Related articles

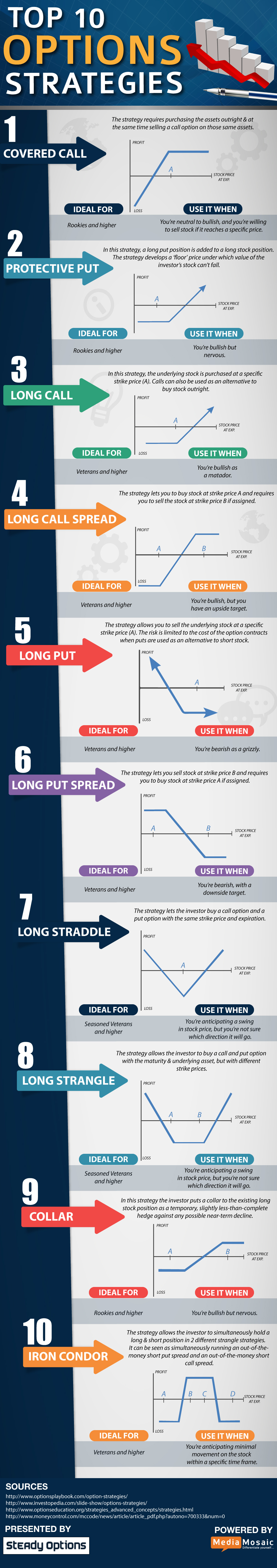

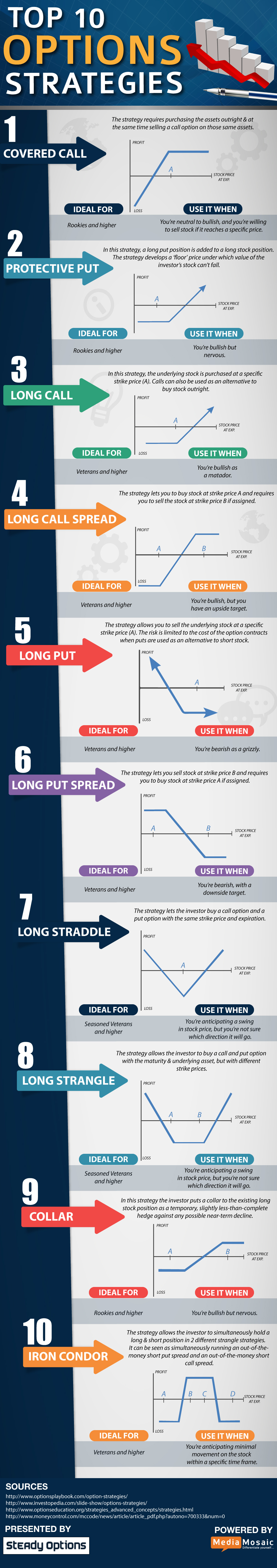

- How We Trade Straddle Option Strategy

- How We Trade Calendar Spreads

- Trading An Iron Condor: The Basics

- Using Directional Butterfly Spread

We invite you to join us and learn how we use different types of options strategies.

Related articles

We invite you to join us and learn how we use different types of options strategies.

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.

Note: Your post will require moderator approval before it will be visible.