I personally think it's the wrong question to ask, instead, investors should determine if the approach is systematic (rules-based) or discretionary (human judgement based).

If you decide to keep it simple and buy either an S&P 500 or US Total Stock Market index fund to represent all or most of your portfolio, recognize that you've made an active management decision. This is because the US represents approximately half of the global equity market, and excluding International and Emerging Markets from your portfolio is an active bet on the US outperforming the rest of the world over your lifetime. So even buying a passively managed cap weighted index fund can be an active management decision. Perhaps only the "global market portfolio" is truly passive investing.

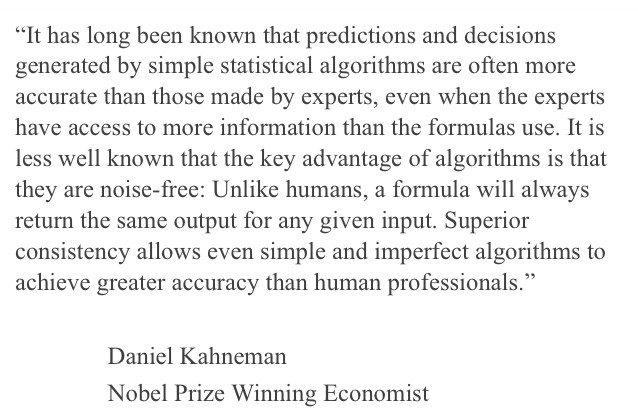

Instead, examine your personal beliefs on whether human based judgement can reliably add value over the long term vs. a well researched evidenced based investing approach that is implemented in a systematic manner. I'll disclose my bias with a quote from Daniel Kahneman:

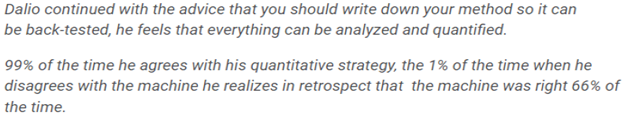

Also, consider Ray Dalio's point of view on this topic:

If you're still not convinced, think about how you feel this month with the equity markets around the world dropping like a rock. Do you think that acting on emotions you feel during times like these will be based on well thought out long-term analysis? From my personal experience along with working with others, the answer to that question is obvious.

Jesse Blom is a licensed investment advisor and Vice President of Lorintine Capital, LP. He provides investment advice to clients all over the United States and around the world. Jesse has been in financial services since 2008 and is a CERTIFIED FINANCIAL PLANNER™. Working with a CFP® professional represents the highest standard of financial planning advice. Jesse has a Bachelor of Science in Finance from Oral Roberts University. Jesse is managing the LC Diversified portfolio and forum, the LC Diversified Fund, as well as contributes to the Steady Condors newsletter.

There are no comments to display.

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.

Note: Your post will require moderator approval before it will be visible.