For those folks, conservative options trading (such as covered calls or naked puts, for example) may be the only certain way to meet or do better than breakeven.

It is not mentioned often, but the breakeven yield is higher than just the interest or dividend rate earned on investments. The two crucial elements to be concerned about are inflation and taxes. To compute your true breakeven, you need to take both of these into account. Many people face a dilemma when they compute breakeven. You have three choices:

- Increase the market risk in your overall portfolio to make enough to get to breakeven.

- Accept lost purchasing power as inevitable and unavoidable.

- Figure out how to increase yield without adding risk – this is where options can play a role.

It is especially rational to use options for trades like covered calls if you also focus on value investments paying better than average dividends. Many fine companies pay 4% or 5%, making it much easier to get to breakeven without added risks. If you focus on dividend achievers, those companies increasing dividend yield for every year over the last decade, you do even better. These companies tend to be better managed than average, so fundamentals are exceptional. This also translates to better price performance over time.

The breakeven taking inflation and taxes into account is calculated following a few steps:

- Determine the rate of inflation. The easiest way to do this is to use the CPI numbers at the Bureau of Labor Statistics. The BLS also provides a free inflation calculator here.

- Find your effective tax rate. This is the rate of taxation applied to your net taxable income (adjusted gross income minus exemptions and deductions).

- Calculate your after-tax income, which is taxable income minus effective tax rate.

From these calculations you can figure out your breakeven rate of return. The formula:

I ÷ ( 100 – E ) = B

I = rate of inflation

E = effective tax rate

B = breakeven yield

In calculating your tax rate, be sure to include all sources of income tax, including federal, state and (where applicable) local. For example, assume your current rate of inflation is 3%. Your effective tax rate is 38% (federal and state, percentage of taxable income). Your breakeven rate is:

3 ÷ ( 100 – 38 ) = 4.8%

You need to earn 4.8% to break even after inflation and taxes. Considering the average portfolio includes many diversified sources including money markets, real estate, stocks and mutual funds, this is a fairly high rate of return. You might have a great year in the stock market but see your mutual funds, 401K and real estate lagging behind. The average for all of a portfolio often is lower than the realistic breakeven.

This is where options can help bring those averages up and beat the breakeven level. As long as you focus on conservative strategies you do not need to take on higher risks than you can afford. The breakeven yield shows that you probably need this offsetting effect. Covered calls writers tend to consistently make double-digit returns. This does not mean your entire portfolio can or should be put into covered calls; that does not make sense. But if you focus on smart, conservative options strategies, a portfolio falling below breakeven can be brought up to the point of meeting or beating breakeven on the entire portfolio.

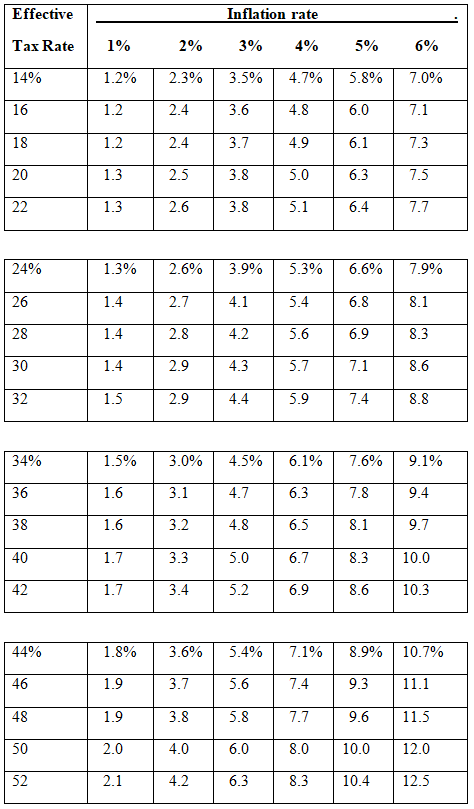

Following is a chart summarizing breakeven for several rates of inflation and effective tax rates:

No one is expected to get double-digit returns on an entire portfolio without increasing risks. The sensible solution is to use options trades as a diversified part of the portfolio to bring the overall average up to the point that your purchasing power can be maintained.

Focusing on conservative options is a sensible idea as part of a program to maximize returns without adding market risks. Beyond covered calls and uncovered puts, other conservative strategies that generate maximum return include the covered straddle or covered strangle, synthetic long or short stock, and well-structured vertical spreads with short-term expiration. In all these conservative strategies, the greatest advantage is gained when expiration is short-term. A single one-week option yields a lower dollar amount but a higher annual yield, than a longer-term option paying more money but a lower yield.

A statistic worth remembering is this: The average option loses one-third of its remaining time value on the Friday one week before expiration. This occurs because from Friday to Monday is one trading day but three calendar days. This day – Friday the week before last trading day – is probably the best day to open short options, with plans to close them on Monday or Tuesday. That is one way to improve your chances of making your way to breakeven yield.

Michael C. Thomsett is a widely published author with over 80 business and investing books, including the best-selling Getting Started in Options, coming out in its 10th edition later this year. He also wrote the recently released The Mathematics of Options. Thomsett is a frequent speaker at trade shows and blogs on his websiteat Thomsett Guide as well as on Seeking Alpha, LinkedIn, Twitter and Facebook.

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account. It's easy and free!

Register a new account

Sign in

Already have an account? Sign in here.

Sign In Now