But adding other equity asset classes to an equity portfolio, such as small cap and value, can increase diversification and expected returns at the expense of occasional "tracking error regret".

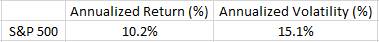

We will look at the period 1970-2018 in our examples. Starting with the S&P 500:

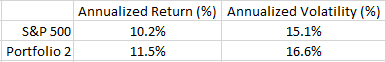

The first step will be to diversify the S&P 500 by holding US small cap stocks. We'll shift half our S&P 500 holding into the Dimensional US Small Cap Index, and rebalance annually.

Portfolio 2

50%: S&P 500 Index

50%: Dimensional US Small Cap Index

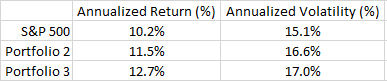

Our next step is to further diversify our holdings to include large and small cap value stocks. We'll again shift half our S&P 500 holdings to make room for the Dimensional US Large Cap Value Index, and half our small cap holdings to make room for the Dimensional US Small Cap Value Index.

Portfolio 3

25%: S&P 500 Index

25%: Dimensional US Large Cap Value Index

25%: Dimensional US Small Cap Index

25%: Dimensional US Small Cap Value Index

The effect of adding small cap and value stocks to the portfolio is an increase in annualized return from 10.2% to 12.7%, a relative increase of 24.5%. This outcome is what we should have expected to see as we added riskier small cap and value stocks to our portfolio. Therefore, we also need to consider how our changes impacted the risk of the portfolio. The annualized volatility increased from 15.1% to 17%, or a relative increase of 12.6%. This means returns increased by 24.5%, but risk only increased by 12.6%, highlighting the power of diversification.

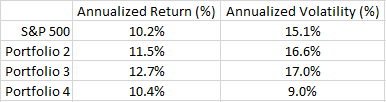

Some investors may be more interested in using diversification to build a portfolio with less risk for a roughly equivalent return. We can do this as well by adding the stability of 5 Year US Treasury Notes to the portfolio.

Portfolio 4

12.5%: S&P 500 Index

12.5%: Dimensional US Large Cap Value Index

12.5%: Dimensional US Small Cap Index

12.5%: Dimensional US Small Cap Value Index

50%: 5 Year US Treasury Notes

Compared with the S&P 500, portfolio 4 achieved a similar return with far less risk (about 40% less). The impact of this reduction in volatility is a worst year of just -12.6% vs. -37% for the S&P 500, and a maximum drawdown of 25.2% vs. 51% for the S&P 500. Another compelling statistic is the performance during "the lost decade", where the S&P 500 produced an annualized return of -1% per year. Portfolio 4 was up more than 7.2% per year during this period, more than doubling the total portfolio value.

Of course, the trade off of a portfolio with 50% in low risk bonds is reduced upside potential during raging bull markets. From 2009-2018, portfolio 4 underperformed the S&P 500 by approximately 5% per year, which can cause investors to lose perspective. Since most investors are risk averse, this may be an acceptable price to pay during bull markets in exchange for much smaller losses during bear markets.

The last important note is that none of the above portfolios required "active management" such as stock picking or market timing. Building an efficient passively managed asset class portfolio can be done based solely on a good understanding of the academic research highlighting the differences in expected returns among stocks and bonds.

Jesse Blom is a licensed investment advisor and Vice President of Lorintine Capital, LP. He provides investment advice to clients all over the United States and around the world. Jesse has been in financial services since 2008 and is a CERTIFIED FINANCIAL PLANNER™. Working with a CFP® professional represents the highest standard of financial planning advice. Jesse has a Bachelor of Science in Finance from Oral Roberts University. Jesse contributes to the Steady Condors newsletter.

There are no comments to display.

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.

Note: Your post will require moderator approval before it will be visible.