The study revealed that only 3% to 5% of issues fell within acceptable ranges predicted by Black-Scholes. That is dismal.

The question of reliability is only one of two question, the second being whether or not a pricing formula is necessary to time trades. Because options are derivatives of the underlying security, it makes more sense to time trades based on historical volatility combined with strongly confirmed technical signals.

Shunning implied volatility and Black-Scholes is a heretical view about options, but it simply makes sense. Black-Scholes is so full of holes that the formula is unreliable, and the logic of this is evident. Fischer Black himself identified nine specific problems with the original formula 15 years after its publication. His article, “The Holes in Black Scholes,” highlighted nine flawed assumptions. These flaws were further augmented in a paper published by EspenGaarderHaug and Nassim Nicholas Taleb in the Journal of Economic Behavior and Organization, entitled "Options traders use (very) sophisticated heuristics, never the Black-Scholes-Merton Formula." Link to this article at http://tinyurl.com/d5fynms

Among the nine flaws were:

- focus on European exercise only,

- no allowance for dividends,

- calculation for calls only, and not for puts),

- assumption that option profits are not taxed,

- no transaction fees are applied,

- interest rates do not change over time,

- trading is continuous and no price gaps occur,

- price movement is normally distributed,

- volatility does not change over the life of an option.

The last two assumptions deserve further discussion. The idea that normal distribution can be applied to option pricing is untrue. Influences such as earnings surprises, mergers, rumors, and current news all affect prices. The flaw in this assumption was well documented by Sheldon Natenberg in Option Volatility and Pricing, pages 400-401 (1994).

The most serious flawed assumption of all is the last one listed, that volatility is a constant. Every trader knows that this is far from the truth. Volatility changes daily, often significantly. In addition, as expiration approaches, volatility collapse throws the whole Black-Scholes model into disarray. Even delta and gamma become unreliable toward the end of the option’s life. This is well documented in Jeff Augen’s book, Trading Options at Expiration (2009).

Despite the academic love of Black-Scholes, it is indisputable that it cannot be applied to identify bargain-priced options. It is just too flawed. This is heretical, but in debating this with other options traders, how many do you know who base their timing on Black-Scholes?

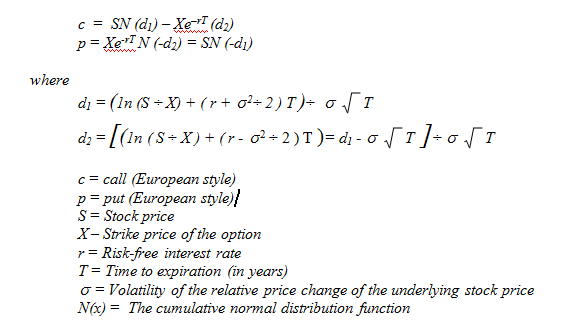

For those intent on using this formula, it is duplicated below.

For anyone interested in checking the formula against their trades, a n online tutorial in the use of Black-Scholes is found at http://www.macroption.com/black-scholes-excel/ and a simplified Excel spreadsheet can be downloaded at www.stern.nyu.edu/~igiddy/spreadsheets/black-scholes.xls.

Michael C. Thomsett is a widely published author with over 80 business and investing books, including the best-selling Getting Started in Options, coming out in its 10th edition later this year. He also wrote the recently released The Mathematics of Options. Thomsett is a frequent speaker at trade shows and blogs on his website at Thomsett Publishing as well as on Seeking Alpha, LinkedIn, Twitter and Facebook.

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account. It's easy and free!

Register a new account

Sign in

Already have an account? Sign in here.

Sign In Now