marks our 14th year as a public trading service. We closed 83 winners out of 136 trades (61.0% winning ratio). Our model portfolio produced 6.5% compounded gain on the whole account based on 10% allocation per trade.

By Kim,

- 0 comments

- 998 views

-

- Added by Kim

-

10 Things That Will Make You a Better Trader

Lots of people think that becoming a successful trader is about finding some secret formula that will ensure that they make all of the right decisions all the time, and never back the wrong horse. This is, of course, very unrealistic and untrue, but you know what?

By Kim,

- 0 comments

- 1040 views

-

- Added by Kim

-

How To Reduce Investment Risks In 2026

Studies show that over a third of US adults hope to explore additional income streams in 2026. Investing is an appealing option for people looking to boost their income and grow their money. There are always risks involved, but there are ways to increase your chances of success and avoid pitfalls.

By Kim,

- 0 comments

- 1228 views

-

- Added by Kim

-

When Investors Lose Their Nerve

It was a rough end to the week for markets, with a sharp sell-off on Friday reminding investors just how quickly sentiment can turn. For anyone who sold in late summer anticipating a correction and then bought back in at the start of October, that one-day drop might have felt like confirmation that they can’t win.

By Kim,

- 0 comments

- 2318 views

-

- Added by Kim

-

Uncovering Common Cryptocurrency Trading Mistakes For Beginners

Are you tempted by the shining allure of crypto trading? You aren’t alone. Decentralized cryptocurrencies hold perhaps the most tempting investment pull of a generation, especially amongst young or beginner investors. After all, by painting a different way to buy and sell, cryptocurrency offers something new that we’re all keen to get in on.

By Kim,

- 0 comments

- 9046 views

-

- Added by Kim

-

Buy Call, Sell Put Strategy Explained | SteadyOptions

The Sell Put And Buy Call Strategy is an example of a synthetic stock options strategy: using call and puts options to mimic the performance of a position, usually involving the purchase of a stock. We saw this when looking at the synthetic covered call strategy elsewhere.

By Chris Young,

- 0 comments

- 78819 views

-

- Added by Chris Young

-

Long Straddle Options Strategy | Maximize Profits with Big Moves

Straddle Options Definition

An options straddle strategy is buying (or selling) both a put and call option with the same strike price and expiration date for the same underlying asset, and paying both the put and call premiums.By Pat Crawley,

- 0 comments

- 82689 views

-

- Added by Pat Crawley

-

Gamma Scalping Options Trading Strategy

Gamma scalping is a sophisticated options trading strategy primarily employed by institutions and hedge funds for managing portfolio risk and large positions in equities and futures. As a complex technique, it is particularly suitable for experienced traders seeking to capitalize on market movements, whether up or down, as they occur in real-time.

By Chris Young,

- 0 comments

- 39049 views

-

- Added by Chris Young

-

Long Gamma vs Short Gamma: Options Strategy Explained

Gamma is one of the primary Options Greeks, which measure an option's sensitivity to specific factors that could affect an option price. Despite traders hyping up several different Greeks and second-order Greeks like "Vanna" and "charm," there are only four primary Greeks that you need to be familiar with to understand options trading.

By Pat Crawley,

- 0 comments

- 64570 views

-

- Added by Pat Crawley

-

Predicting Probabilities in Options Trading: A Deep Dive into Advanced Methods

In options trading, the focus should not be on predicting the exact closing price of a ticker on a given date - a near-impossible task given the pseudo-random nature of markets. Instead, we aim to estimate probabilities: the likelihood of a ticker being above a specific value at a certain point in time. This perspective turns trading into a probabilistic exercise, leveraging historical data to make informed decisions.

By Romuald,

- 1 comment

- 23989 views

-

- Comment by blackice

There are no comments to display.

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.

Note: Your post will require moderator approval before it will be visible.