For an investor that wants to bet on a market decline, one of the simplest ways to do so is with a bear put spread.

Description of the Strategy

A bear put spread consists of two options: a long put and a short put. The two options combined form the "spread." The idea behind such a put spread is to profit on the long put option while losing on the short put option. Because the short put is covered by the long put, the long put option will have more intrinsic value at expiration than the short put, producing a profit.

Here is a simple example: Suppose you have been watching stock XXX, which is currently trading at $25 per share. You believe that an upcoming earnings announcement will fall short of expectations, and the stock could see a significant decline. You decide that the best way to play such a potential move is with a bearish put spread.

With the stock price at $25, you elect to initiate a bearish put spread using the $24 and $21 strike prices. Therefore, you simultaneously buy the $24 put and sell the $21 put for a net premium of $.50. The options have 60 days until expiration. The maximum profit potential on this spread is calculated as the spread between strike prices ($24 minus $21 equals a $3.00 spread) minus the premium paid of $.50 for a maximum profit of $2.50.

The maximum risk on the position is the premium paid plus any commissions and fees. In the above example, therefore, the maximum risk is just $.50.

To produce the maximum profit, the stock price must decline to $21 or less at expiration. If the market declines, but not all the way to $21 or below, break-even may be calculated as the long option strike price of $24 minus the premium paid of $.50 for a break-even level of $23.50. Any movement between the break-even level of $23.50 and $21 would equal a point-for-point profit. If the stock was at $22 at expiration, for example, the profit would be calculated as break-even of $23.50 minus $22 for a $1.50 profit.

Of course, not every trade will go as planned. Now suppose for a moment that your forecast for the stock was completely off-base, and the stock doesn't fall but climbs. In this case, if the stock price is above the long strike price of $24 at expiration, you would stand to lose the entire premium paid of $.50.

Bear Put Spread Profit & Loss Diagram

When to put Bear Put Spread

A bear put spread can be used for either a bearish forecast on the stock or extremely low levels of implied volatility. If you believe that a stock or other asset class is due to fall, the bearish put spread can be a great way to play that opinion with limited risk and decent profit potential.

Because options are also affected by levels of implied volatility, a bearish put spread can also be used to express an opinion on IV levels. In this case, the market does not necessarily even have to move lower to produce a profit. The trade potentially profits from an increase in IV, which can lead to rising option values.

Pros of the Bear Put Spread Strategy

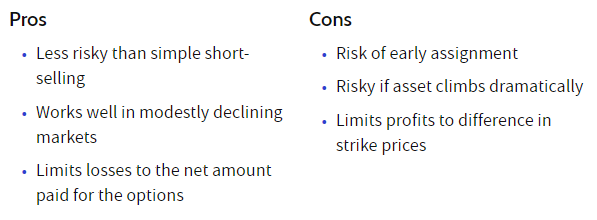

The bearish put spread has a number of potential advantages. Perhaps the biggest advantage to this type of spread is its defined risk. Regardless of what the market does, the investor cannot lose more than the premium paid for the position.

Selling the put option with the lower strike price helps offset the cost of purchasing the put option with the higher strike price. Therefore, the net outlay of capital is lower than buying a single put outright.

This type of spread may also potentially produce a higher return on investment, or ROI, compared to trading the underlying stock or contract. This is because selling stock short requires margin, and the investor may have to put up significantly more capital to sell short compared to buying an option spread.

Cons of the Bear Put Spread Strategy

Because the spread uses options, it is exposed to the numerous risks that come with a long-options position. Due to the fact that options have a limited lifespan and expiration date, they will lose value as time passes with all other inputs remaining constant. A bearish put spread can also lose money even if the market does decline due to a sharp drop in implied volatility levels.

Options are affected by several key factors, including IV levels, time and price. This means that not only does the trader have to be correct about the market direction, but they also have to be right about the timing and other factors as well.

Risk Management

There are many different schools of thought when it comes to managing a bearish put spread. The risk management techniques used can be based on price, time and value. For example, a simple method for managing risk is to close the position if it declines in value by half. Using the previous example above, if you bought a put spread for $.50 and it declined to $.25, you would close the position and move on.

Another method involves time until expiration. If you bought a put spread with 90 days until expiration, you might elect to close the position win, lose or draw once it has only 30 days left.

Appropriate risk management techniques may depend on the investor's risk tolerance, market conditions and other factors. Whatever method is chosen, the most important thing is to have a plan and then stick to it.

Possible Adjustments

A bearish put spread may also be adjusted as the trade unfolds. For example, if the market has started to move favorably, but the options only have a short amount of time left until they expire, you can elect to "roll" the position out. This involves selling the current spread and buying the same spread or even using different strikes for a later expiration date.

If you have seen a large percentage profit on a spread that still has a lot of time left, you could elect to take profits and buy a new spread that is further away (even lower strikes).

The bearish put spread is a simple, yet very powerful strategy that even novice option traders can use. With its defined risk and solid profit potential characteristics, it should be an important tool in any trader's toolbox.

The Bottom Line

The bear put spread offers an outstanding alternative to selling short stock or buying puts in those instances when a trader or investor wants to speculate on lower prices, but does not want to commit a great deal of capital to a trade or does not necessarily expect a massive decline in price.

In either of these cases, a trader may give him or herself an advantage by trading a bear put spread, rather than simply buying a put option.

About the Author: Chris Young has a mathematics degree and 18 years finance experience. Chris is British by background but has worked in the US and lately in Australia. His interest in options was first aroused by the ‘Trading Options’ section of the Financial Times (of London). He decided to bring this knowledge to a wider audience and founded Epsilon Options in 2012.

Subscribe to SteadyOptions now and experience the full power of options trading at your fingertips. Click the button below to get started!

Join SteadyOptions Now!

There are no comments to display.

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.

Note: Your post will require moderator approval before it will be visible.