While the past cannot guarantee future outcomes, it remains our most reliable resource for understanding market behavior. Previously, I outlined how Monte Carlo simulations can be used to estimate these probabilities. But relying solely on one method is limiting. Diversifying the ways we calculate probabilities adds robustness to the analysis.

In this article, I will delve deeply into three additional methods for calculating probabilities: Hidden Markov Models (HMM), seasonality-based probabilities, and implied probabilities derived from options prices. Each method has distinct advantages and complements the Monte Carlo approach, providing a comprehensive framework for assessing Credit Put Spreads.

1. Hidden Markov Models (HMM): Unveiling Hidden Market Dynamics

Hidden Markov Models (HMM) are a sophisticated machine learning technique designed to analyze time-series data. They operate on the assumption that observed data (e.g., ticker prices) are generated by an underlying set of "hidden states" that cannot be directly observed. These states represent distinct market conditions, such as bullish trends, bearish trends, or periods of low volatility.

How HMM Works

-

Defining Observations and States:

- The observed data in this context are the historical closing prices of the ticker.

-

The hidden states are abstract conditions influencing price movements. For example:

- State 1 (Bullish): Higher probabilities of upward price movements.

- State 2 (Bearish): Higher probabilities of downward price movements.

-

State 3 (Neutral): Limited price movement or consolidation.

-

Training the Model:

- The HMM is trained on historical price data to learn the transition probabilities between states and the likelihood of observing specific price changes within each state.

-

For example, the model might learn that a bullish state is likely to transition to a neutral state 30% of the time, and remain bullish 70% of the time.

-

Making Predictions:

- Once trained, the HMM can estimate the current state of the market and use this information to predict future price movements.

-

It calculates the probability of the ticker being above a specific threshold on a given date by analyzing likely state transitions and their associated price changes.

Advantages of HMM in Options Trading

- Pattern Recognition: HMM excels at identifying non-linear patterns in price movements, which are often overlooked by simpler models.

- Dynamic Analysis: Unlike static models, HMM adapts to changing market conditions by incorporating state transitions.

- Probability Estimation: For a Credit Put Spread, HMM provides a probabilistic measure of whether the underlying will remain above the short strike based on historical market behavior.

By capturing hidden dynamics, HMM offers a more nuanced view of market probabilities, making it a valuable tool for assessing risk and reward in Credit Put Spreads.

2. Seasonality-Based Probabilities: Unlocking Historical Patterns

Seasonality refers to recurring patterns in price movements influenced by factors such as economic cycles, investor behavior, or external events. In options trading, seasonality-based probabilities quantify how often a ticker's price has exceeded a certain percentage of its current value over a specific time horizon.

How to Calculate Seasonality-Based Probabilities

-

Define the Threshold:

-

The threshold is expressed as a percentage relative to the current price (e.g., -2%, +0%, +2%). This normalization ensures the probability calculation is independent of the absolute price level.

-

The threshold is expressed as a percentage relative to the current price (e.g., -2%, +0%, +2%). This normalization ensures the probability calculation is independent of the absolute price level.

-

Analyze Historical Data:

- For a given holding period (e.g., 30 days), calculate the percentage change in price for each historical observation.

-

Example: If the current price is $100, and the threshold is +2%, count how often the price exceeded $102 after 30 days in the historical data.

-

Aggregate the Results:

- Divide the number of times the threshold was exceeded by the total number of observations to calculate the probability.

-

Example: If the price exceeded the threshold in 70 out of 100 instances, the probability is 70%.

Applications in Credit Put Spreads

Seasonality-based probabilities answer the question: "In similar conditions, how often has this ticker remained above the breakeven?" This approach is particularly useful for ETFs, which often exhibit more predictable patterns than individual stocks. For example, certain sectors might perform better during specific times of the year, providing an additional layer of insight.

Limitations to Consider

- Seasonality probabilities rely entirely on historical data and assume that past patterns will persist. While this is often true for ETFs, it may be less reliable for individual stocks or during periods of market disruption.

3. Implied Probabilities from Options Prices: Extracting Market Sentiment

Options prices are more than just numbers; they encapsulate the collective beliefs of market participants about future price movements. By analyzing the prices of puts and calls across various strikes for a given expiration date, we can derive the implied probabilities of the ticker being in specific price ranges.

Steps to Calculate Implied Probabilities

-

Collect Options Data:

- Obtain the bid-ask prices for puts and calls at different strike prices for the desired expiration date.

-

Calculate Implied Volatility:

- Use the options prices to derive the implied volatility (IV) for each strike. IV reflects the market's expectations of future price volatility.

-

Estimate Probabilities:

- For each strike, calculate the probability of the ticker being at or above that level by using IV and the Black-Scholes model (or similar methods).

-

The probabilities are then aggregated to construct a distribution of expected prices at expiration.

Why Implied Probabilities Matter

- Market Consensus: Implied probabilities reflect what the market "thinks" about the future, offering a forward-looking perspective.

-

Dynamic Adjustments: Unlike historical methods, implied probabilities adapt in real-time to changes in market sentiment, such as news events or macroeconomic data.

Application to Credit Put Spreads

For a Credit Put Spread, implied probabilities can answer questions such as: "What is the market-implied likelihood that the ticker will remain above the short strike?" This insight helps traders align their strategies with prevailing market sentiment.

Conclusion

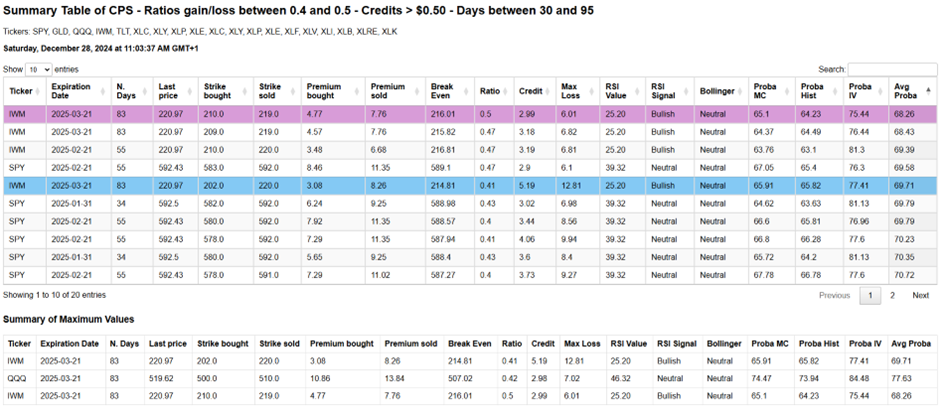

By integrating these three methods—Hidden Markov Models, seasonality-based probabilities, and implied probabilities from options prices—into my existing Monte Carlo framework, I’ve developed a robust system for evaluating Credit Put Spreads. This approach enables a comprehensive analysis of Out-of-the-Money (OTM) Credit Put Spreads among a selection of ETFs, filtering for:

- Gain/loss ratios within specific thresholds,

- Expiration dates within a defined range,

-

A minimum credit of $0.50.

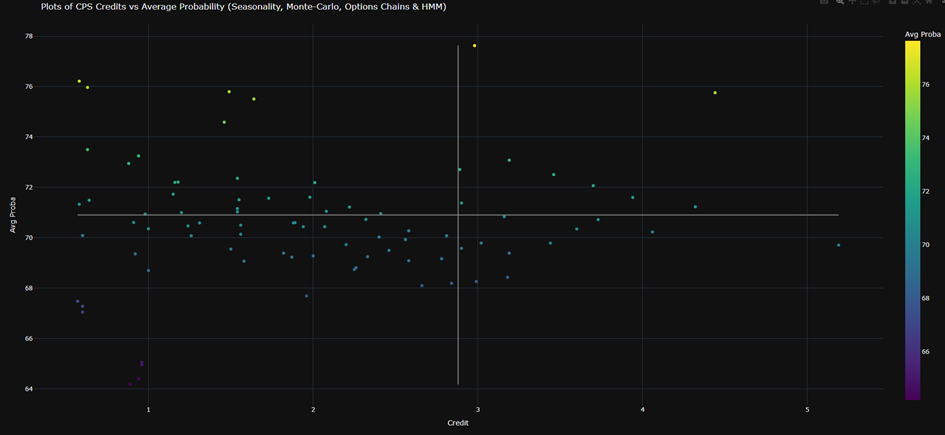

The result is what I like to call a “stellar map” of selected spreads:

accompanied by a summary table:

These tools provide clarity and actionable insights, helping traders identify the best trades—those offering the highest probability of success while maximizing potential returns relative to risk.

Looking ahead, the next step will involve calculating the expected value ($EV) of these trades, combining probabilities and potential outcomes to further refine the selection process.

The ultimate goal remains the same: to stack the odds in our favor—not by predicting exact prices, but by estimating probabilities with precision and rigor.

Stay tuned as I continue refining these methods and expanding their applications!

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.

Note: Your post will require moderator approval before it will be visible.