If you don't you can find your entire account blown out over a weekend.

Assignments occur in two basic varieties. First, on expiration Friday (or Thursday or Wednesday depending on the instrument your trading, but most commonly on Friday). If you have a position that is .01 in the money, or more, you WILL be assigned. For instance, if you have a 100 Call on stock XYZ that expires today, and XYZ closes (AFTER HOURS) at 100.01, you will find that you own, sometime Saturday, 100 shares of XYZ that you paid $100/share for.

Now this option might have only cost you $100 or so. But all of a sudden, due to the inherent multiplier in options, you are now out of pocket $10,000.00. What if you're account only had $5,000.00 in it? Well, you are going to get both a Regulation T Notice and margin call from your broker. First thing Monday morning, your broker will automatically liquidate the position. What if there is adverse news over the weekend and the opening price is only $80? Well you just lost $2,000.0 -- in a $5,000.00 account. In other words, that $100 option just cost you 40% of your entire account. This happens.

What if you had "hedged" the position though, and had a vertical call spread? For instance, you might have bought the $100/$105 spread on XYZ. Well if XYZ closes anywhere above $105 you are ok because BOTH positions will be auto-exercised. This SOMETIMES results in a margin call as well -- but don't worry. Option clear throughout the day on Saturday and your account will frequently show one position and the other not exercised yet. By Sunday morning it will be fixed. By way of example, I had a very large position (for me) (20 contracts) in the LNKD 92.5/95 vertical call before earnings. Well earnings did what they were supposed to and LNKD jumped to 104. Well Saturday morning, all of a sudden, I was SHORT 2000 shares of LNKD and had received roughly $190K in cash into my account. This sends off all kinds of margin alerts. I got an email, a call, and another call. Ignore them. The 92.5 side simply hadn't cleared yet. Three hours later the other option cleared, buying the shorts back at 92.5. Then Sunday morning, your account statement will reflect that all trades happened at the same time.

HOWEVER, what if, on that 100/105 spread, XYZ closes at 103 on Friday? Well, guess what, you'll be assigned on the 100 position, the 105 will expire worthless, and now your back in margin call.

MORAL OF THE STORY:

DON'T EVER LET YOURSELF BE ASSIGNED ON A SPREAD THATS NOT FAR IN THE MONEY ON BOTH LEGS.

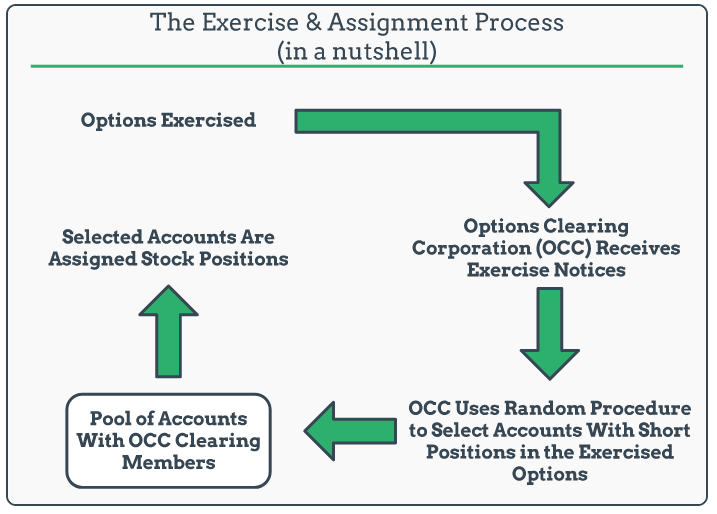

Image courtesy of https://www.projectoption.com.

What if, on Friday, the price of XYZ was at $106 at close? You better have closed the spread, because of after hours trading. The price of XYZ can move after hours -- but you can't get out of the options. So if the market closes at 106, and you say good, both legs will clear and I won't pay commissions (or pay less commissions) and get a huge tax break, you could be wrong, as in after hours the market might go back to $104.98. Then you're screwed, only the 100 option gets exercised and you go into margin call. I'm convinced when your near a strike the market makers manipulate the after hours markets to have this happen.

Of course if you have enough cash in your account, you won't get margin called -- you're risk profile will just be largely out of whack.

And this isn't to say you can't have a big benefit from this. My single most profitable trade EVER occurred on a spread that was $.50 above the line, I didn't close it, and then in after hours the price dropped. So I got assigned long on the lower strike. Well, that weekend there was big news involving the company and the price jumped 15% the next morning. In that case, here's what happens -- I own the 100 (long) /105 (short) vertical. After hours, the price is $104.92. Well that spread was worth $4.85 at close on 20 contracts, or $9,700. Well, Saturday I'm now the proud owner of 2,000 shares bought at $100.00 each, for a net cost of $200,000 -- oops. Margin call, broker call, broker email, etc. Well they inform me the trade will immediately close at open on Monday. Well the price jumped, and the position was closed, at $240,000.00. My original investment of $8,500.00, that I didn't want to close at $9,700.00, netted me $40,000.00, or roughly a 470% return. BUT, what if the price had gone down 20%? Well I would be owing my broker money and have completely blown out my account.

If you have ANY questions on this, please let me know.

Now SITUATION TWO -- and you will, sooner or later, encounter this. Let's say we have a 100(long)/105 (short) put spread on XYZ. Only we own the September spread and today (Friday) XYZ closes at 103. No big deal - UNLESS someone exercises their 105 option. American style options can be exercised at anytime. Why would this happen with time value? Who knows, most likely someone needed to unwind a position, hedge something, take profits, or any number of things.

Well if you had a 10 contract position, on Saturday your account is down $105,000.00 in cash and you are long 1,000 shares of XYZ. You will again likely go into margin call, unless you had over $105,000 in cash in your account. However, while this is a headache and you will have to deal with your broker, you don't need to panic because the position is still hedged.

So what happens here? Well when Monday rolls around ideally the price of XYZ has gone up. If it has, you sell the shares and keep the money. If the price has gone DOWN though, you stand to lose up to $5,000.00. You can't lose more than that because you still own the 100 puts. Depending on what occurs here, your broker might just auto-close the whole position, may allow you to exercise the 100 puts and have that resolve the situation, or may let you just sell off enough to get out of margin call. Different brokers handle margin violations differently. The good news is though your losses are capped.

When this happens, take your lumps and move on. I have this happen about once a quarter and my worse loss was 4%. There's nothing you can do to protect against this. You are hedged, and you won't blow your account out, but it does suck - particularly if the price moves down quite a bit at the open.

I hope that clears some things. If not, please let us know.

Christopher Welsh is a licensed investment advisor in the State of Texas and is the president of an investment firm, Lorintine Capital, LP which is a general partner of three separate private funds. He is also an attorney practicing in Dallas, Texas. Chris has been practicing since 2006 and is a CERTIFIED FINANCIAL PLANNER™. Working with a CFP® professional represents the highest standard of financial planning advice. He offers investment advice to his clients, both in the law practice and outside of it. Chris has a Bachelor of Science in Economics, a Bachelor of Science in Computer Science from Texas A&M University, and a law degree from Southern Methodist University. Chris manages the Anchor Trades portfolio, the Steady Options Fund, and oversees Lorintine Capital's distressed real estate debt fund.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account. It's easy and free!

Register a new account

Sign in

Already have an account? Sign in here.

Sign In Now