Options provide investors with the ability to proactively hedge their portfolios against potential market crashes. In this article, we will discuss the importance of being proactively hedged in an options portfolio.

Why to Hedge?

One of the most critical reasons why it is important to be proactively hedged in an options portfolio is that it is too late to hedge once a market crash has already started.

When a market crash occurs, the prices of stocks plummet, and investors suffer significant losses. The time to hedge your portfolio is before the crash occurs, not after. Proactive hedging involves taking steps to protect your portfolio before the market downturn occurs.

Proactive hedging involves purchasing options that will benefit from a market downturn. These options are typically put options, which give the holder the right to sell an underlying asset at a predetermined price.

When the market crashes, the value of these put options increases, offsetting the losses incurred in the underlying stock. Another reason why it is important to be proactively hedged in an options portfolio is that it can help reduce the overall risk of the portfolio.

By purchasing put options, investors are essentially buying insurance against potential market downturns. While the cost of these options can be significant, they can provide a significant return on investment if a market crash occurs. In essence, proactive hedging is a form of risk management that can help protect investors from significant losses.

Furthermore, proactive hedging can also help investors take advantage of market opportunities. When the market is in a downturn, there are often opportunities to purchase stocks at discounted prices. By hedging their portfolios, investors can protect themselves against losses while still having the capital available to take advantage of these opportunities.

The Collar

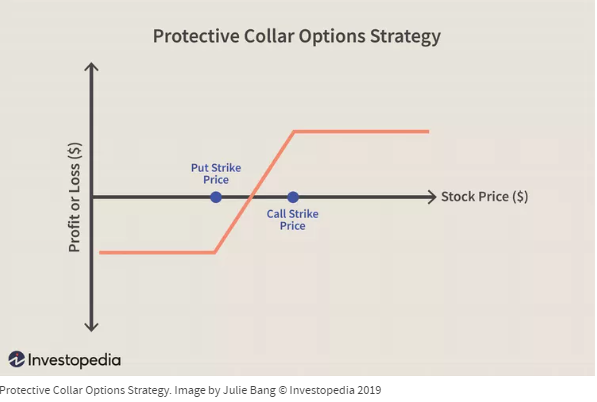

There is a well known technique used to be proactively hedged while looking to profit. This technique is called the "collar" strategy.

This strategy involves simultaneously purchasing put options to protect against downside risk while selling call options to generate income. The income generated from selling the call options can be used to finance the purchase of the put options, effectively creating a "collar" around the portfolio.

A collar is a trading strategy that is commonly used to limit the potential loss of an underlying asset while also capping its potential profit. It is created by combining a long position in an asset with a protective put option and a short call option.

While a collar can be an effective way to protect an investor's position in the market, there are several weaknesses to this trade structure. Here are a few examples:

-

Limited Profit Potential: One of the main weaknesses of a collar is that it limits the potential profit that an investor can make. By using a protective put option and a short call option, the investor is essentially giving up some of their potential gains in exchange for protection against losses. While this may be a smart move in certain market conditions, it can also be a hindrance in others.

-

Costly to Implement: Another weakness of a collar is that it can be expensive to implement. This is because the investor must pay for both the protective put option and the short call option. Depending on the price of the underlying asset and the specific options being used, this cost can add up quickly.

-

Requires Active Management: A collar also requires active management in order to be effective. This means that the investor must be constantly monitoring the market and their position in order to make informed decisions about when to adjust the collar. This can be time-consuming and stressful for some investors.

The Alternatives

The collar strategy, while well-known, has some weaknesses that can limit an investor's potential gains and require active management. However, there are lesser-known strategies that can achieve the goal of proactively hedging without these downsides. These advanced techniques involve combining ratio spreads with butterflies and relying on second-order Greeks. As a result, these strategies offer several advantages, including:

-

Greater Flexibility: These advanced strategies are more flexible than the collar strategy, allowing for more nuanced adjustments to an investor's position in response to changing market conditions.

-

Lower Cost: These strategies are less expensive to implement than the collar strategy, which can require the purchase of both a protective put option and a short call option.

-

Potential for Higher Gains: By relying on second-order Greeks and combining ratio spreads with butterflies, these strategies have the potential for higher gains than the collar strategy.

- Reduced Need for Active Management: These advanced strategies can require less active management than the collar strategy, which can be a benefit for busy investors or those who prefer a more hands-off approach.

While the collar strategy has its place in certain market conditions, there are advanced options trading strategies that can offer several advantages over the collar strategy. These techniques are worth exploring for investors who are interested in proactively hedging their positions while also maximizing their potential gains.

Conclusion

In conclusion, investing in the stock market can be risky and unpredictable, but options trading can provide a way to proactively hedge against potential market crashes.

Being proactively hedged involves taking steps to protect your portfolio before a market downturn occurs. The collar strategy is a well-known technique used for proactively hedging, but it has some weaknesses that can limit an investor's potential gains and require active management. However, there are advanced options trading strategies that can offer greater flexibility, lower cost, potential for higher gains, and reduced need for active management.

Ultimately, investors should consider all options trading strategies to find the one that best suits their risk tolerance, investment goals, and market conditions. By proactively hedging their portfolios, investors can reduce their risk exposure, take advantage of market opportunities, and potentially achieve higher returns.

About the Author: Karl Domm's 29+ years in options trading showcases his ability to trade for a living with a proven track record. His journey began as a retail trader, and after struggling for 23 years, he finally achieved

consistent profitability in 2017 through his own options-only portfolio using quantitative trading strategies.

After he built a proven trading track record, he accepted outside investors. His book, "A Portfolio for All Markets," focuses on option portfolio investing. He earned a BS Degree from Fresno State and currently resides in Clovis, California. You can follow him on YouTube and visit his website real-pl for more insights.

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account. It's easy and free!

Register a new account

Sign in

Already have an account? Sign in here.

Sign In Now