The Index and the Index-based ETF

The starting place is understanding the differences between an Index and an Index-based ETF. Indices are numerical calculations and have no physical existence (sort of like digital currency). On the other hand, one can replicate an index by buying the components that make up the Index. That's what Index-based ETFs such as SPY do. The ETF buys the underlying stocks in the proportions necessary to mimic the associated index. One can buy or sell an ETF. One cannot buy or sell an Index.

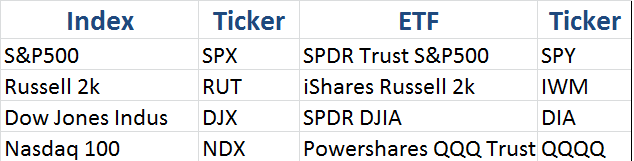

So, let's look at the major indices (most popular) and the ETFs that replicate them. Other Indices and ETFs exist, but they are more thinly traded and present some nuance beyond the scope of this article.

One way to indirectly invest in an index is to invest in an ETF that corresponds to the index. However, though one can't directly invest in an Index, they can trade options on it.

Settlement

SPY, DIA, QQQ and IWM are ETFs and their options are American style. Both the last trading day and expiration day for these options are the same: the third Friday of the month just like options on individual stocks.

SPX, DJX, NDX, and RUT are indexes and their options are Index Options. They are European Style options, which means that their monthly “last trading day” is different than those of ETFs. Index options expire on the third Friday of the month, so their last trading day is the third Thursday of the month.

If you are not familiar with the important differences between these option styles, check out this post. I recommend NEVER holding RUT options into settlement Friday to avoid settlement risk.

Assignment Risk

Some investors use call or put spreads in IRAs. Some use bull spreads and some bear spreads. Whether they are calls or puts, bull or bear, one leg is always "short" and susceptible to assignment. This possibility is magnified around the ex-dividend date.

The short call assignment: If the investor used a call spread and the short leg is assigned ... well, "Houston We Have a Problem". IRAs do not permit the short sale of stock, and if a short call is assigned one must immediately cover the short. Well one can't cover a short unless one has cash available to execute a closing buy of the short. If ready cash isn't sufficient it will necessitate selling other holdings. If there isn't sufficient cash under any circumstance they jeopardize the tax deferral of the entire IRA. If you've ever encountered this, you know what a mess it is. ETF options run that risk, index options do not. BIG difference.

If one is using call spreads in an IRA it practically mandates using SPX, not SPY.

The short put assignment: Unlike naked shorts, naked puts are permitted in IRAs provided there is sufficient cash on hand to cover an assignment (cash secured puts). So that problem is self-remedied. However, if one is using put spreads and not cash secured puts, they run the risk of being assigned without sufficient cash to cover the assignment. So, cash-secured-puts can use SPY options, while put spreads should consider SPX.

Covered calls: There's the counterpart to "assignment" ... getting "called away". In this situation, one owns SPY and sells a covered call. Well, if the call goes ITM, one risks it being exercised and SPY is automatically liquidated. This isn't the technical problem resultant from spreads, but it can be an inconvenience. Additionally, one would incur cost to reinstitute the position. They might even have to reinstitute at a higher price. SPX options would just make the cash adjustment.

What most investors don't know is that the CBOE allows one to pair Index options with its corresponding ETF. So one isn't restricted to pairing SPY options with SPY, but can sell covered calls using SPX. Some broker-dealers may not permit this, so check with your broker. Just because the CBOE allows it, doesn't mean the BD has the capability of allowing it.

Liquidity

SPY has very "tight" bid/ask spreads. This helps planning because one has a pretty could idea of the execution price. It also enables the use of market orders which are easier and can execute much quicker than limit orders. When using market orders, many brokers (I know Fidelity does) offer price improvements that can result in favorable execution prices.

SPX, on the other hand, has a relatively wide bid/ask spread when compared to SPY. This means that limit orders are a must. That means some "bargaining" with the price and much slower execution. It is more time intensive, less precise and one never really knows if they received the best price.

Some traders prefer ETFs like SPY or IWM due to better liquidity. What they often forget is the fact that Index options are 10 times bigger product, so 20 cents spread on RUT is equivalent to 2 cents spread on IWM. For example, spread of 10.00/10.50 on RUT would be equivalent to 1.00/1.05 on IWM. The slippage on RUT is usually no more than 10-15 cents which is 1-1.5 cents on IWM.

Position size

There are differences in size of the contracts. For example, the SPY is 1/10 the size of the SPX and the IWM is 1/10 the size of the RUT. To build the same dollar amount position, you will need to buy 10 times more contracts on IWM than on RUT. That means you will need 10 contracts of IWM for every one RUT option to have the same profit potential. But small traders may not want to trade as much as a one-lot in RUT, and can invest smaller sums by trading a few contracts of IWM.

Commissions

Buying less contracts means a significant difference in commissions. For example: if you buy one lot of 10 strike RUT Iron Condor, you will trade 8 round trip contracts. At $1/contract, that's $8 or 0.8% of the $1,000 margin. Buy 10 lots of 1 strike IWM Iron Condor - and the commissions jump to $80 or 8% of the $1,000 margin.

Tax Treatment Differences

Here there is a substantial plus to Index options. The IRS treats these indexes differently from stocks (or ETFs).

The Index options get special Section 1256 treatment which enables the investor to have 60% of a gain as long term (at a 15% tax rate), and the other 40% treated as short term (at the regular 35% short term capital gains rate) even if the position is held for less than a year.

By contrast, the ETFs are treated as ordinary stocks, and thus if held less than a year, all gains are taxed at the less favorable 35% short-term capital gains rate.

Thus the Index options can be better from a tax standpoint. You should of course consult with your tax advisor to see how these tax implications may or may not be significant in your situation.

Verdict: SPX tax treatment is significantly better than SPY. SPY has an advantage in LEAPS, but from a practical point of view, it can't even come close to the advantages offered SPX. Remember, it's not what you make it's what you keep that matters.

Summary

There are many factors to consider in choosing SPY options versus SPX options. Each has their advantages and shortcomings.

SPX clearly wins the "assignment risk" war, the "trading costs" war and the "taxable account" war. It loses on flexibility and convenience.

For those that trade options in IRAs and ROTHs, SPX should be very seriously considered. Sometimes it's better to pay a little and NOT be sitting on a time-bomb.

For those with taxable accounts the tax advantages afforded SPX dwarfs any increase in costs. In the end it comes down to one's willingness to spend extra time and effort to achieve tax savings..

For me, the choice is clear: I prefer RUT over IWM and SPX over SPY. But it might be different for you, as you might have a different commissions structure, different tax treatment, prefer smaller size trades etc.

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.

Note: Your post will require moderator approval before it will be visible.