The first approach is to take a fixed dollar withdrawal each year, plus inflation increases. For example, a $1,000,000 portfolio might begin with a $40,000 withdrawal in the first year that is increased by 3% annually to help offset inflation.

Fixed dollar + 3%

Year 1: $40,000

Year 2: $41,200

Year 3: $42,436

Etc.

The advantage of this approach is that it produces predictable cash flows for spending purposes. The disadvantage is that the lack of flexibility means the investment portfolio could potentially be depleted if long-term performance ends up being worse than expected. Alternatively, the portfolio could grow substantially over time to where the individual ends up spending far less than what they could have afforded to. The result would be a large legacy to beneficiaries, which may or may not be the desirable outcome.

The second approach is to take a fixed percentage withdrawal each year, based on the current portfolio value. For example, a $1,000,000 portfolio with a 4% annual withdrawal would produce the same $40,000 withdrawal in the first year. Due to market performance, this will be different each year thereafter.

Fixed percentage

+15% portfolio return: $1,150,000 * 4% = $46,000 withdrawal

Or…

-15% portfolio return: $850,000 * 4% = $34,000 withdrawal

The advantage of this approach is that the portfolio can never be depleted, and there is significant upside spending potential when market performance is strong. The disadvantage is that spending amounts can be volatile each year,which may be unrealistic for those who need a certain dollar amount every year from their portfolio to cover fixed living expenses. Those in this situation might consider deferring social security and also annuitizing part of their nest egg so that a higher amount of fixed living expenses are covered by sources of guaranteed lifetime income.The remaining portfolio value can then be used to produce a fixed percentage withdrawal that can fund discretionary spending.

The third approach is a hybrid where an investor would use a fixed percentage withdrawal, but then place a floor on how much spending may be cut from the prior year and a cap on how much spending can be increased. For example, a $1,000,000 portfolio with the same 4% withdrawal rate could be modeled along with a -3% floor and +5% cap.

Fixed percentage plus floor and cap

Year 1 withdrawal: $40,000

Year 2 spending floor = $40,000 * -3% = $38,800

Year 2 spending cap = $40,000 * 5% = $42,000

If we use the same positive or negative 15% portfolio returns for the year as in example 2, we see that the withdrawal amount would be the floor or cap amount for the year since the 4% of the $850,000 and $1,150,000 portfolio values would be below the floor and above the cap. The end result is a withdrawal strategy that combines the advantages of both the fixed dollar amount and the fixed percentage withdrawal strategies. Adding some flexibility to withdrawals incorporates the impact of market performance, but within a more predictable range than a pure fixed percentage approach.

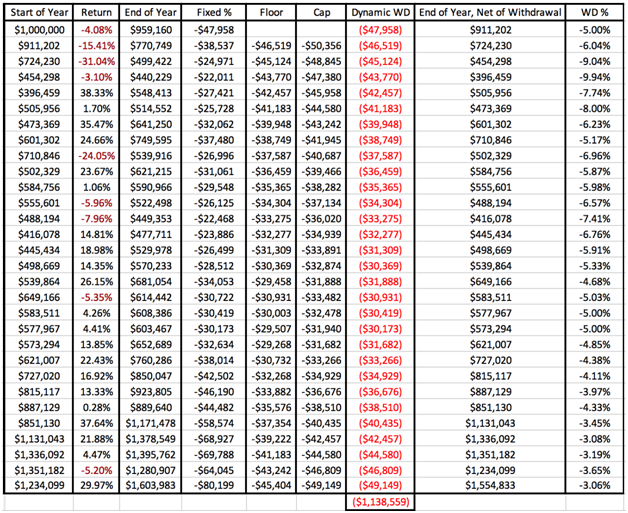

Stress Test: 1929 - The mother of all bear markets

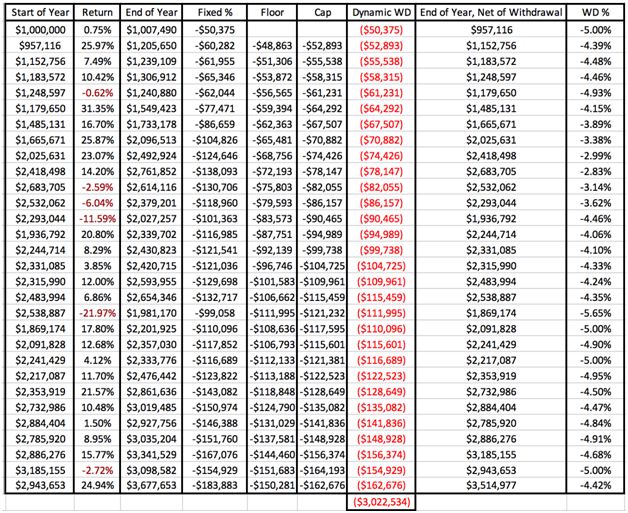

Portfolio: 70% S&P 500, 30% 5 Year US Treasury Notes

Rebalance: Annually

Withdrawal rule: 5% of end of year portfolio value, -3% floor, +5% cap

Past performance doesn’t guarantee future results. No deduction of taxes or fees are included, and indexes are not available for direct investment.

Recent History: 1990-2019

Summary

There are many different ways to spend from a portfolio during retirement. Some investors prefer to change their portfolio so that the securities provide the cash flows through dividends, but this is not recommended as it moves an investor away from the optimal portfolio that is well diversified and/or results in underconsumption. A total return approach, where withdrawals are based on a hybrid model combining the advantages of the fixed dollar amount and fixed percentage withdrawal strategies, is more likely to produce desired outcomes and is also more tax efficient. The chosen percentage withdrawal rate can be adjusted up or down based on the expected number of years that withdrawals will be taken and based on the chosen allocation between stocks and bonds. Furthermore, different floor and cap rates can be chosen to meet each individual’s tolerance for variations in spending. For this reason, the assistance of a qualified financial advisor is recommended.

Jesse Blom is a licensed investment advisor and Vice President of Lorintine Capital, LP. He provides investment advice to clients all over the United States and around the world. Jesse has been in financial services since 2008 and is a CERTIFIED FINANCIAL PLANNER™ professional. Working with a CFP® professional represents the highest standard of financial planning advice. Jesse has a Bachelor of Science in Finance from Oral Roberts University.

There are no comments to display.

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.

Note: Your post will require moderator approval before it will be visible.