Here are 10 important things about VIX options.

-

VIX options settle in cash and trade in the European style. European style options cannot be exercised until expiration. The options can be opened or closed anytime before expiration. You don’t need to worry about ending up with an unwanted position in VIX after expiration. If your VIX options expire In-The-Money (ITM), you get a cash payout. The payout is the difference between the strike price and the VRO quotation on the expiration day (basically the amount the option is ITM). For example, the payout would be $2.50 if the strike price of your call option strike was $15 and the VRO was $17.50.

-

Expiration Days: VIX options do not expire on the same days as equity options. The Expiration Date (usually a Wednesday) will be identified explicitly in the expiration date of the product. If that Wednesday is a market holiday, the Expiration Date will be on the next business day. On the expiration Wednesday the only SPX options used in the VIX calculation are the ones that expire in 30 days. Last Trading Day for VIX options is the business day prior to the Expiration Date of each contract expiration. When the Last Trading Day is moved because of a Cboe holiday, the Last Trading Day for an expiring VIX option contract will be the day immediately preceding the last regularly scheduled trading day.

-

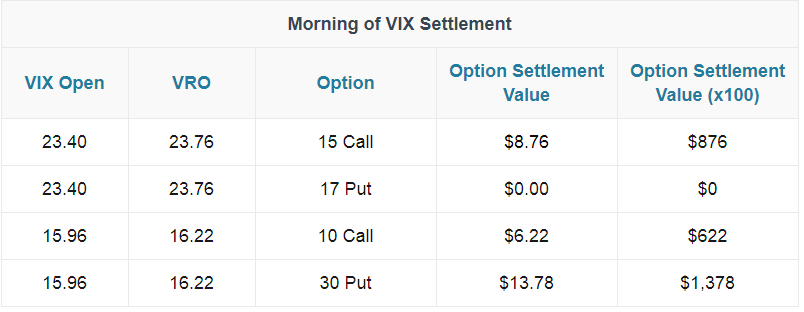

The exercise-settlement value for VIX options (Ticker: VRO) is a Special Opening Quotation (SOQ) of VIX calculated from the sequence of opening prices during regular trading hours for SPX of the options used to calculate the index on the settlement date. The opening price for any series in which there is no trade shall be the average of that option's bid price and ask price as determined at the opening of trading. Click here for Settlement Information for VIX options. For example:

Table courtesy of projectoption.com.

-

Contract Expirations: Up to six 6 weekly expirations and up to 12 standard (monthly) expirations in VIX options may be listed. The 6 weekly expirations shall be for the nearest weekly expirations from the actual listing date and standard (monthly) expirations in VIX options are not counted as part of the maximum six weekly expirations permitted for VIX options. Like the VIX monthlys, VIX weeklys usually expire on Wednesdays.

-

VIX Options Trading Hours are 8:30 a.m. to 3:15 p.m. Central time (Chicago time). Extended hours are 2:00 a.m. to 8:15 a.m. Central time (Chicago time). CBOE extended trading hours for VIX options in 2015. The ability to trade popular VIX options after the close of the market provides traders with a useful alternative, especially from overseas market participants looking to gain exposure to the U.S. market and equity market volatility. VIX options are among of the most actively traded contracts the options market has to offer.

-

VIX options are based on a VIX futures, not the spot index ($VIX) quote. Therefore VIX options prices are based on the VIX futures prices rather than the current cash VIX index. To understand the price action in VIX options, look at VIX futures. This can lead to unusual pricing of some VIX strategies. For example, VIX calendars can trade at negative values. This is something that can never happen with equity options.

-

Hedging with VIX options: VIX can be used as a hedging tool because VIX it has a strong negative correlation to the SPX – and is generally about four times more volatile. For this reason, traders many times would buy of out of the money calls on the VIX as a relatively inexpensive way to hedge long portfolio positions. Similar hedges can be constructed using VIX futures or the VIX ETNs.

-

VIX is a mean-reverting index. Many times, spikes in the VIX do not last and usually drop back to moderate levels soon after. So, unless the expiration date is very near, the market will take into account the mean-reverting nature of the VIX when estimating the forward VIX. Hence, VIX calls are many times heavily discounted whenever the VIX spikes.

-

VIX options time sensitivity: VIX Index is the most sensitive to volatility changes, while VIX futures with further settlement dates are less sensitive. As a result, longer-term options on the VIX are less sensitive to changes implied volatility. For example, between September 2nd and October 10th 2008, the following movements occurred in each volatility product:

Product

Sep. 02 - Oct. 10 Change

VIX Index

+218%

October VIX Future

+148%

November VIX Future

+67%

December VIX Future

+47%

Table courtesy of projectoption.com.

So, while trading long-term options on the VIX might give you more time to be right, volatility will need to experience much more significant fluctuations for your positions to profit.

-

Option Greeks for VIX options (e.g. Implied Volatility, Delta, Gamma, Theta) shown by most brokers are wrong. Options chains are usually based on the VIX index as the underlying security for the options. In reality the appropriate volatility future contract is the underlying. For example, August VIX options are based on August VIX futures, not VIX spot.

Related articles:

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account. It's easy and free!

Register a new account

Sign in

Already have an account? Sign in here.

Sign In Now