For this reason, front month expirations will generally have higher IVs than back months. After earnings, the implied volatility falls more in the front months than in the back months for this reason.

There are various measurements to view this effect. Measuring the effect starts with estimating where IV will fall in each of the expirations. This can be accomplished by estimating an earnings effect in each month and varying the effect until the relationship between the IVs make a rational term structure. A rational term structure is where the expirations fit into a smooth curve drawn over time. The term structure is not necessarily a flat as many calculations use. Sometimes the term structure will solve to contango, with aa lower front month, or in backwardation with higher front IVs than back month IVs.

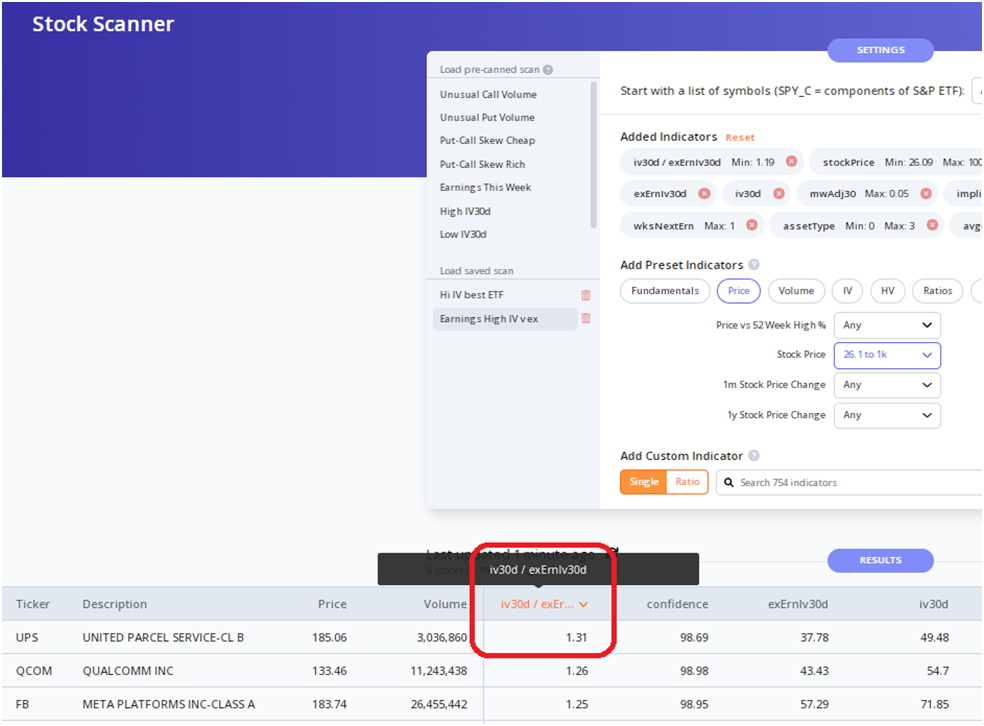

When the part of IV that is the earnings effect is extracted from the raw IV, an ex-earnings IV can be compared. Below is a list of stocks with IV 30 day divided by ex-earnings IV 30 day sorted from highest to lowest.

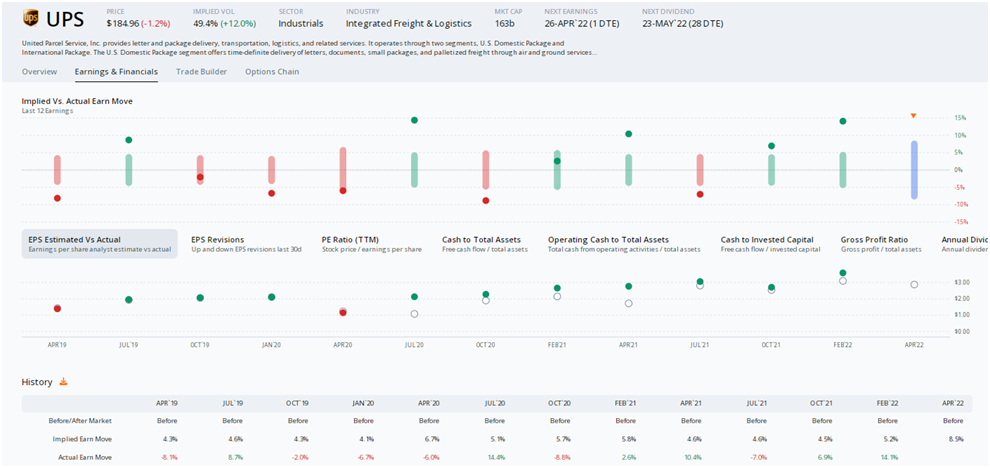

UPS is the highest ratio at 1.31 with the IV=49.48% and ex earnings IV=37.78%.

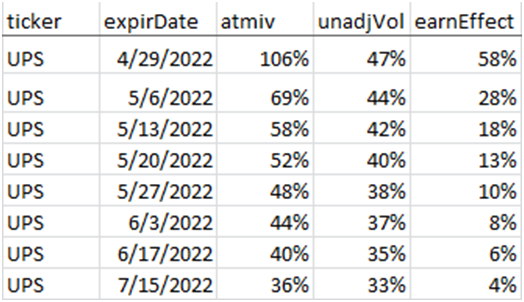

Here's a view of the monthly unadjusted ATM IV for UPS. May 27th is about 30 days out and the IV is 48%. Constructing a rational term structure taking out an earnings effect over the months makes a 38% ex earnings IV for May 27th. The front month of 4/29/22 trading at 106% IV is expected to come down to 47%. The term structure, post earnings is still in backwardwardation.

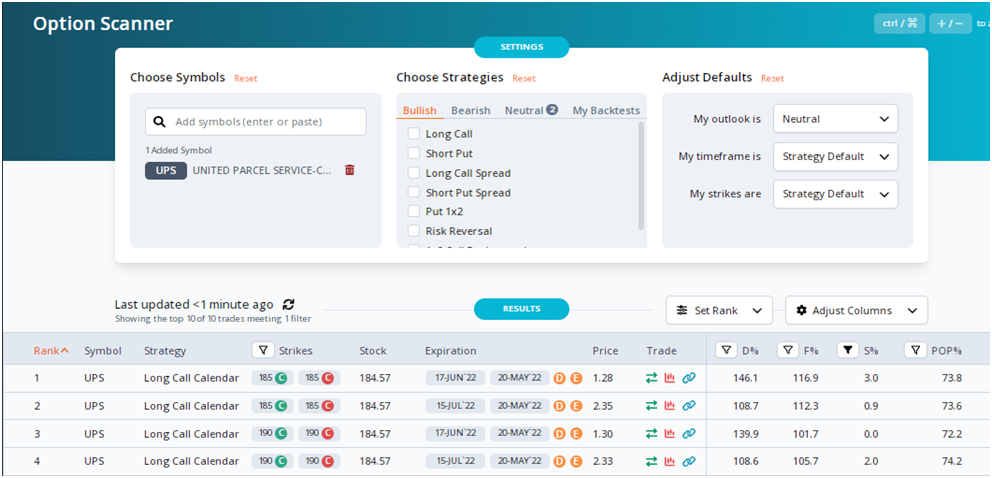

An options trade to take advantage of this high IV vs ex earnings IV is a time spread or calendar spread.

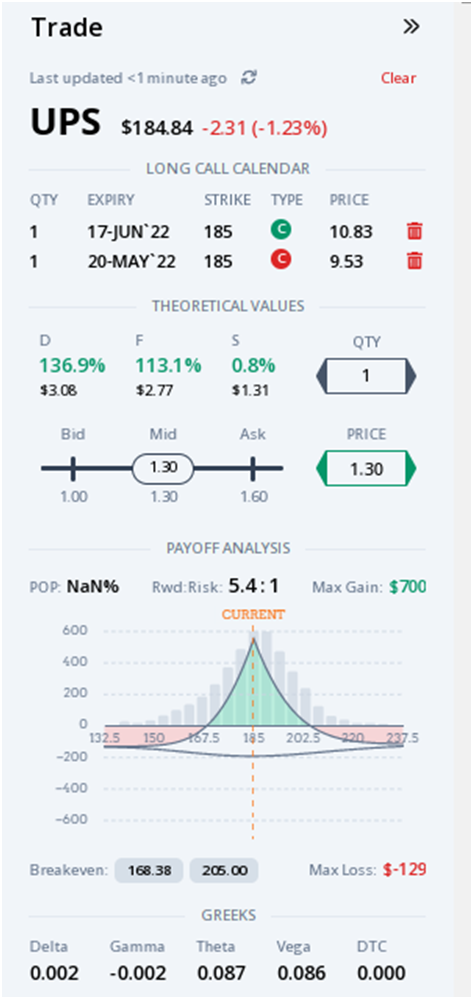

The May-20 June-17 $185 Long Call Calendar has the following profile:

The break even points are estimated at $168.38 -9% and $205 +11%.

The history of UPS moves versus expectations are below:

There are two moves of +14% in the last 12 observations but the rest of the earnings moves would probably result in a winning trade.

About the Author: Matt Amberson, Principal and Founder of Option Research & Technology Services. ORATS was born out of a need by traders to get access to more accurate and realistic option research. Matt started ORATS to support his options market making firm where he would hire statistically minded individuals, put them on the floor, and develop research to aid in trading options. He is heavily involved with product design and quantitative research. ORATS offers data and backtesting on a subscription basis at www.orats.com. Matt has a Master’s degree from Kellogg School of Business.

There are no comments to display.

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.

Note: Your post will require moderator approval before it will be visible.